6PDUW/RFN

70

+RPH(TXLW\/LQHRI&UHGLW'LVFORVXUH3DFNHW

7KDQN\RXIRUFKRRVLQJ2UUVWRZQ%DQNIRU\RXUILQDQFLQJQHHGV

7KLVSDFNHWFRQWDLQVLPSRUWDQWLQIRUPDWLRQDERXW2UUVWRZQ%DQN¶V6PDUW/RFN

70

+RPH(TXLW\

/LQHRI&UHGLWSURGXFW 3OHDVHUHYLHZFDUHIXOO\DQGUHWDLQDFRS\IRU\RXUUHIHUHQFH ,IIRU

DQ\UHDVRQ\RXFDQQRWSULQWWKHGLVFORVXUHVSOHDVH FRQWDFWXVDW

7KLVSDFNHWFRQWDLQVWKHIROORZLQJGLVFORVXUHVIRU\RXUUHYLHZ

x ,PSRUWDQW7HUPV$ERXW2XU+RPH(TXLW\$SSOLFDWLRQ'LVFORVXUH

x 3ULYDF\1RWLFH

x :KDW<RX6KRXOG.QRZ$ERXW+RPH(TXLW\/LQHVRI&UHGLW

Lender: Orrstown Bank

P O Box 250

Shippensburg, PA 17257

Home Equity Application Disclosure

IMPORTANT TERMS OF OUR HOME EQUITY APPLICATION DISCLOSURE

This disclosure contains important information about our PA/WV SmartLock Interest Only Home Equity Line of Credit (the "Plan").

You should read it carefully and

keep a copy for your records.

AVAILABILITY OF TERMS. All of the terms of the Plan described herein are subject to change. If any of these terms change (other than the

ANNUAL PERCENTAGE RATE) and you decide, as a result, not to enter into an agreement with us, you are entitled to a re

fund of any fees

that

you paid to us or anyone else in connection with your application.

SECURITY INTEREST. We will take a security interest in your home. You could lose your home if you do not meet the obligations in your

agreement with us.

POSSIBLE ACTIONS. Under this Plan, we have the following rights:

Termination and Acceleration. We can terminate the Plan and require you to pay us the entire outstanding balance in one payment,

and charge you certain fees, if any of the following happens:

(a)

You commit fraud or make a material misrepresentation at any time in connection with the Plan. This can include, for example,

a false statement about your income, assets, liabilities, or any other aspect of your financial condition.

(b)

You do not meet the repayment terms of the Plan.

(c)

Your action or inaction adversely affects the collateral for the Plan or our rights in the collateral. This can include, for example,

failure to maintain required insurance, waste or destructive use of the dwelling, failure to pay taxes

, death of all persons liable on

the account, transfer of title or sale of the dwelling, creation of a senior lien on the dwelling without our permission, foreclosure

by the holder of another lien or the use of funds or the dwelling for prohibited purposes.

Suspension or Reduction. In addition to any other rights we may have, we can suspend additional extensions of credit or reduce your

credit limit during any period in which any of the following are in effect:

(a)

The value of your dwelling declines significantly below the dwelling's appraised value for purposes of the Plan. This includes,

for example, a decline such that the initial difference between the credit limit and the available equity is reduced by fifty percent

and may include a smaller decline depending on the individual circumstances.

(b)

We reasonably believe that you will be unable to fulfill your payment obligations under the Plan due to a material change in your

financial circumstances.

(c)

You are in default under any material obligation of the Plan. We consider all of your obligations to be material. Categories of

material obligations include, but are not limited to, the events described above under Termination and Acceleration , obligations

to pay fees and charges, obligations and limitations on the receipt of credit advances, obligations concerning maintenance or

use of the dwelling or proceeds, obligations to pay and perform the terms of any other deed of trust, mortgage or lease of the

dwelling, obligations to notify us and to provide documents or information to us (such as updated financial information),

obligations to comply with applicable laws (such as zoning restrictions).

(d)

We are precluded by government action from imposing the annual percentage rate provided for under the Plan.

(e)

The priority of our security interest is adversely affected by government action to the extent that the value of the security int

erest

is less than 120 percent of the credit limit.

(f)

We have been notified by governmental authority that continued advances may constitute an unsafe and unsound business

practice.

(g)

The maximum annual percentage rate under the Plan is reached.

Change in Terms. We may make changes to the terms of the Plan if you agree to the change in writing at that time , if the change will

unequivocally benefit you throughout the remainder of the Plan, or if the change is insignificant (such as changes relating to our data

processing systems).

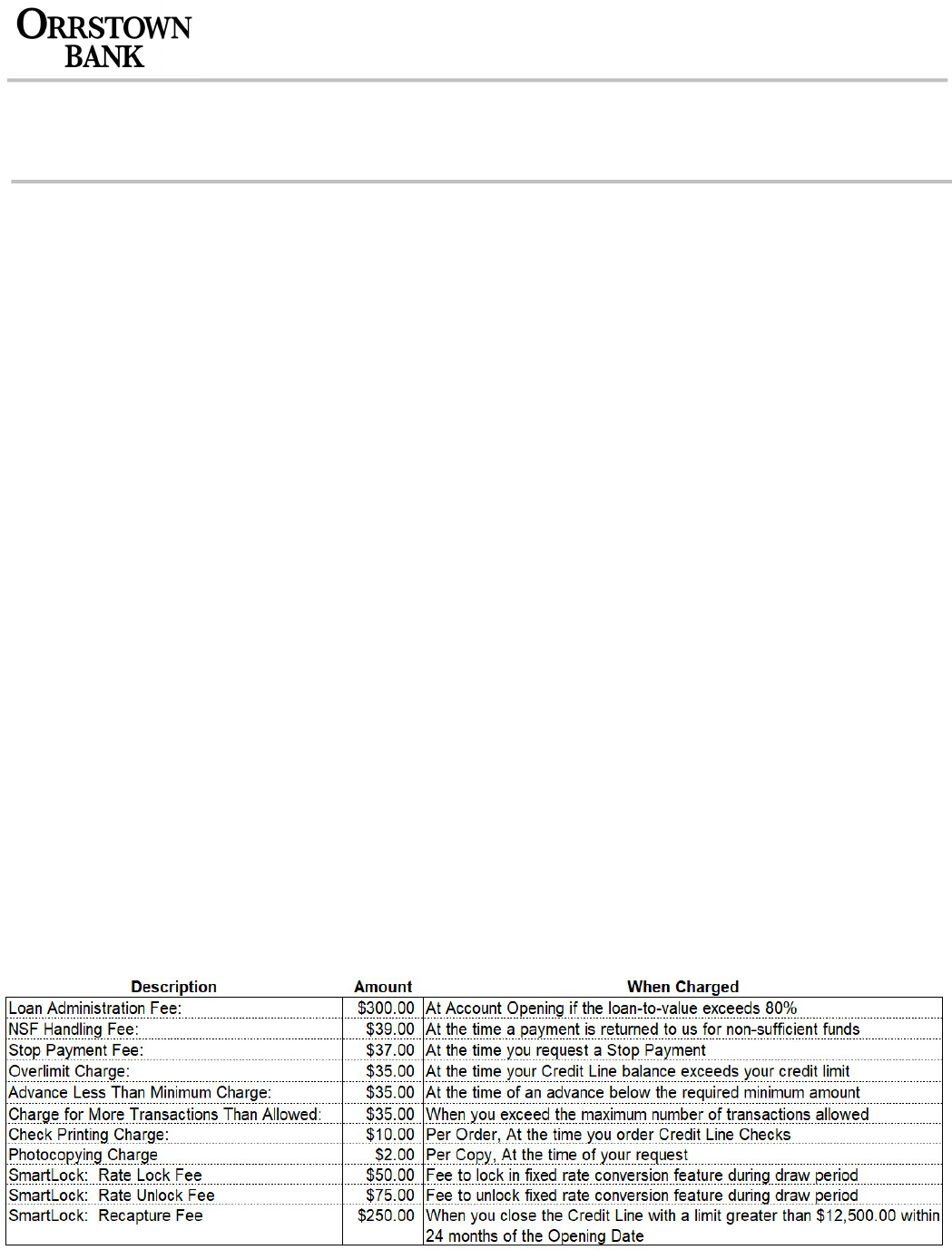

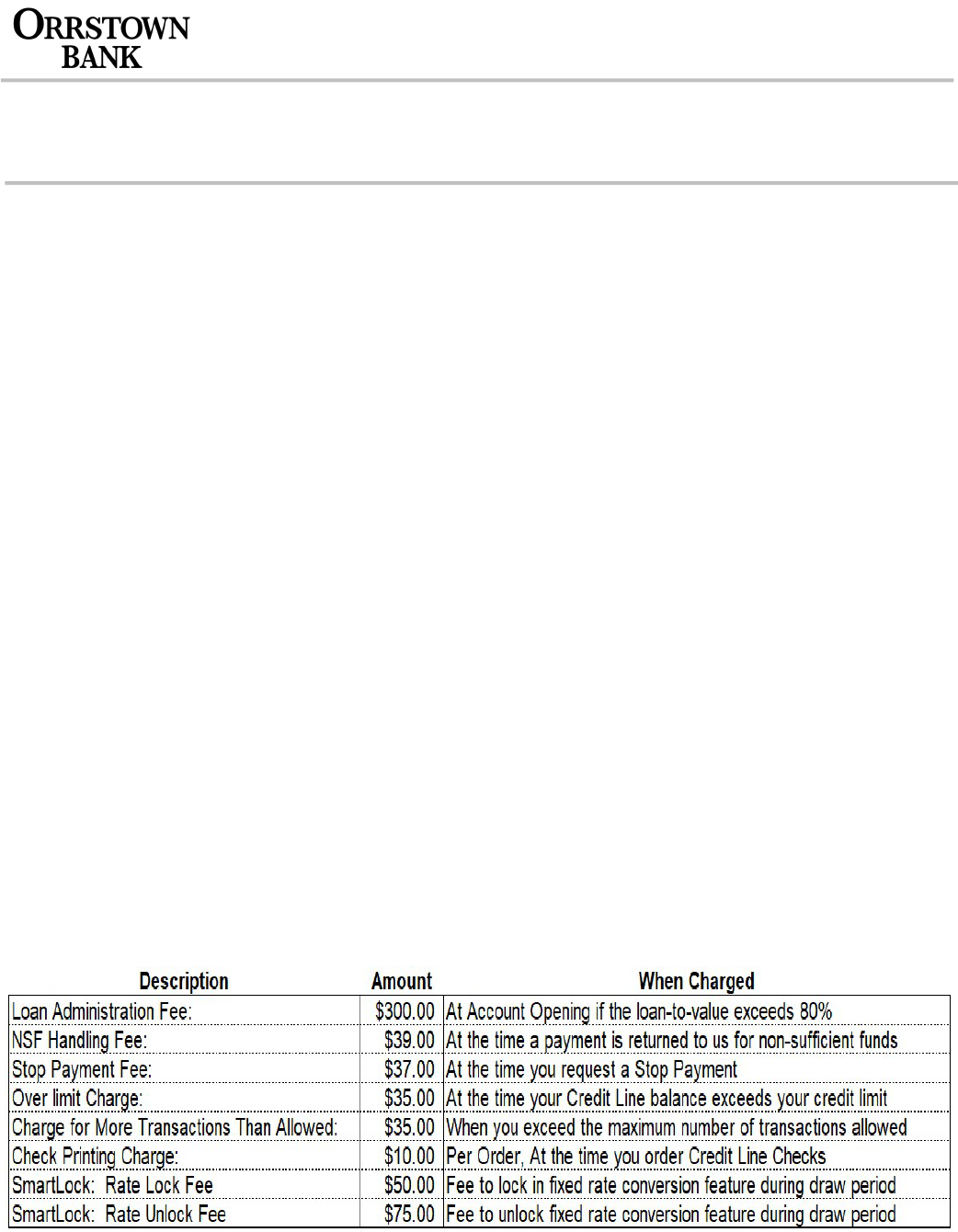

Fees and Charges. In order to open and maintain an account, you must pay certain fees and charges.

Lender Fees. The following fees must be paid to us:

Lender: Orrstown Bank

P O Box 250

Shippensburg, PA 17257

Home Equity Application Disclosure

Late Charge. Your payment will be late if it is not received by us within 16 days after the "Payment Due Date" shown on your

periodic statement. If your payment is late we may charge you 10.000% of the payment or $20.00, whichever is greater.

Third Party Fees. If you are purchasing a property that will also secure the Credit Line, you must pay certain fees to third parties

such as appraisers, credit reporting firms, and government agencies. These third party fees generally total between $300.00 and

$4,580.00 (for a Credit Line amount of $100,000.00). Upon request, we will provide you with an itemization of the fees y

ou have to pay

to third parties.

PROPERTY INSURANCE. You must carry insurance on the property that secures the Plan.

MINIMUM PAYMENT REQUIREMENTS. You can obtain advances of credit during the following period: for a period of ten years from the

Opening Date. You may however begin the amortization period sooner than ten years, which would discontinue your draw period at that time

(the "Draw Period"). After the Draw Period ends, the repayment period will begin. You will no longer be able to obtain credit advances. The

length of the repayment period is as follows: for a period of twenty years. Your Regular Payment will equal the amount of your accrued

FINANCE CHARGES ("First Payment Stream"). You will make 120 of these payments. Your payments will be due monthly. Your "Minimum

Payment" will be the Regular Payment, plus any amount past due and all other charges. An increase in the ANNUAL PERCENTAGE RATE

may increase the amount of your Regular Payment. The Minimum Payment during the First Payment Stream will not reduce the principal that is

outstanding on your Credit Line.

After completion of the First Payment Stream, your Regular Payment will be based on an amortization of your balance at the st

art of this payment

period as shown below (“Second Payment Stream”). Your payments will be due monthly.

Range of Balances Number of Payments Regular Payment Calculation

All Balances 240 240 payments

Your "Minimum Payment" will be the Regular Payment, plus any amount past due and all other charges.

A change in the ANNUAL PERCENTAGE RATE can cause the balance to be repaid more quickly or more slowly. When rates decrease, less

interest is due, so more of the payment repays the principal balance. When rates increase, more interest is due, so less of the payment repays

the principal balance. If this happens, we may adjust your payment as follows: your payment may be increased by the amount necessary to

repay the balance by the end of this payment stream. Each time the ANNUAL PERCENTAGE RATE changes, we will review the effect the

change has on your Credit Line Account to see if your payment is sufficient to pay the ba

lance by the Maturity Date. If it is not, your payment will

be increased by an amount necessary to repay the balance by the Maturity Date.

MINIMUM PAYMENT EXAMPLE.

Loan-to-Value 80% or Less: If you made only the minimum payment and took no other credit advances, it would take 30 years to pay off

a credit advance of $10,000.00 at an ANNUAL PERCENTAGE RATE of 8.25%. During that period, you would make 120 monthly

payments ranging from $63.29 to $70.07. Then you would make 240 monthly payments ranging from $82.65 to $85.23. We have used

this rate of 8.25% recently on Credit Lines less than $100,000.00.

Loan-to-Value Exceeds 80%: If you made only the minimum payment and took no other credit advances, it would take 30 years to pay

off a credit advance of $10,000.00 at an ANNUAL PERCENTAGE RATE of 9.50%. During that period, you would make 120 monthly

payments ranging from $72.88 to $80.68. Then you would make 240 monthly payments ranging from $89.63 to $93.24.

TRANSACTION REQUIREMENTS. The following transaction limitations will apply to the use of your Credit Line:

Credit Line Credit Line Check Limitations. The following transaction limitations will apply to your Credit Line and the writing of Credit

Line Checks.

Maximum Number of Advances Per Period. The maximum number of advances that you may obtain per month is 10.

Minimum Advance Amount. The minimum amount of any credit advance that can be made on your Credit Line is $100.00. This

means any Credit Line Check must be written for at least the minimum advance amount.

Telephone Request Limitations. The following transaction limitations will apply to your Credit Line and requesting an advance by

telephone.

Maximum Number of Advances Per Period. The maximum number of advances that you may obtain per month is 10.

Minimum Advance Amount. The minimum amount of any credit advance that can be made on your Credit Line is $100.00.

Overdraft Limitations. The following transaction limitations will apply to your Credit Line and writing a check in excess of your checking

account balance.

Maximum Number of Advances Per Period. The maximum number of advances that you may obtain per month is 20.

Minimum Advance Amount. The minimum amount of any credit advance that can be made on your Credit Line is $50.00.

Other Transaction Requirements. If the credit line balance is less than $50.00, and the overdraft is less than $50.00, the amount of

the overdraft will be taken.

In Person Request Limitations. The following transaction limitations will apply to your Credit Line and requesting an advance in person.

Maximum Number of Advances Per Period. The maximum number of advances that you may obtain per month is 10.

Minimum Advance Amount. The minimum amount of any credit advance that can be made on your Credit Line is $100.00.

Internet Banking Limitations. The following transaction limitations will apply to your Credit Line and accessing by other methods.

Maximum Number of Advances Per Period. The maximum number of advances that you may obtain per month is 10.

Minimum Advance Amount.

The minimum amount of any credit advance that can be made on your Credit Line is $100.00.

Lender: Orrstown Bank

P O Box 250

Shippensburg, PA 17257

Home Equity Application Disclosure

CONVERSION OPTION.

This agreement contains an option to convert a portion or all of the balance under your Credit Line from a variable

ANNUAL PERCENTAGE RATE to a fixed ANNUAL PERCENTAGE RATE as determined below. Each portion of the balance under your

Credit

Line you convert to a fixed ANNUAL PERCENTAGE RATE is referred to as a “Fixed-Rate Advance.” The following information describes the

terms and features of the conversion option available under this Agreement:

ANNUAL PERCENTAGE RATE Increase. Your ANNUAL PERCENTAGE RATE may increase if you exercise this option to convert

to a fixed rate.

Conversion Periods. You can exercise the option to convert to a fixed rate only during the following period or periods: You can

exercise the option to convert to a fixed ANNUAL PERCENTAGE RATE at any time during the Draw Period, and any extension of the Draw

Period. After the Draw Period ends, or if you do not meet the repayment terms of this credit agreement, you will not be able to exercise the

option to convert to a fixed ANNUAL PERCENTAGE RATE.

Conversion Fees. You will be required to pay the following fees at the time of the conversion to a fixed rate: a rate lock fee of

$50.00 each time you exercise the option to convert to a fixed ANNUAL PERCENTAGE RATE. This is a FINANCE CHARGE. You will be

required to pay a rate unlock fee of $75.00 each time you exercise the option to convert to a variable ANNUAL PERCENTAGE RATE. This is a

FINANCE CHARGE.

Rate Determination: The fixed rate will be determined as follows: The fixed rate will be based on certain credit criteria and length of

the fixed rate term, in conjunction with our published rates for a closed-end home equity loan at the time of the conversion request.

Conversion Rules. You can convert to

a fixed rate only during the period or periods described above. In addition, the following rules

apply to the conversion option under this agreement: You can exercise the option to convert to a fixed ANNUAL PERCENTAGE RATE only

during the period or periods described above. The minimum fixed rate advance is $5,000.00.

(a)

Minimum and maximum term. If you exercise the option to convert to a fixed ANNUAL PERCENTAGE RATE, the term of the Fixed-

Rate Advance cannot be less than twelve (12) months or longer than two hundred and forty (240) months.

(b)

Number of Fixed-

Rate Advances. You can exercise the option to convert to a fixed ANNUAL PERCENTAGE RATE from time to time,

but you may not have more than five (5) different Fixed Rate Advances outstanding under your Credit Line Account at any one time.

(c)

Ineligible for Promotional Rates. In determining your interest rate and ANNUAL PERCENTAGE RATE as described in the Rate

Determination paragraph above, our published closed-end home equity loan interest rates and ANNUAL PERCENTAGE RATE will

not include any special, promotion or coupon interest rates and interest rates available only for newly opened accounts. If we offer a

discounted interest rate and ANNUAL PERCENTAGE RATE for agreeing to make payments through automatic deduction from a

checking account maintained with us, that discounted rate will be considered the published rate for purposes of the Rate

Determination paragraph above, only if you have agreed to have payments under your Credit Line Account automatically deducted

from a checking account you maintain with us.

(d)

Complete Election Form. In order to exercise the option to convert to a fixed ANNUAL PERCENTAGE RATE, you must complete the

SmartLock Rate Lock Request Form.

(e)

Minimum Monthly Payments. At the time you exercise the option to convert to a fixed ANNUAL PERCENTAGE RATE, we will

determine a minimum monthly payment applicable to that Fixed-Rate Advance. The minimum monthly payment will include both

principal and interest and will be sufficient to repay the Fi

xed Rate Advance in equal monthly installments of principal and interest over

the term of the Fixed Rate Advance. The minimum monthly payment with respect to a Fixed-Rate Advance will not be less than

$50.00. If you have more than one Fixed-Rate Advance outstanding, you will have to make minimum monthly payments with respect

to each Fixed Rate Advance. The minimum monthly payments due with respect to Fixed Rate Advances will be in addition to the

Minimum Payment due with respect to any balance under your Credit Line subject to a variable ANNUAL PERCENTAGE RATE.

(f)

How Payments Are Applied If You Have A Fixed-Rate Advance Outstanding. Separate billing will be provided for each Fixed-Rate

Advance. Payments include principal and interest. Unless otherwise agreed or required by applicable law, payments will be applied

first to any accrued unpaid interest; then to principal; then to any late charges; and then to any unpaid collection costs. In the event

you make a payment in excess of the amount necessary to pay all of these amounts, the excess will be first applied to reduce any

principal outstanding. Any prepayments of principal will not reduce the amount of, or extend the due date for, any future minimum

monthly payments.

(g)

Unlock Requirement. The fixed rate portion must be in effect for a minimum of 365 days before you can exercise your option to

convert the fixed rate portion into a variable rate. You will need to execute the SmartLock Rate Unlock Request Form to convert back

to a variable rate feature after the 365 day fixed rate period, if desired.

Lender: Orrstown Bank

P O Box 250

Shippensburg, PA 17257

Home Equity Application Disclosure

TAX DEDUCTIBILITY. You should consult a tax advisor regarding the deductibility of interest and charges for the Plan.

ADDITIONAL HOME EQUITY PROGRAMS. Please ask us about our other available Home Equity Line of Credit plans.

VARIABLE RATE FEATURE. The Plan has a variable rate feature. The ANNUAL PERCENTAGE RATE (corresponding to the periodic rate),

and the minimum payment amount can change as a result. The ANNUAL PERCENTAGE RATE does not include costs other than interest.

THE INDEX. The annual percentage rate is based on the value of an index (referred to in this disclosure as the "Index"). The Index is the Wall

Street Prime. Information about the Index is available or published in the Wall Street Journal. We will use the most recent Index value available

to us as of the date of any annual percentage rate adjustment. If the Index is no longer available, we will choose a new Index and margin. The

new Index will have an historical movement substantially similar to the original Index, and the new Index and margin will result in an annual

percentage rate that is substantially similar to the rate in effect at the time the original Index becomes unavailable.

ANNUAL PERCENTAGE RATE. To determine the Periodic Rate that will apply to your First Payment Stream , we add a margin to the value of

the Index, round that sum up to the nearest 0.125%, then divide the rounded value by the number of days in a year (daily). To obtain the

ANNUAL PERCENTAGE RATE we multiply the Periodic Rate by the number of days in a year (daily). This result is the ANNUAL

PERCENTAGE

RATE for your First Payment Stream. To determine the Periodic Rate that will apply to your Second Payment Stream , we add a margin to the

value of the Index, round that sum up to the nearest 0.125%, then divide the rounded value by the number of days in a year

(daily). To obtain the

ANNUAL PERCENTAGE RATE we multiply the Periodic Rate by the number of days in a year (daily). This result is the

ANNUAL PERCENTAGE

RATE for your Second Payment Stream. A change in the Index rate generally will result in a change in the ANNUAL PERCENTAGE RATE. The

amount that your ANNUAL PERCENTAGE RATE may change also may be affected by the lifetime annual percentage rate limits, as discussed

below.

Initial Annual Percentage Rate Discount. The initial annual percentage rate is “discounted” – it is not based on the Index and margin

used for later rate adjustments. The initial discounted rate will be in effect for six (6) months. The interest rate of 4.35% will be

calculated and in effect for 6 months from the original date of the Credit Agreement and Disclosure. Offer valid ONLY on new

SmartLock customers. Additional credit score and loan-to-value restrictions may apply which may impact the initial annual percentage

rate.

Please ask us for the current Index value, margin, discount and annual percentage rate. After you open a credit line, rate information

will be provided on periodic statements that we send to you.

PREFERRED VARIABLE RATE. The ANNUAL PERCENTAGE RATE under the Plan includes a preferred variable rate which is subject to the

following rules and provisions:

Description of Event That Would Cause Lender to Increase the ANNUAL PERCENTAGE RATE. Automatic drafting of payment

from an Orrstown Bank checking or savings account is discontinued.

How The New Rate Will Be Determined. As determined above, the ANNUAL PERCENTAGE RATE under this Plan is variable based

on the Index value plus a margin. Should the event described above occur, the ANNUAL PERCENTAGE RATE will be increased as

follows: by adding 0.75% to the current rate.

FREQUENCY OF ANNUAL PERCENTAGE RATE ADJUSTMENTS. Your ANNUAL PERCENTAGE RATE can change quarterly. There is no

limit on the amount by which the annual percentage rate can change during any one year period. However, under no circumstances will your

ANNUAL PERCENTAGE RATE exceed 18.000% per annum or, except for any initi

al discount period, go below 3.250% per annum at any time

during the term of the Plan.

MAXIMUM RATE AND PAYMENT EXAMPLE.

Draw Period. If you had an outstanding balance of $10,000.00, the minimum payment at the maximum ANNUAL PERCENTAGE RATE of

18.000% would be $152.88. This ANNUAL PERCENTAGE RATE could be reached at the time of the 1st payment.

Repayment Period. If you had an outstanding balance of $10,000.00, the minimum payment at the maximum ANNUAL PERCENTAGE

RATE of 18.000% would be $154.36. This ANNUAL PERCENTAGE RATE could be reached at the time of the 1st payment during the

repayment period.

PREPAYMENT. You may prepay all or any amount owing under the Plan at any time without penalty.

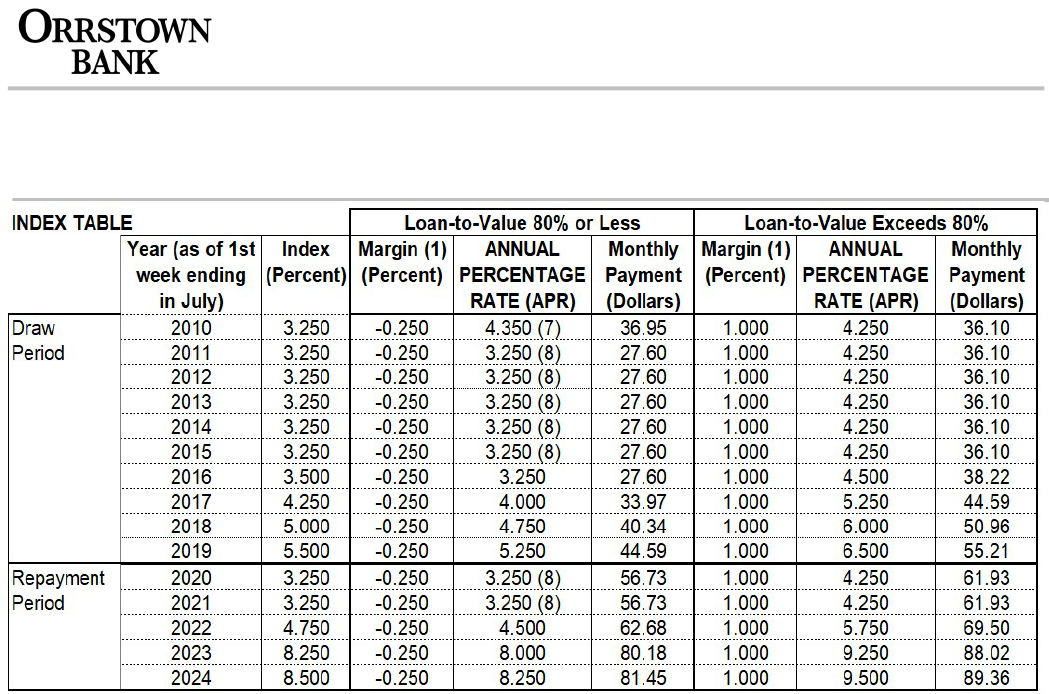

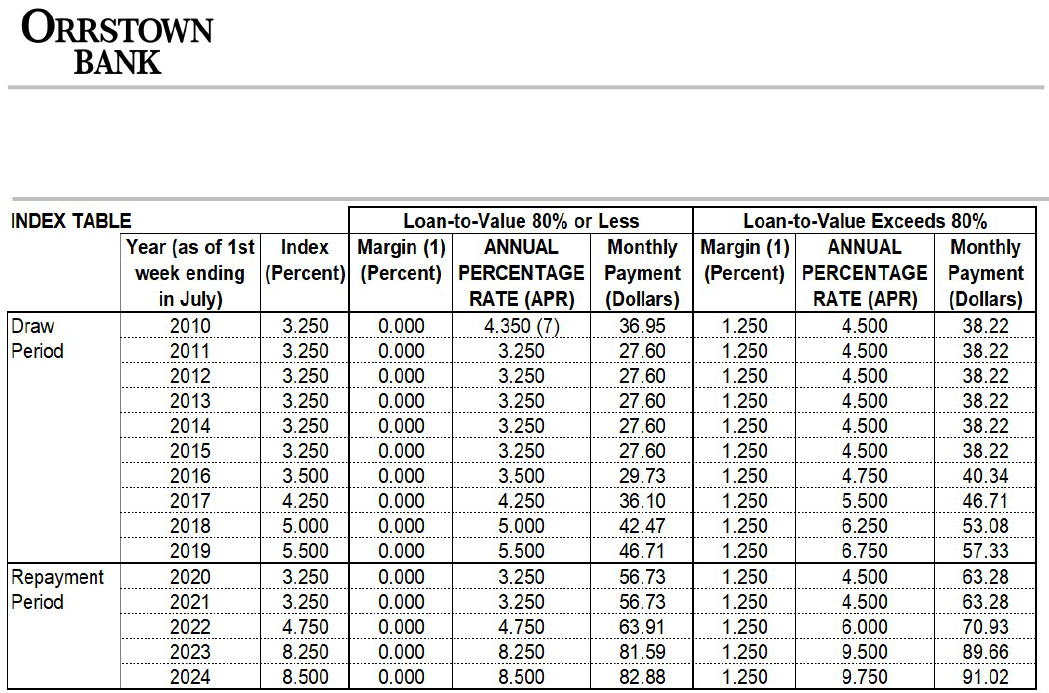

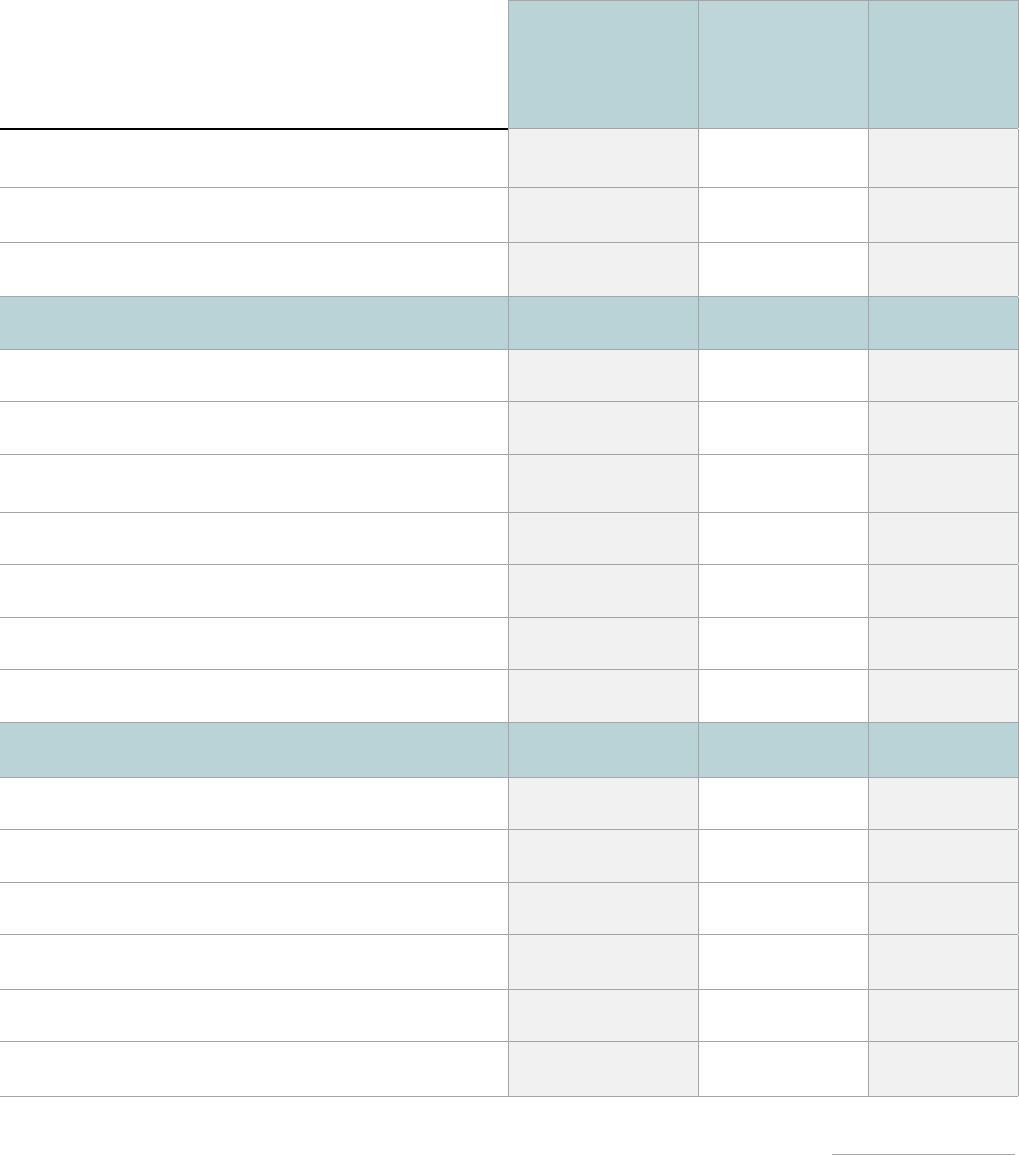

HISTORICAL EXAMPLE. The examples below show how the ANNUAL PERCENTAGE RATE and the minimum payments for a single

$10,000.00 credit advance would have changed based on changes in the Index from 2010 to 2024. The Index values are from the following

reference period: as of 1st week ending in July. While only one payment per year is shown, payments may have varied during each year.

Different outstanding principal balances could result in different payment amounts.

The table assumes that no additional credit advances were taken, that only the minimum payments were made, and that the rate remained

constant during the year. It does not necessarily indicate how the Index or your payments would change in the future.

Lender: Orrstown Bank

P O Box 250

Shippensburg, PA 17257

Home Equity Application Disclosure

(1) This is a margin we have used recently; your margin may be different.

(7) This ANNUAL PERCENTAGE RATE reflects a discount that we have provided recently; your Plan may be dicounted by a different amount.

(8) This A.P.R. reflects a 3.250 percent floor.

LASER PRO Lending, Ver. 18.1.0 Copr. Harland Financial Solutions, Inc. 1997, 2013. All Rights Reserved. - PA c:\CFI\LPL\B11.FC PR-271 (M)

MF rev. 07/15/24

Lender: Orrstown Bank

P O Box 250

Shippensburg, PA 17257

Home Equity Application Disclosure

IMPORTANT TERMS OF OUR HOME EQUITY APPLICATION DISCLOSURE

This disclosure contains important information about our MD SmartLock Interest Only Home Equity Line of Credit (the "Plan"). You

should read it carefully and keep a copy for your records.

AVAILABILITY OF TERMS. All of the terms of the Plan described herein are subject to change. If any of these terms change (other than the

ANNUAL PERCENTAGE RATE) and you decide, as a result, not to enter into an agreement with us, you are entitled to a re

fund of any fees that

you paid to us or anyone else in connection with your application.

SECURITY INTEREST. We will take a security interest in your home. You could lose your home if you do not meet the obligations in your

agreement with us.

POSSIBLE ACTIONS. Under this Plan, we have the following rights:

Termination and Acceleration. We can terminate the Plan and require you to pay us the entire outstanding balance in one payment,

and charge you certain fees, if any of the following happens:

(a)

You commit fraud or make a material misrepresentation at any time in connection with the Plan. This can include, for example,

a false statement about your income, assets, liabilities, or any other aspect of your financial condition.

(b)

You do not meet the repayment terms of the Plan.

(c)

Your action or inaction adversely affects the collateral for the Plan or our rights in the collateral. This can include, for example,

failure to maintain required insurance, waste or destructive use of the dwelling, failure to pay taxes

, death of all persons liable on

the account, transfer of title or sale of the dwelling, creation of a senior lien on the dwelling without our permission, foreclosure

by the holder of another lien or the use of funds or the dwelling for prohibited purposes.

Suspension or Reduction. In addition to any other rights we may have, we can suspend additional extensions of credit or reduce your

credit limit during any period in which any of the following are in effect:

(a)

The value of your dwelling declines significantly below the dwelling's appraised value for purposes of the Plan. This includes,

for example, a decline such that the initial difference between the credit limit and the available equity is reduced by fifty percent

and may include a smaller decline depending on the individual circumstances.

(b)

We reasonably believe that you will be unable to fulfill your payment obligations under the Plan due to a material change in

your

financial circumstances.

(c)

You are in default under any material obligation of the Plan. We consider all of your obligations to be material. Categories of

material obligations include, but are not limited to, the events described above under Termination and Acceleration , obligations

to pay fees and charges, obligations and limitations on the receipt of credit advances, obligations concerning maintenance or

use of the dwelling or proceeds, obligations to pay and perform the terms of any other deed of trust, mortgage or lease of the

dwelling, obligations to notify us and to provide documents or information to us (such as updated financial information),

obligations to comply with applicable laws (such as zoning restrictions).

(d)

We are precluded by government action from imposing the annual percentage rate provided for under the Plan.

(e)

The priority

of our security interest is adversely affected by government action to the extent that the value of the security interest

is less than 120 percent of the credit limit.

(f)

We have been notified by governmental authority that continued advances may constitute an unsafe and unsound business

practice.

(g)

The maximum annual percentage rate under the Plan is reached.

Change in Terms. We may make changes to the terms of the Plan if you agree to the change in writing at that time , if the change will

unequivocally benefit you throughout the remainder of the Plan, or if the change is insignificant (such as changes relating to our data

processing systems).

Fees and Charges. In order to open and maintain an account, you must pay certain fees and charges.

Lender Fees. The following fees must be paid to us:

Lender: Orrstown Bank

P O Box 250

Shippensburg, PA 17257

Home Equity Application Disclosure

Recapture Fee: If you elect or request to terminate or close the Credit Line within twenty-four (24) months of the Opening Date, you

may be required to remit any closing costs Orrstown Bank paid on your behalf, including but not limited to recordation taxes.

Late Charge. Your payment will be late if it is not received by us within 16 days after the "Payment Due Date" shown on your

periodic statement. If your payment is late we may charge you 10.000% of the payment or $5.00, whichever is greater.

Third Party Fees. If you are purchasing a property that will also secure the Credit Line, you must pay certain fees to third parties

such as appraisers, credit reporting firms, and government agencies. These third party fees generally total between $300.00 and

$4,580.00 (

for a Credit Line amount of $100,000.00). Upon request, we will provide you with an itemization of the fees you have to pay

to third parties.

PROPERTY INSURANCE. You must carry insurance on the property that secures the Plan.

MINIMUM PAYMENT REQUIREMENTS. You can obtain advances of credit during the following period: for a period of ten years from the

Opening Date. You may however begin the amortization period sooner than ten years, which would discontinue your draw period at that time

(the "Draw Period"). After the Draw Period ends, the repayment period will begin. You will no longer be able to obtain credit advances. The

length of the repayment period is as follows: for a period of twenty years. Your Regular Payment will equal the amount of your accrued

FINANCE CHARGES ("First Payment Stream"). You will make 120 of these payments. Your payments will be due monthly. Your "Minimum

Payment" will be the Regular Payment, plus any amount past due and all other charges. An increase in the ANNUAL PERCENTAGE RATE

may increase the amount of your Regular Payment. The Minimum Payment during the First Payment Stream will not reduce the principal that is

outstanding on your Credit Line.

After completion of the First Payment Stream, your Regular Payment will be based on an amortization of your balance at the st

art of this

payment period as shown below (“Second Payment Stream”). Your payments will be due monthly.

Range of Balances Number of Payments Regular Payment Calculation

All Balances

240 240 payments

Your "Minimum Payment" will be the Regular Payment, plus any amount past due and all other charges.

A change in the ANNUAL PERCENTAGE RATE can cause the balance to be repaid more quickly or more slowly. When rates decrease, l

ess

interest is due, so more of the payment repays the principal balance. When rates increase, more interest is due, so less of the payment repays

the principal balance. If this happens, we may adjust your payment as follows: your payment may be increased by the amount necessary to

repay the balance by the end of this payment stream. Each time the ANNUAL PERCENTAGE RATE changes, we will review the effect the

change has on your Credit Line Account to see if your payment is sufficient to pay the balance by the Maturity Date. If it is

not, your payment will

be increased by an amount necessary to repay the balance by the Maturity Date.

MINIMUM PAYMENT EXAMPLE.

Loan-to-Value 80% or Less: If you made only the minimum payment and took no other credit advances, it would take 30 years to pay off

a credit advance of $10,000.00 at an ANNUAL PERCENTAGE RATE of 8.50%. During that period, you would make 120 monthly

payments ranging from $65.21 to $72.19. Then you would make 240 monthly payments ranging from $86.80 to 88.25

. We have used this

rate of 8.50% recently on Credit Lines less than $100,000.00.

Loan-to-Value Exceeds 80%: If you made only the minimum payment and took no other credit advances, it would take 30 years to pay

off a credit advance of $10,000.00 at an ANNUAL PERCENTAGE RATE of 9.75%. During that period, you would make 120 monthly

payments ranging from $74.79 to $82.81. Then you would make 240 monthly payments ranging from $94.87 to $97.87.

TRANSACTION REQUIREMENTS. The following transaction limitations will apply to the use of your Credit Line:

Credit Line Credit Line Check Limitations. The following transaction limitations will apply to your Credit Line and the writing of Credit

Line Checks.

Maximum Number of Advances Per Period. The maximum number of advances that you may obtain per month is 10.

Minimum Advance Amount. The minimum amount of any credit advance that can be made on your Credit Line is $100.00. This

means any Credit Line Check must be written for at least the minimum advance amount.

Telephone Request Limitations. The following transaction limitations will apply to your Credit Line and requesting an advance by

telephone.

Maximum Number of Advances Per Period. The maximum number of advances that you may obtain per month is 10.

Minimum Advance Amount. The minimum amount of any credit advance that can be made on your Credit Line is $100.00.

Overdraft Limitations. The following transaction limitations will apply to your Credit Line and writing a check in excess of your checking

account balance.

Maximum Number of Advances Per Period. The maximum number of advances that you may obtain per month is 20.

Minimum Advance Amount. The minimum amount of any credit advance that can be made on your Credit Line is $50.00.

Other Transaction Requirements. If the credit line balance is less than $50.00, and the overdraft is less than $50.00, the amount of the

overdraft will be taken.

In Person Request Limitations. The following transaction limitations will apply to your Credit Line and requesting an advance in person.

Maximum Number of Advances Per Period. The maximum number of advances that you may obtain per month is 10.

Minimum Advance Amount. The minimum amount of any credit advance that can be made on your Credit Line is $100.00.

Lender: Orrstown Bank

P O Box 250

Shippensburg, PA 17257

Home Equity Application Disclosure

Internet Banking Limitations. The following transaction limitations will apply to your Credit Line and accessing by other methods.

Maximum Number of Advances Per Period. The maximum number of advances that you may obtain per month is 10.

Minimum Advance Amount.

The minimum

amount of any credit advance that can be made on your Credit Line is $100.00.

CONVERSION OPTION.

This agreement contains an option to convert a portion or all of the balance under your Credit Line from a variable

ANNUAL PERCENTAGE RATE to a fixed

ANNUAL PERCENTAGE RATE as determined below. Each portion of the balance under your

Credit Line you convert to a fixed ANNUAL

PERCENTAGE RATE is referred to as a “Fixed-Rate Advance.” The following information describes the terms and features of the conversion

option available under this Agreement:

ANNUAL PERCENTAGE RATE Increase. Your ANNUAL PERCENTAGE RATE may increase if you exercise this option to convert

to a fixed rate.

Conversion Periods. You can exercise the option to convert to a fixed rate only during the following period or periods: You can

exercise the option to convert to a fixed ANNUAL PERCENTAGE RATE at any time during the Draw Period, and any extension of the Draw

Period. After the Draw Period ends, or if you do not meet the repayment terms of this credit agreement, you will not be able to exercise the

option to convert to a fixed ANNUAL PERCENTAGE RATE.

Conversion Fees. You will be required to pay the following fees at the time of the conversion to a fixed rate: a rate lock fee of

$50.00 each time you exercise the option to convert to a fixed ANNUAL PERCENTAGE RATE. This is a FINANCE CHARGE. You will be

required to pay a rate unlock fee of $75.00 each time you exercise the option to convert to a variable ANNUAL PERCENTAGE RATE. This is a

FINANCE CHARGE.

Rate Determination: The fixed rate will be determined as follows: The fixed rate will be based on certain credit criteria and length of

the fixed rate term, in conjunction with our published rates for a closed-end home equity loan at the time of the conversion request.

Conversion Rules. You can convert to

a fixed rate only during the period or periods described above. In addition, the following rules

apply to the conversion option under this agreement: You can exercise the option to convert to a fixed ANNUAL PERCENTAGE RATE only

during the period or periods described above. The minimum fixed rate advance is $5,000.00.

(a) Minimum and maximum term. If you exercise the option to convert to a fixed ANNUAL PERCENTAGE RATE, the term of the Fixed-

Rate Advance cannot be less than twelve (12) months or longer than two hundred and forty (240) months.

(b) Number of Fixed-Rate Advances. You can exercise the option to convert to a fixed ANNUAL PERCENTAGE RATE from time to time,

but you may not have more than five (5) different Fixed Rate Advances outstanding under your Credit Line Account at any one time.

(c) Ineligible for Promotional Rates. In determining your interest rate and ANNUAL PERCENTAGE RATE as described in the Rate

Determination paragraph above, our published closed-end home equity loan interest rates and ANNUAL PERCENTAGE RATE will not

include any special, promotion or coupon interest rates and interest rates available only for newly opened accounts. If we offer a

discounted interest rate and ANNUAL PERCENTAGE RATE for agreeing to make payments through automatic deduction from a

checking account maintained with us, that discounted rate will be considered the published rate for purposes of the Rate Determination

paragraph above, only if you have agreed to have payments under your Credit Line Account automatically deducted from a checking

account you maintain with us.

(d) Complete Election Form. In order to exercise the option to convert to a fixed ANNUAL PERCENTAGE RATE, you must complete the

SmartLock Rate Lock Request Form.

(e) Minimum Monthly Payments. At the time you exercise the option to convert to a fixed ANNUAL PERCENTAGE RATE, we will

determine a minimum monthly payment applicable to that Fixed-Rate Advance. The minimum monthly payment will include both

principal and interest and will be sufficient to repay the Fixed Rate Advance in equal monthly installments of principal and interest over

the term of the Fixed Rate Advance. The minimum monthly payment with respect to a Fixed-

Rate Advance will not be less than $50.00.

If you have more than one Fixed-Rate Advance outstanding, you will have to make minimum monthly payments with respect to each

Fixed Rate Advance. The minimum monthly payments due with respect to Fixed Rate Advances will be in addition to the Minimum

Payment due with respect to any balance under your Credit Line subject to a variable ANNUAL PERCENTAGE RATE.

(f) How Payments Are Applied If You Have A Fixed-Rate Advance Outstanding. Separate billing will be provided for each Fixed-Rate

Advance. Payments include principal and interest. Unless otherwise agreed or required by applicable law, payments will be applied

first to any accrued unpaid interest; then to principal; then to any late charges; and then to any unpaid collection costs.

In the event you

make a payment in excess of the amount necessary to pay all of these amounts, the excess will be first applied to reduce any principal

outstanding. Any prepayments of principal will not reduce the amount of, or extend the due date for, any future minimum monthly

payments.

(g) Unlock Requirement. The fixed rate por

tion must be in effect for a minimum of 365 days before you can exercise your option to convert

the fixed rate portion into a variable rate. You will need to execute the SmartLock Rate Unlock Request Form to convert back to a

variable rate feature after the 365 day fixed rate period, if desired.

Lender: Orrstown Bank

P O Box 250

Shippensburg, PA 17257

Home Equity Application Disclosure

TAX DEDUCTIBILITY. You should consult a tax advisor regarding the deductibility of interest and charges for the Plan.

ADDITIONAL HOME EQUITY PROGRAMS. Please ask us about our other available Home Equity Line of Credit plans.

VARIABLE RATE FEATURE. The Plan has a variable rate feature. The ANNUAL PERCENTAGE RATE (corresponding to the periodic rate),

and the minimum payment amount can change as a result. The ANNUAL PERCENTAGE RATE does not include costs other than interest.

THE INDEX. The annual percentage rate is based on the value of an index (referred to in this disclosure as the "Index"). The Index is the Wall

Street Prime. Information about the Index is available or published in the Wall Street Journal. We will use the most recent Index value available

to us as of the date of any annual percentage rate adjustment. If the Index is no longer available, we will choose a new Index and margin. The

new Index will have an historical movement substantially similar to the original Index, and the new Index and margin will result in an annual

percentage rate that is substantially similar to the rate in effect at the time the original Index becomes unavailable.

ANNUAL PERCENTAGE RATE. To determine the Periodic Rate that will apply to your First Payment Stream , we add a margin to the value of

the Index, round that sum up to the nearest 0.125%, then divide the rounded value by the number of days in a year (daily). To obtain the

ANNUAL

PERCENTAGE RATE we multiply the Periodic Rate by the number of days in a year (daily). This result is the ANNUAL PERCENTAGE

RATE for your First Payment Stream. To determine the Periodic Rate that will apply to your Second Payment Stream , we add a margin to the

value of the Index, round that sum up to the nearest 0.125%, then divide the rounded value by the number of days in a year (d

aily). To obtain the

ANNUAL PERCENTAGE RATE we multiply the Periodic Rate by the number of days i

n a year (daily). This result is the ANNUAL PERCENTAGE

RATE for your Second Payment Stream. A change in the Index rate generally will result in a change in the ANNUAL PERCENTAGE RATE. The

amount that your ANNUAL PERCENTAGE RATE may change also may be affected by the lifetime annual percentage rate limits, as discussed

below.

Initial ANNUAL PERCENTAGE RATE Discount. The initial ANNUAL PERCENTAGE RATE is “discounted” – it is not based on the

Index and margin used for later rate adjustments. The initial discounted rate will be in effect for six (6) months. The interest rate of

4.35% will be calculated and in effect for 6 months from the original date of the Credit Agreement and Disclosure. Offer valid ONLY on

new SmartLock customers. Additional credit score and loan-to-value restrictions may apply which may impact the initial annual

percentage rate.

Please ask us for the current Index value, margin, discount and annual percentage rate. After you open a credit line, rate information

will be provided on periodic statements that we send to you.

PREFERRED VARIABLE RATE. The ANNUAL PERCENTAGE RATE under the Plan may include a preferred variable rate which is subject to

the following rules and provisions:

Description of Event That Would Cause Lender to Increase the ANNUAL PERCENTAGE RATE. Automatic drafting of payment

from an Orrstown Bank checking or savings account is discontinued.

How The New Rate Will Be Determined. As determined above, the ANNUAL PERCENTAGE RATE under this Plan is variable based

on the Index value plus a margin. Should the event described above occur, the ANNUAL PERCENTAGE RATE will be increased as

follows: by adding 0.75% to the current rate.

FREQUENCY OF ANNUAL PERCENTAGE RATE ADJUSTMENTS. Your ANNUAL PERCENTAGE RATE can change quarterly. There is no

limit on the amount by which the annual percentage rate can change during any one year period. However, under no circumstances will your

ANNUAL PERCENTAGE RATE exceed 18.000% per annum or, except for any initial discount period, go below

3.250% per annum at any time

during the term of the Plan.

MAXIMUM RATE AND PAYMENT EXAMPLE.

Draw Period. If you had an outstanding balance of $10,000.00, the minimum payment at the maximum ANNUAL PERCENTAGE RATE of

18.000% would be $152.88. This ANNUAL PERCENTAGE RATE could be reached at the time of the 1st payment.

Repayment Period. If you had an outstanding balance of $10,000.00, the minimum payment at the maximum ANNUAL PERCENTAGE

RATE of 18.000% would be $154.36. This ANNUAL PERCENTAGE RATE could be reached at the time of the 1st payment during the

repayment period.

PREPAYMENT. You may prepay all or any amount owing under the Plan at any time without penalty.

HISTORICAL EXAMPLE. The examples below show how the ANNUAL PERCENTAGE RATE and the minimum payments for a single

$10,000.00 credit advance would have changed based on changes in the Index from 2010 to 2024. The Index values are from the following

reference period: as of 1st week ending in July. While only one payment per year is shown, payments may have varied during each year.

Different outstanding principal balances could result in different payment amounts.

The table assumes that no additional credit advances were taken, that only the minimum payments were made, and that the rate remained

constant during the year. It does not necessarily indicate how the Index or your payments would change in the future.

Lender: Orrstown Bank

P O Box 250

Shippensburg, PA 17257

Home Equity Application Disclosure

(1) This is a margin we have used recently; your margin may be different.

(7) This ANNUAL PERCENTAGE RATE reflects a discount that we have provided recently; your Plan may be discounted by a different amount.

LASER PRO Lending, Ver. 17.1.10 Copr. Harland Financial Solutions, Inc. 1997, 2013. All Rights Reserved. - PA c:\CFI\LPL\B11.FC PR-271 (M)

MF rev. 07/15/24

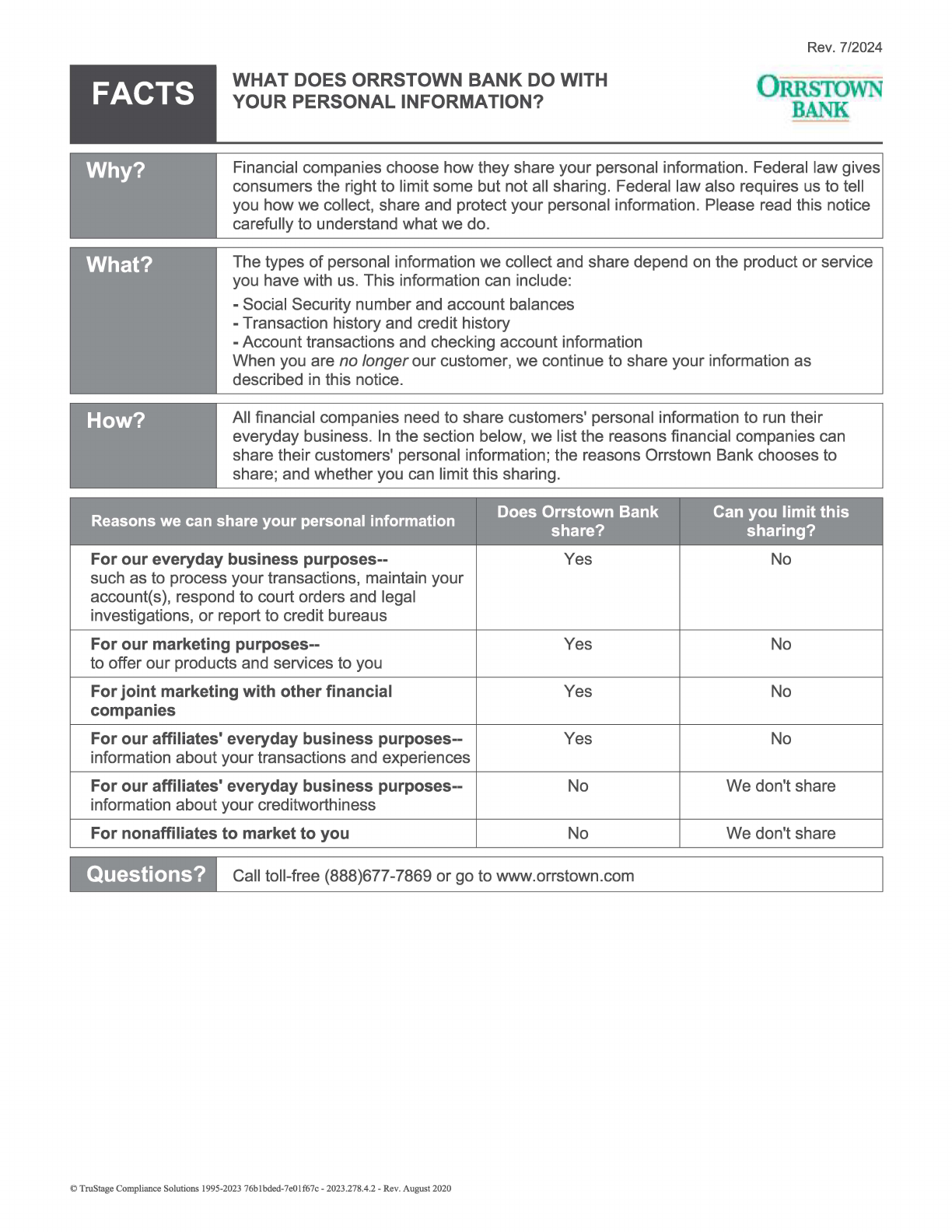

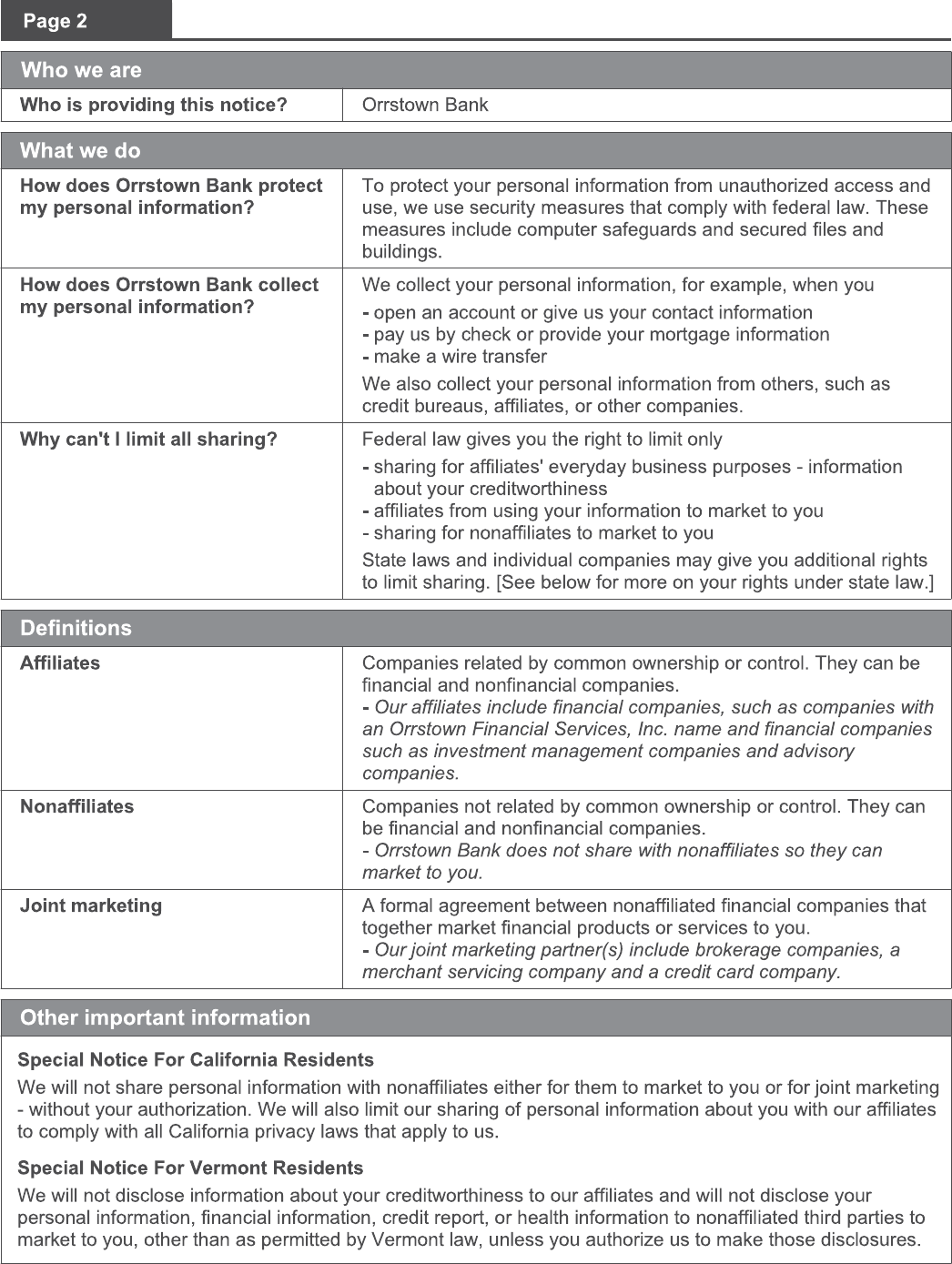

FACTS

WHAT DOES ORRSTOWN BANK DO WITH

YOUR PERSONAL INFORMATION?

Rev. 7/2024

OiffisroWN

BANK

Why?

Financial companies choose how they share your personal information. Federal law gives

consumers the right to limit some but not all sharing. Federal law also requires us to tell

you how we collect, share and protect your personal information. Please read this notice

carefully to understand what we do.

The types

of

personal information we collect and share depend on the product or service

you have with us. This information can include:

- Social Security number and account balances

- Transaction history and credit history

- Account transactions and checking account information

When you are no longer our customer, we continue to share your information as

described

in

this notice.

How?

All financial companies need to share customers' personal information to run their

everyday business.

In

the section below, we list the reasons financial companies can

share their customers' personal information; the reasons Orrstown Bank chooses to

share; and whether you can limit this sharing.

Reasons

we

can

share your personal information

Does Orrstown Bank Can you limit this

share? sharing?

For our everyday business purposes--

Yes No

such as to process your transactions, maintain your

account(s), respond to court orders and legal

investigations, or report to credit bureaus

For our marketing purposes-- Yes No

to offer our products and services to you

For joint marketing with other financial Yes No

companies

For our affiliates' everyday business purposes--

Yes No

information about your transactions and experiences

For our affiliates' everyday business purposes--

No

We don't share

information about your creditworthiness

For nonaffiliates to market to you No We don't share

Questions?

Call toll-free (888)677-7869 or go to www.orrstown.com

© TruStage Compliance Solutions 1995-2023 76blbded-7e0lf67c- 2023.278.4.2 - Rev. August 2020

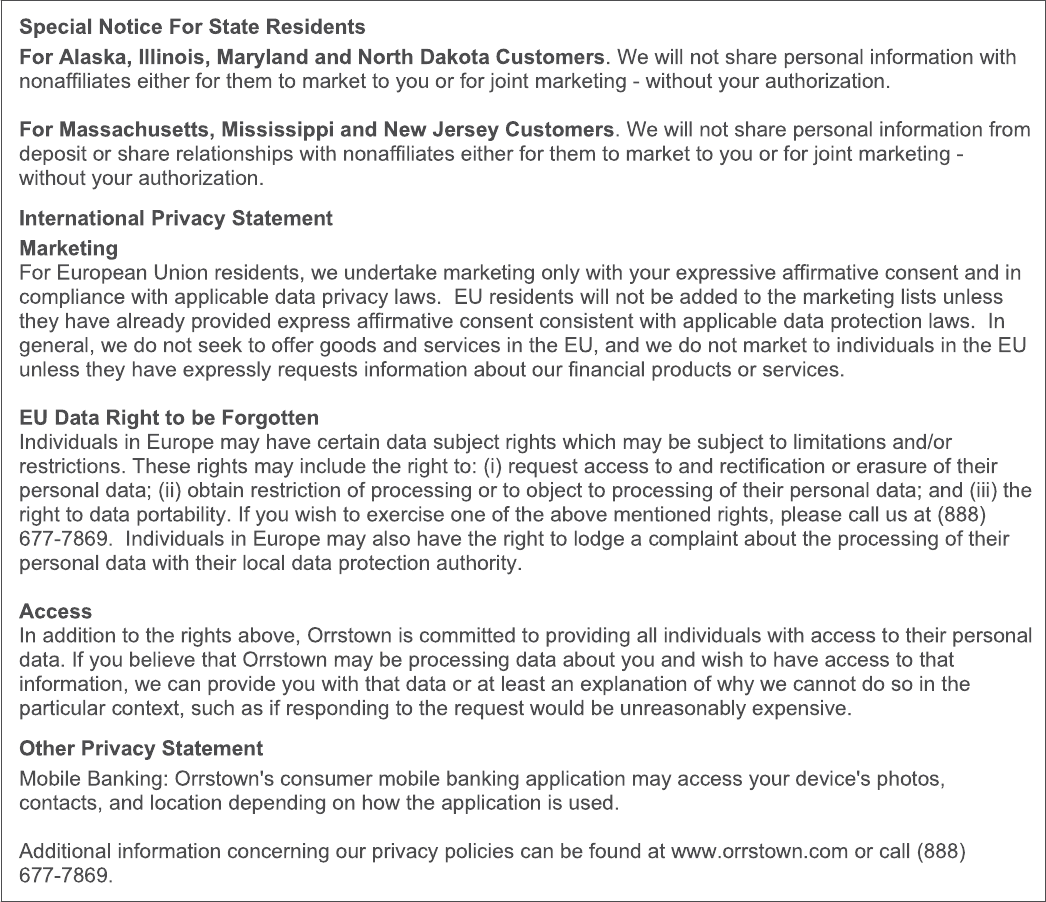

What we do

How does Orrstown Bank protect

my personal information?

How does Orrstown Bank collect

my personal information?

Why can't I limit all sharing?

Definitions

Affiliates

Nonaffiliates

Joint marketing

Other important information

To protect your personal information from unauthorized access and

use, we use security measures that comply with federal law. These

measures include computer safeguards and secured files and

buildings.

We collect your personal information, for example, when you

- open

an

account or give us your contact information

- pay us by check or provide your mortgage information

- make a wire transfer

We also collect your personal information from others, such as

credit bureaus, affiliates, or other companies.

Federal law gives you the right to limit only

- sharing for affiliates' everyday business purposes - information

about your creditworthiness

- affiliates from using your information to market to you

- sharing for nonaffiliates to market to you

State laws and individual companies may give you additional rights

to limit sharing. [See below for more on your rights under state law.]

Companies related by common ownership or control. They can be

financial and nonfinancial companies.

- Our affiliates include financial companies, such as companies with

an Orrstown Financial Services, Inc. name and financial companies

such as investment management companies and advisory

companies.

Companies not related by common ownership or control. They can

be financial and nonfinanci

al

companies.

- Orrstown Bank does not share with nonaffiliates so they can

market to you.

A formal agreement between nonaffiliated financial companies that

together market financial products

or

services to you.

- Our joint marketing partner(s) include brokerage companies, a

merchant servicing company and a credit card company.

Special Notice For California Residents

We will not share personal information with nonaffiliates either for them to market to you or for joint marketing

- without your authorization. We will also limit our sharing

of

personal information about you with our affiliates

to comply with all California privacy laws that apply to us.

Special Notice For Vermont Residents

We will not disclose information about your creditworthiness to our affiliates and will not disclose your

personal information, financial information, credit report,

or

health information to nonaffiliated third parties to

market to you, other than as permitted by Vermont law, unless you authorize us to make those disclosures.

Special Notice For State Residents

For Alaska, Illinois, Maryland and North Dakota Customers. We will not share personal information with

nonaffiliates either for them to market to you or for joint marketing - without your authorization.

For Massachusetts, Mississippi and New Jersey Customers. We will not share personal information from

deposit or share relationships with nonaffiliates either for them to market to you

or

for joint marketing -

without your authorization.

International Privacy Statement

Marketing

For European Union residents, we undertake marketing only with your expressive affirmative consent and

in

compliance with applicable data privacy laws.

EU

residents will not

be

added to the marketing lists unless

they have already provided express affirmative consent consistent with applicable data protection laws.

In

general, we do not seek to offer goods and services in the

EU

, and we do not market to individuals

in

the

EU

unless they have expressly requests information about our financial products or services.

EU

Data Right to be Forgotten

Individuals

in

Europe may have certain data subject rights which may be subject to limitations and/or

restrictions. These rights may include the right to: (i) request access to and rectification or erasure

of

their

personal data; (ii) obtain restriction

of

processing or to object to processing of their personal data; and (iii) the

right to data portability. If you wish to exercise one

of

the above mentioned rights, please call us at (888)

677-7869. Individuals

in

Europe may also have the right to lodge a complaint about the processing

of

their

personal data with their local data protection authority.

Access

In

addition to the rights above, Orrstown is committed to providing all individuals with access to their personal

data. If you believe that Orrstown may be processing data about you and wish to have access to that

information, we can provide you with that data or at least an explanation

of

why we cannot do so

in

the

particular context, such as

if

responding to the request would be unreasonably expensive.

Other Privacy Statement

Mobile Banking: Orrstown's consumer mobile banking application may access your device's photos,

contacts, and location depending on how the application is used.

Additional information concerning our privacy policies can be found at www.orrstown.com or call (888)

677-7869.

WHAT YOU SHOULD KNOW ABOUT

Home Equity

Lines of Credit

(HELOC)

Borrowing from the

value of your home

Consumer Financial

Protection Bureau

An ofcial publication of the U.S. government

How to use the booklet

When you and your lender discuss home equity

lines of credit, often referred to as HELOCs,

you receive a copy of this booklet. It helps you

explore and understand your options when

borrowing against the equity in your home.

You can nd more information from the

Consumer Financial Protection Bureau (CFPB)

about home loans at cfpb.gov/mortgages.

You’ll also nd other mortgage-related CFPB

resources, facts, and tools to help you take

control of your borrowing options.

About the CFPB

The CFPB is a 21st century agency that

implements and enforces federal consumer

nancial law and ensures that markets for

consumer nancial products are fair, transparent,

and competitive.

This pamphlet, titled What you should know about

home equity lines of credit, was created to comply with

federal law pursuant to 15 U.S.C. 1637a(e) and 12 CFR

1026.40(e).

How can this booklet help you?

This booklet can help you decide whether

home equity line of credit is the right choice

for you, and help you shop for the best

available option.

A home equity line of credit (HELOC) is

a loan that allows you to borrow, spend,

and repay as you go, using your home as

collateral.

Typically, you can borrow up to a

specied percentage of your equity.

Equity is the value of your home minus

the amount you owe on your mortgage.

Consider a HELOC if you are condent

you can keep up with the loan

payments. If you fall behind or can’t

repay the loan on schedule, you could

lose your home.

After you nish this booklet:

• You’ll understand the effect of borrowing

against your home

• You’ll think through your borrowing and

nancing options, besides a HELOC

• You’ll see how to shop for your best HELOC

offer

• You’ll see what to do if the economy or your

situation changes

TIP

Renting your home out to other people may be

prohibited under the terms of your line of credit.

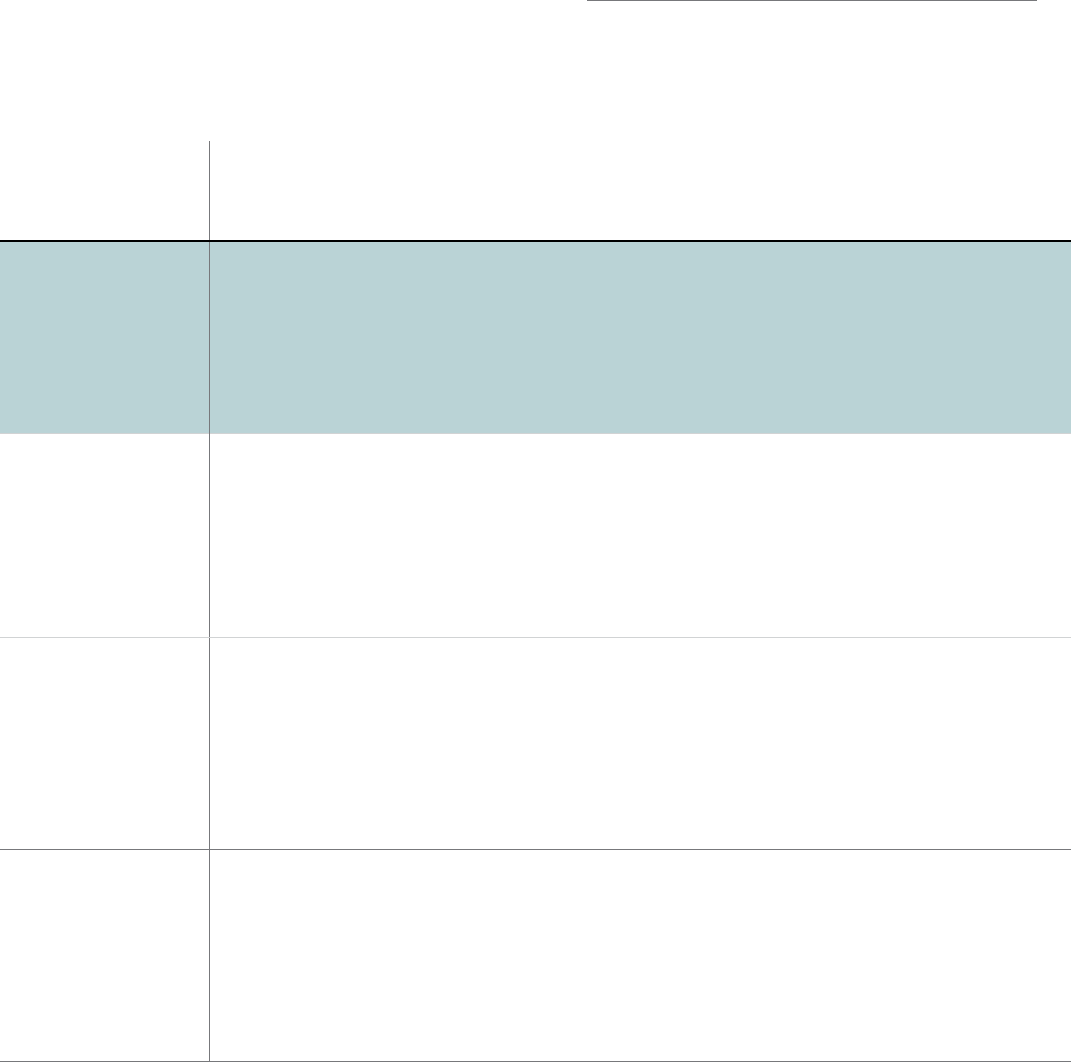

Compare a HELOC to other

money sources

Before you decide to take out a HELOC, it might

make sense to consider other options that might

be available to you, like the ones below.

VARIABLE IS YOUR

HOW MUCH CAN YOU TYPICAL TYPICAL

MONEY SOURCE

OR FIXED HOME AT

BORROW ADVANTAGES DISADVANTAGES

RATE RISK?

SECOND

Generally a

Fixed Yes Equal payments If you need more

percentage of the

that pay off the money, you need to

MORTGAGE OR

appraised value

entire loan apply for a new loan;

of your home,

repayment is often

HOME EQUITY

LOAN

minus the amount

required when you

You borrow against

you owe on your

sell your home

the equity in your

mortgage

home

CASH-OUT

Generally a

Variable Yes Continue to make Closing costs are

REFINANCE

percentage of the

or xed just one mortgage generally higher;

appraised value

payment it may take longer

You replace your

of your home; the

to pay off your

amount of your

mortgage; interest

existing mortgage

with a bigger

existing loan plus

rate may be higher

mortgage and take

the amount you

than your current

the difference in cash

want to cash out

mortgage

PERSONAL LINE OF

Up to your Variable, No Continue repaying

Solid credit is

CREDIT

credit limit, as typically and borrowing

required; you may

determined by the for several years

need to pay the

You borrow based on

lender without additional

entire amount due

approvals or

once a year; higher

your credit, without

using your home as

paperwork

interest rate than a

collateral

loan that uses your

home as collateral

HELOC

You borrow against

the equity in your

home

percentage of the

appraised value

of your home,

minus the amount

you owe on your

mortgage

typically

Generally a

Variable. Yes Continue

repaying and

Repayment amount

borrowing for

several years

often required when

without additional

approvals or

paperwork

varies; repayment is

you sell your home

2 HOME EQUITY LINES OF CREDIT COMPARE A HELOC TO OTHER MONEY SOURCES 3

Compare a HELOC to

other money sources

MONEY SOURCE

HOW MUCH CAN YOU

BORROW

VARIABLE

OR FIXED

RATE

IS YOUR

HOME AT

RISK?

TYPICAL

ADVANTAGES

TYPICAL

DISADVANTAGES

RETIREMENT PLAN

Generally, up Fixed No Repay through

If you leave or lose

LOAN

You borrow from your

to 50% of your

vested balance

or $50,000,

paycheck

deductions;

paperwork

your job, repay the

whole amount at

that time or pay

retirement savings

whichever is less required but no

taxes and penalties;

in a 401(k) or similar

credit check and

spouse may need to

plan through your

no impact on your

consent

current employer

credit score

HOME EQUITY

Depends on your Fixed or Yes You don’t make

The amount you owe

CONVERSION

age, the interest variable monthly loan

grows over time;

MORTGAGE (HECM)

You must be age 62

rate on your loan,

and the value of

your home

payments—

instead, you

typically repay the

you might not have

any value left in your

home if you want to

or older, and you

loan when you

leave it to your heirs

borrow against the

move out, or your

equity in your home

survivors repay it

after you die

CREDIT CARD

Up to the amount Fixed or No No minimum

Higher interest rate

You borrow money

of your credit limit, variable purchase;

than a loan that

from the credit card

company and repay

as determined by

the credit card

company

consumer

protections in the

case of fraud or

uses your home as

collateral

as you go

lost or stolen card

FRIENDS AND

Agreed on by Variable, No Reduced waiting Forgiven loans

FAMILY

You borrow money

the borrower and

lender

xed or

other

time, fees, and

paperwork

compared to a

and unreported or

forgiven interest can

complicate taxes,

from someone you

are close to

formal loan especially for large

loans; can jeopardize

important personal

relationships if

something goes

wrong

4 HOME EQUITY LINES OF CREDIT COMPARE A HELOC TO OTHER MONEY SOURCES 5

How HELOCs work

PREPARE FOR UP-FRONT COSTS

Some lenders waive some or all of the up-front

costs for a HELOC. Others may charge fees. For

example, you might get charged:

• A fee for a property appraisal, which is a formal

estimate of the value of your home

• An application fee, which might not be

refunded if you are turned down

• Closing costs, including fees for attorneys,

title search, mortgage preparation and ling,

property and title insurance, and taxes

PULL MONEY FROM YOUR LINE OF CREDIT

Once approved for a HELOC, you can generally

spend up to your credit limit whenever you want.

When your line of credit is open for spending, you

are in the you are in the borrowing period, also

called the draw period. Typically, you use special

checks or a credit card to draw on your line. Some

plans require you to borrow a minimum amount

each time (for example, $300) or keep a minimum

amount outstanding. Some plans require you to

take an initial amount when the credit line is set up.

MAKE REPAYMENTS DURING THE “DRAW

PERIOD”

Some plans set a minimum monthly payment that

includes a portion of the principal (the amount you

borrow) plus accrued interest. The portion of your

payment that goes toward principal typically does

not repay the principal by the end of the term.

Other plans may allow payment of the interest only,

during the draw period, which means that you pay

nothing toward the principal.

If your plan has a variable interest rate, your

monthly payments may change even if you don’t

draw more money.

ENTER THE “REPAYMENT PERIOD”

Whatever your payment arrangements during the

draw period—whether you pay some, a little, or

none of the principal amount of the loan—when the

draw period ends you enter a repayment period.

Your lender may set a schedule so that you repay

the full amount, often over ten or 15 years.

Or, you may have to pay the entire balance owed,

all at once, which might be a large amount called

a balloon payment. You must be prepared to

make this balloon payment by renancing it with

the lender, getting a loan from another lender, or

some other means. If you are unable to pay the

balloon payment in full, you could lose your home.

RENEW OR CLOSE OUT THE LINE OF CREDIT

At the end of the repayment period, your lender

might encourage you to leave the line of credit

open. This way you don’t have to go through the

cost and expense of a new loan, if you expect to

borrow again. Be sure you understand if annual

maintenance fees or other fees apply, even if you

are not actively using the credit line.

TIP

If you sell your home, you are generally required

to pay off your HELOC in full immediately. If you

are likely to sell your home in the near future,

consider whether or not to pay the up-front costs

of setting up a line of credit.

6 HOME EQUITY LINES OF CREDIT HOW HELOCS WORK 7

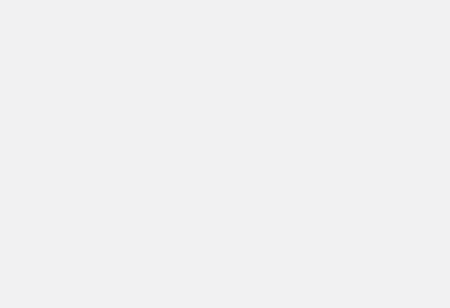

GET THREE HELOC ESTIMATES

Shopping around lets you compare costs and

features, so you can feel condent you’re making

the best choice for your situation.

OFFER A OFFER B OFFER C

Initiating the HELOC

Credit limit

$

First transaction

$

Minimum transaction

$

Minimum balance

$

Fixed annual percentage rate

Variable annual percentage rate

» Index used and current value

» Amount of margin

» Frequency of rate adjustments

» Amount/length of discount rate (if any)

» Interest rate cap and oor

Length of plan

» Draw period

» Repayment period

Initial fees

» Appraisal fee

$

» Application fee

$

8 HOME EQUITY LINES OF CREDIT GET THREE HELOC ESTIMATES 9

GET THREE HELOC ESTIMATES

Shopping around lets you compare costs and

features, so you can feel condent you’re making the

best choice for your situation.

OFFER A OFFER B OFFER C

» Up-front charges, including points

$

» Early termination fee

$

» Closing costs

During the draw period

» Interest and principal payments

$

» Interest-only payments?

$

» Fully amortizing payments

$

» Annual fee (if applicable)

$

» Transaction fee (if applicable)

$

» Inactivity fee

$

» Prepayment and other penalty fees

$

During the repayment period

» Penalty for overpayments?

» Fully amortizing payment amount?

» Balloon repayment of full balance owed?

» Renewal available?

» Renancing of balance by lender?

» Conversion to xed-term loan?

10 HOME EQUITY LINES OF CREDIT

My best HELOC offer is:

How variable interest rates work

Home equity lines of credit typically involve

variable rather than xed interest rates.

A variable interest rate generally has two parts:

the index and the margin.

An index is a measure of interest rates generally

that reects trends in the overall economy

Different lenders use different indexes in their

loans. Common indexes include the U.S. prime

rate and the Constant Maturity Treasury (CMT)

rate. Talk with your lender to nd out more about

the index they use.

The margin is an extra percentage that the lender

adds to the index.

Lenders sometimes offer a temporarily discounted

interest rate for home equity lines—an introductory

or teaser rate that is unusually low for a short

period, such as six months.

Rights and responsibilities

Lenders are required to disclose the terms and

costs of their home equity lines of credit. They

need to tell you:

• Annual percentage rate (APR)

• Information about variable rates

• Payment terms

• Requirements on transactions, such as

minimum draw amounts and number of draws

allowed per year

• Annual fees

• Miscellaneous charges

You usually get these disclosures when

you receive a loan application, and you get

additional disclosures before the line of credit is

opened. In general, the lender cannot charge a

nonrefundable fee as part of your application until

three days after you have received the disclosures.

If the lender changes the terms before the loan is

made, you can decide not to go forward with it,

and the lender must return all fees. There is one

exception: the variable interest rate might change,

and in that case if you decide not to go ahead with

the loan, your fees are not refunded.

Lenders must give you a list of HUD-approved

housing counselors in your area. You can talk

to counselor about how HELOCs work and get

free or low-cost help with budgeting and money

management.

Right to cancel (also called right to rescind)

If you change your mind for any reason, under

federal law, you can cancel the credit line in the

rst three days. Notify the lender in writing within

the rst three days after the account was opened.

The lender must then cancel the loan and return

the fees you paid, including application and

appraisal fees.

TIP

Some HELOCs let you convert some of your

balance to a xed interest rate. The xed interest

rate is typically higher than the variable rate, but

it means more predictable payments.

12 HOME EQUITY LINES OF CREDIT HOW HELOCS WORK 13

If something changes during

the course of the loan

HELOCs generally permit the lender to freeze or

reduce your credit line if the value of your home

falls or if they see a change for the worse in your

nancial situation. If this happens, you can:

• Talk with your lender. Find out the reason

for the freeze or reduction. You might need

to check your credit reports for errors that

might have caused a downgrade in your

credit. Or, you might need to talk with your

lender about a new appraisal on your home

and make sure the lender agrees to accept a

new appraisal as valid.

• Shop for another line of credit. If another

lender offers you a line of credit, you may be

able to use that to pay off your original line

of credit. Application fees and other fees

may apply for the new loan.

WELL DONE!

For most people, a home is their most

valuable asset. A HELOC can help you

make the most of this asset, when you

understand the ins and outs and know

what to expect.

14 HOME EQUITY LINES OF CREDIT HOW HELOCS WORK 15

In this booklet:

ASK YOURSELF

Have I considered other sources of money

and loans, besides a HELOC?

Have I shopped around for HELOC features

and fees?

Am I comfortable with the worst-case

scenario, where I could lose my home?

ONLINE TOOLS

CFPB website

cfpb.gov

Answers to common questions

cfpb.gov/askcfpb

Tools and resources for home buyers

cfpb.gov/owning-a-home

Talk to a HUD-approved housing counselor

cfpb.gov/nd-a-housing-counselor

Submit a complaint

cfpb.gov/complaint

Last updated 08/22