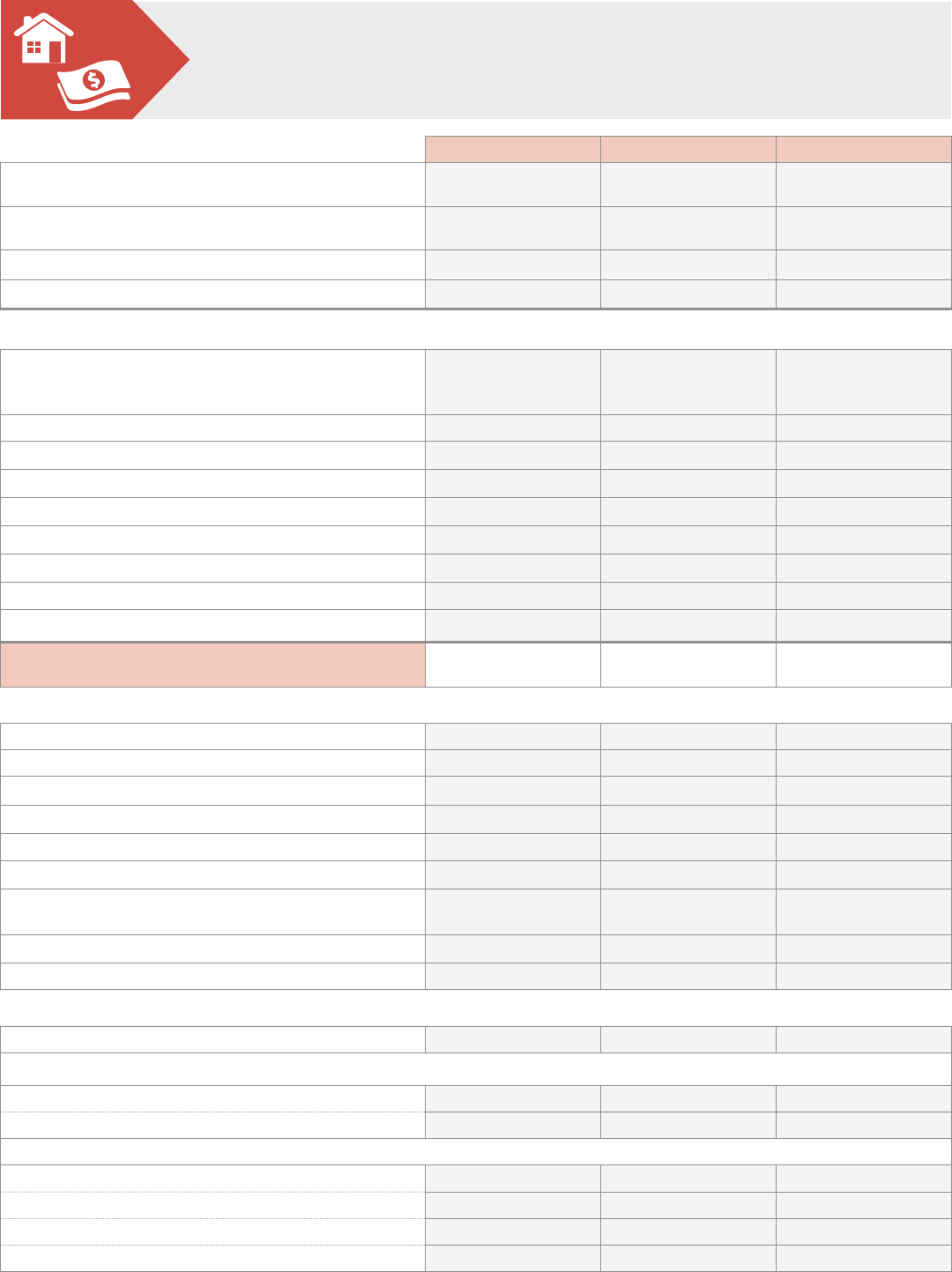

Mortgage Shopping Worksheet

Lender 1 Lender 2 Lender 3

Lender name

Lender contact name

Date/time you talked

Mortgage Amount

Type of mortgage: fixed-rate, adjustable-rate, conventional,

FHA, other? (If adjustable, see Adjustable Rate Mortgage

on p. 2)

Minimum down payment required

Length of loan

Interest rate

Annual percentage rate (APR)

Points?

Monthly private mortgage insurance (PMI) payment?

Keep PMI for how long?

Estimated escrow payments (for property tax, insurance)

Estimated total monthly payment (principal, interest,

taxes, insurance)

Application/loan processing fee

Origination/underwriting fee

Lender/funding fee

Appraisal fee

Attorney fees

Document preparation and recording fees

Broker fees (might show up as points, origination fees, or

interest rate add-on)

Credit report fee

Other fees?

Title search

Title insurance.

That protects you?

That protects the lender?

Prepayment estimates:

Interest

Taxes

Insurance

Escrow payments

Basic Information

Fees

Other Costs at Closing or Settlement

May 2021 | Federal Trade Commission | consumer.ftc.gov

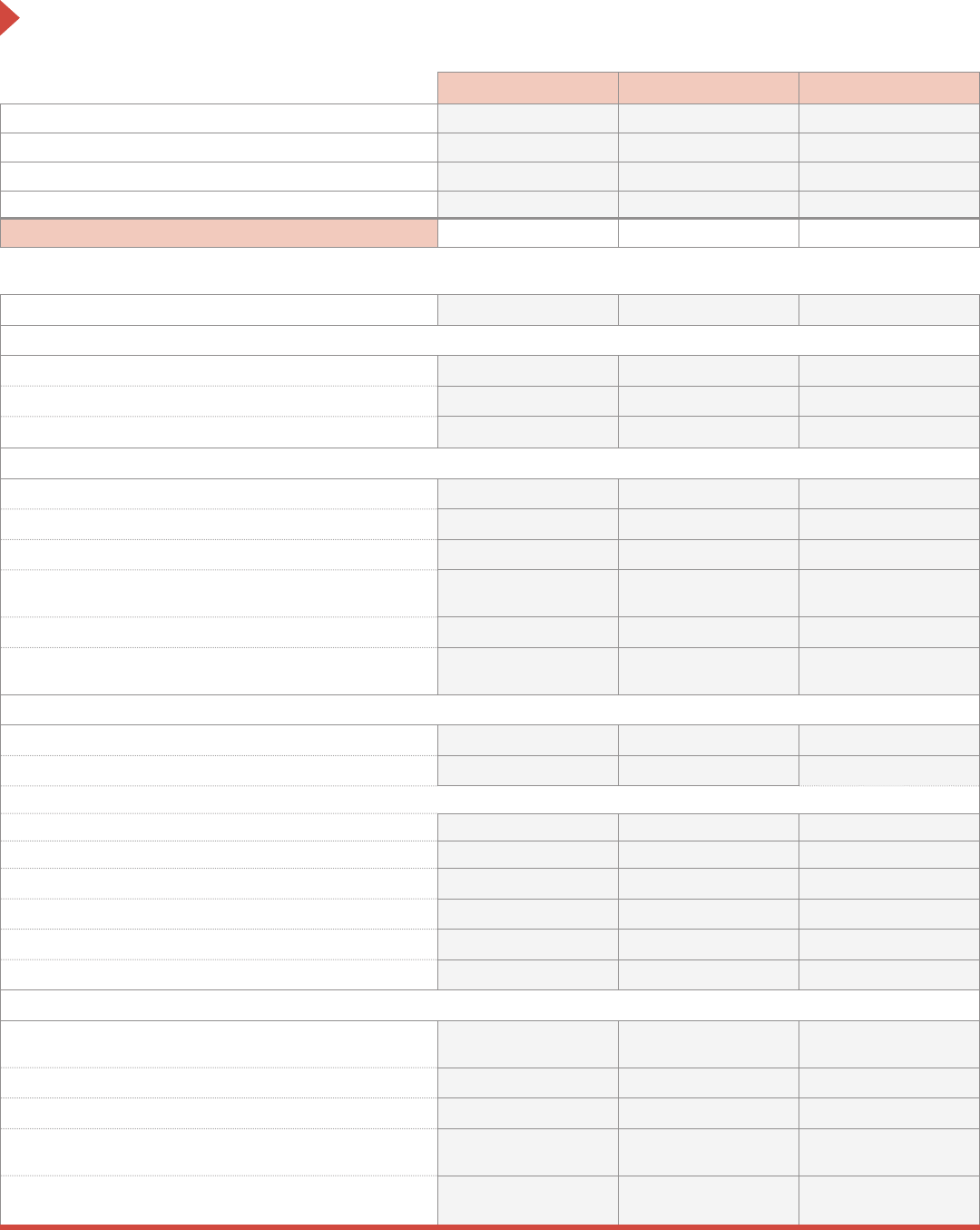

Mortgage Shopping Worksheet

Will the lender waive any costs/fees?

Prepayment Penalties

If there is one, how much is it?

How long does the penalty period last?

Can I make extra principal payments?

Mortgage Rate Lock-Ins

Is the agreement in writing?

Is there a fee to lock in my rate?

Does the lock-in cover points?

When does the rate lock in?

(At application? Approval? Other?)

How long does the lock-in last?

If the rate drops before closing, can I lock in the

lower rate?

Is it an Adjustable Rate Mortgage (ARM)?

What’s the initial rate?

What’s the maximum the rate could be next year?

What are the rate and payment caps:

Each year?

For the life of the loan?

How often could the rate change?

How often could my monthly payment change?

What index will the lender use?

What margin will the lender add to the index?

Credit Life Insurance

Does the monthly mortgage payment quoted include

credit life insurance?

How much does it cost?

Does the lender require it for me to get the loan?

How much would my monthly payment be without credit

life insurance?

If it’s not required but I still want it, what rates can I get

from other insurance providers?

Other Things to Consider

Lender 1 Lender 2 Lender 3

Taxes (State/local, stamp, transfer taxes)

Flood insurance? (If required)

Prepaid PMI (If required)

Surveys or home inspections

Total – Estimated Closing or Settlement Costs

Other Costs at Closing or Settlement (Continued)