Mortgage Shopper's

Resource Kit

Consumer Information from the

Federal Trade Commission and other Agencies

Presented by the Michigan Department of Insurance and Financial Services

Patrick M. McPharlin, Director

This packet contains materials that are designed to help you, the consumer get a good mortgage at a fair

rate, with reasonable costs.

The booklets “Looking for the Best Mortgage” and “Mortgage Servicing: Making Sure Your Payments

Count” are provided to help you understand issues that you need to consider when choosing your

mortgage. In addition to these brochures, there is information available from lenders, government, and

consumer groups. Read up on mortgages. Learn some “tricks of the trade” before you begin talking to

lenders.

When you shop for a mortgage, use common sense. Don’t be pressured into a deal. The mortgage industry

is very competitive. Seldom will a company or financial institution offer a deal that can’t be matched by

another.

You are under no obligation to use a mortgage provider recommended by your real estate agent. Shop for

the deal that is in your best interest.

Many terms are negotiable. Lenders can often adjust the interest rate and some closing costs. Some fees

may be waived if you ask. Compare individual items using the checklist in “Looking for the Best

Mortgage,” then compare the overall deals from various institutions.

If a deal sounds too good to be true, it probably is. Always shop around.

Always get any quotes, estimates and promises in writing.

Review the terms of your mortgage BEFORE your closing. A review of mortgage and closing documents

by a real estate attorney is always a good idea. It is a small investment that could save you thousands of

dollars.

Get more information from the DIFS website at http://www.michigan.gov/difs, or by phoning us toll free at

877-999-6442.

The Michigan Department of Insurance and Financial Services (DIFS) is responsible for the regulation of HMOs, banks, credit unions, insurance companies,

consumer finance lenders, and insurance agents.

The Department of Insurance and Financial Services does not require public tax dollars for its regulatory and consumer assistance activities. DIFS has

insurance and financial institutions information available online at the DIFS web site, www.michigan.gov/difs

. All information is also available through the

DIFS toll-free number, 877-999-6442.

FIS-PUB 2005 (12/15)

Shopping around

for a home loan

or mortgage will

help you to get the best

financing deal. A mort-

gage—whether it’s a home

purchase, a refinancing, or

a home equity loan—is a

product, just like a car, so

the price and terms may be

negotiable. You’ll want to

compare all the costs in-

volved in obtaining a mort-

gage. Shopping, comparing,

and negotiating may save

you thousands of dollars.

interest rate, or both. You should ask

each broker you work with how he or

she will be compensated so that you

can compare the different fees. Be

prepared to negotiate with the brokers

as well as the lenders.

Obtain All Important

Cost Information

Be sure to get information about

mortgages from several lenders or

brokers. Know how much of a down

payment you can afford, and find out

all the costs involved in the loan.

Knowing just the amount of the

monthly payment or the interest rate is

not

enough. Ask for information about

the same loan amount, loan term, and

type of loan so that you can

compare

the information. The following informa-

tion is important to get from each

lender and broker:

Rates

• Ask each lender and broker for a

list of its current mortgage interest

rates and whether the rates being

quoted are the lowest for that day

or week.

• Ask whether the rate is fixed or

adjustable. Keep in mind that when

interest rates for adjustable-rate

loans go up, generally so does the

monthly payment.

• If the rate quoted is for an

adjustable-rate loan, ask how your

rate and loan payment will vary,

including whether your loan pay-

ment will be reduced when rates go

down.

Obtain Information

from Several Lenders

Home loans are available from several

types of lenders—thrift institutions*,

commercial banks, mortgage compa-

nies, and credit unions. Different

lenders may quote you different

prices, so you should contact several

lenders to make sure you’re getting

the best price. You can also get a

home loan through a

mortgage broker

.

Brokers arrange transactions rather

than lending money directly; in other

words, they find a lender for you. A

broker’s access to several lenders can

mean a wider selection of loan prod-

ucts and terms from which you can

choose. Brokers will generally contact

several lenders regarding your appli-

cation, but they are not obligated to

find the best deal for you unless they

have

contracted

with you to act as

your agent. Consequently, you should

consider contacting more than one

broker, just as you should with banks

or thrift institutions.

Whether you are dealing with a lender

or a broker may not always be clear.

Some financial institutions operate as

both lenders and brokers. And most

brokers’ advertisements do not use the

word “broker.” Therefore, be sure to

ask whether a broker is involved. This

information is important because

brokers are usually paid a fee for their

services that may be separate from

and in addition to the lender’s origina-

tion or other fees. A broker’s compen-

sation may be in the form of “points”

paid at closing or as an add-on to your

S

hop,

Compare,

Negotiate

Looking

for the

Best Mortgage?

*Words and terms appearing in bold in the

text are defined in the glossary.

• Ask about the loan’s annual

percentage rate (APR). The APR

takes into account not only the

interest rate but also points, broker

fees, and certain other credit

charges that you may be required

to pay, expressed as a yearly rate.

Points

Points are fees paid to the lender or

broker for the loan and are often linked

to the interest rate; usually the more

points you pay, the lower the rate.

• Check your local newspaper for

information about rates and points

currently being offered.

• Ask for points to be quoted to you

as a dollar amount—rather than just

as the number of points—so that

you will actually know how much

you will have to pay.

Fees

A home loan often involves many fees,

such as loan origination or under-

writing fees, broker fees, and trans-

action, settlement, and closing

costs. Every lender or broker should

be able to give you an estimate of its

fees. Many of these fees are nego-

tiable. Some fees are paid when you

apply for a loan (such as application

and appraisal fees), and others are

paid at closing. In some cases, you

can borrow the money needed to pay

these fees, but doing so will increase

your loan amount and total costs. “No

cost” loans are sometimes available,

but they usually involve higher rates.

• Ask what each fee includes.

Several items may be lumped into

one fee.

• Ask for an explanation of any fee

you do not understand. Some

common fees associated with a

home loan closing are listed on the

Mortgage Shopping Worksheet in

this brochure.

Down Payments and

Private Mortgage Insurance

Some lenders require 20 percent of

the home’s purchase price as a down

payment. However, many lenders now

offer loans that require less than 20

percent down—sometimes as little as

5 percent on conventional loans. If a

20 percent down payment is not

made, lenders usually require the

home buyer to purchase private

mortgage insurance (PMI) to protect

the lender in case the home buyer fails

to pay. When government-assisted

programs such as FHA (Federal

Housing Administration), VA (Veterans

Administration), or Rural Development

Services are available, the down

payment requirements may be sub-

stantially smaller.

• Ask about the lender’s

requirements for a down payment,

including what you need to do to

verify that funds for your down

payment are available.

• Ask your lender about special

programs it may offer.

If PMI is required for your loan,

• Ask what the total cost of the

insurance will be.

• Ask how much your monthly

payment will be when including the

PMI premium.

• Ask how long you will be required to

carry PMI.

Obtain the Best Deal

That You Can

Once you know what each lender has

to offer, negotiate for the best deal that

you can. On any given day, lenders

and brokers may offer different prices

for the same loan terms to different

consumers, even if those consumers

have the same loan qualifications. The

most likely reason for this difference in

price is that loan officers and brokers

are often allowed to keep some or all

of this difference as extra compensa-

tion. Generally, the difference between

the lowest available price for a loan

product and any higher price that the

borrower agrees to pay is an overage.

When overages occur, they are built

into the prices quoted to consumers.

They can occur in both fixed and

variable-rate loans and can be in the

form of points, fees, or the interest

rate. Whether quoted to you by a loan

officer or a broker, the price of any

loan may contain overages.

Have the lender or broker write down

all the costs associated with the loan.

Then ask if the lender or broker will

waive or reduce one or more of its

fees or agree to a lower rate or fewer

points. You’ll want to make sure that

the lender or broker is not agreeing to

lower one fee while raising another or

to lower the rate while raising points.

There’s no harm in asking lenders or

brokers if they can give better terms

than the original ones they quoted or

than those you have found elsewhere.

Once you are satisfied with the terms

you have negotiated, you may want to

obtain a written lock-in from the

lender or broker. The lock-in should

include the rate that you have agreed

upon, the period the lock-in lasts, and

the number of points to be paid. A fee

may be charged for locking in the loan

rate. This fee may be refundable at

closing. Lock-ins can protect you from

rate increases while your loan is being

processed; if rates fall, however, you

could end up with a less favorable

rate. Should that happen, try to

negotiate a compromise with the

lender or broker.

Remember:

Shop, Compare,

Negotiate

When buying a home, remember to

shop around, to compare costs and

terms, and to negotiate for the best

deal. Your local newspaper and the

Internet are good places to start

shopping for a loan. You can usually

find information both on interest rates

and on points for several lenders.

Since rates and points can change

daily, you’ll want to check your news-

paper often when shopping for a home

loan. But the newspaper does not list

the fees, so be sure to ask the lenders

about them.

The Mortgage Shopping Worksheet

that follows may also help you. Take it

with you when you speak to each

lender or broker and write down the

information you obtain. Don’t be afraid

to make lenders and brokers compete

with each other for your business by

letting them know that you are shop-

ping for the best deal.

Fair Lending Is

Required by Law

The

Equal Credit Opportunity Act

prohibits lenders from discriminating

against credit applicants in any aspect

of a credit transaction on the basis of

race, color, religion, national origin,

sex, marital status, age, whether all or

part of the applicant’s income comes

from a public assistance program, or

whether the applicant has in good faith

exercised a right under the Consumer

Credit Protection Act.

The

Fair Housing Act

prohibits dis-

crimination in residential real estate

transactions on the basis of race,

color, religion, sex, handicap, familial

status, or national origin.

Under these laws, a consumer cannot

be

refused

a loan based on these

characteristics nor be

charged more

for a loan or

offered less favorable

terms

based on such characteristics.

Credit Problems?

Still Shop, Compare,

and Negotiate

Don’t assume that minor credit prob-

lems or difficulties stemming from

unique circumstances, such as illness

or temporary loss of income, will limit

your loan choices to only high-cost

lenders.

If your credit report contains negative

information that is accurate, but there

are good reasons for trusting you to

repay a loan, be sure to explain your

situation to the lender or broker. If your

credit problems cannot be explained,

you will probably have to pay more

than borrowers who have good credit

histories. But don’t assume that the

only way to get credit is to pay a high

price. Ask how your past credit history

affects the price of your loan and what

you would need to do to get a better

price. Take the time to shop around

and negotiate the best deal that you

can.

Whether you have credit problems or

not, it’s a good idea to review your

credit report for accuracy and com-

pleteness before you apply for a loan.

To order a copy of your credit report,

contact:

Equifax: (800) 685-1111

TransUnion: (800) 916-8800

Experian: (800) 682-7654

Glossary

Adjustable-rate loans,

also known as

variable-rate loans

,

usually offer

a lower initial interest rate than

fixed-rate loans. The interest rate

fluctuates over the life of the loan

based on market conditions, but

the loan agreement generally

sets maximum and minimum

rates. When interest rates rise,

generally so do your loan pay-

ments; and when interest rates

fall, your monthly payments may

be lowered.

Annual percentage rate (APR)

is the

cost of credit expressed as a

yearly rate. The APR includes

the interest rate, points, broker

fees, and certain other credit

charges that the borrower is

required to pay.

Conventional loans

are mortgage

loans other than those insured or

guaranteed by a government

agency such as the FHA (Fed-

eral Housing Administration), the

VA (Veterans Administration), or

the Rural Development Services

(formerly know as Farmers

Home Administration, or FmHA).

Escrow

is the holding of money or

documents by a neutral third

party prior to closing. It can also

be an account held by the lender

(or servicer) into which a home-

owner pays money for taxes and

insurance.

Fixed-rate loans

generally have

repayment terms of 15, 20, or 30

years. Both the interest rate and

the monthly payments (for

principal and interest) stay the

same during the life of the loan.

The interest rate

is the cost of

borrowing money expressed as a

percentage rate. Interest rates

can change because of market

conditions.

Loan origination fees

are fees

charged by the lender for pro-

cessing the loan and are often

expressed as a percentage of

the loan amount.

Lock-in

refers to a written agreement

guaranteeing a home buyer a

specific interest rate on a home

loan provided that the loan is

closed within a certain period of

time, such as 60 or 90 days.

Often the agreement also

specifies the number of points to

be paid at closing.

A

mortgage

is a document signed by

a borrower when a home loan is

made that gives the lender a

right to take possession of the

property if the borrower fails to

pay off on the loan.

Overages

are the difference between

the lowest available price and

any higher price that the home

buyer agrees to pay for the loan.

Loan officers and brokers are

often allowed to keep some or all

of this difference as extra com-

pensation.

Points

are fees paid to the lender for

the loan. One point equals 1

percent of the loan amount.

Points are usually paid in cash at

closing. In some cases, the

money needed to pay points can

be borrowed, but doing so will

increase the loan amount and

the total costs.

Private mortgage insurance (PMI

)

protects the lender against a loss

if a borrower defaults on the

loan. It is usually required for

loans in which the down payment

is less than 20 percent of the

sales price or, in a refinancing,

when the amount financed is

greater than 80 percent of the

appraised value.

Thrift institution

is a general term for

savings banks and savings and

loan associations.

Transaction, settlement, or closing

costs

may include application

fees; title examination, abstract

of title, title insurance, and

property survey fees; fees for

preparing deeds, mortgages, and

settlement documents; attorneys’

fees; recording fees; and notary,

appraisal, and credit report fees.

Under the Real Estate Settle-

ment Procedures Act, the

borrower receives a good faith

estimate of closing costs at the

time of application or within three

days of application. The good

faith estimate lists each expected

cost either as an amount or a

range.

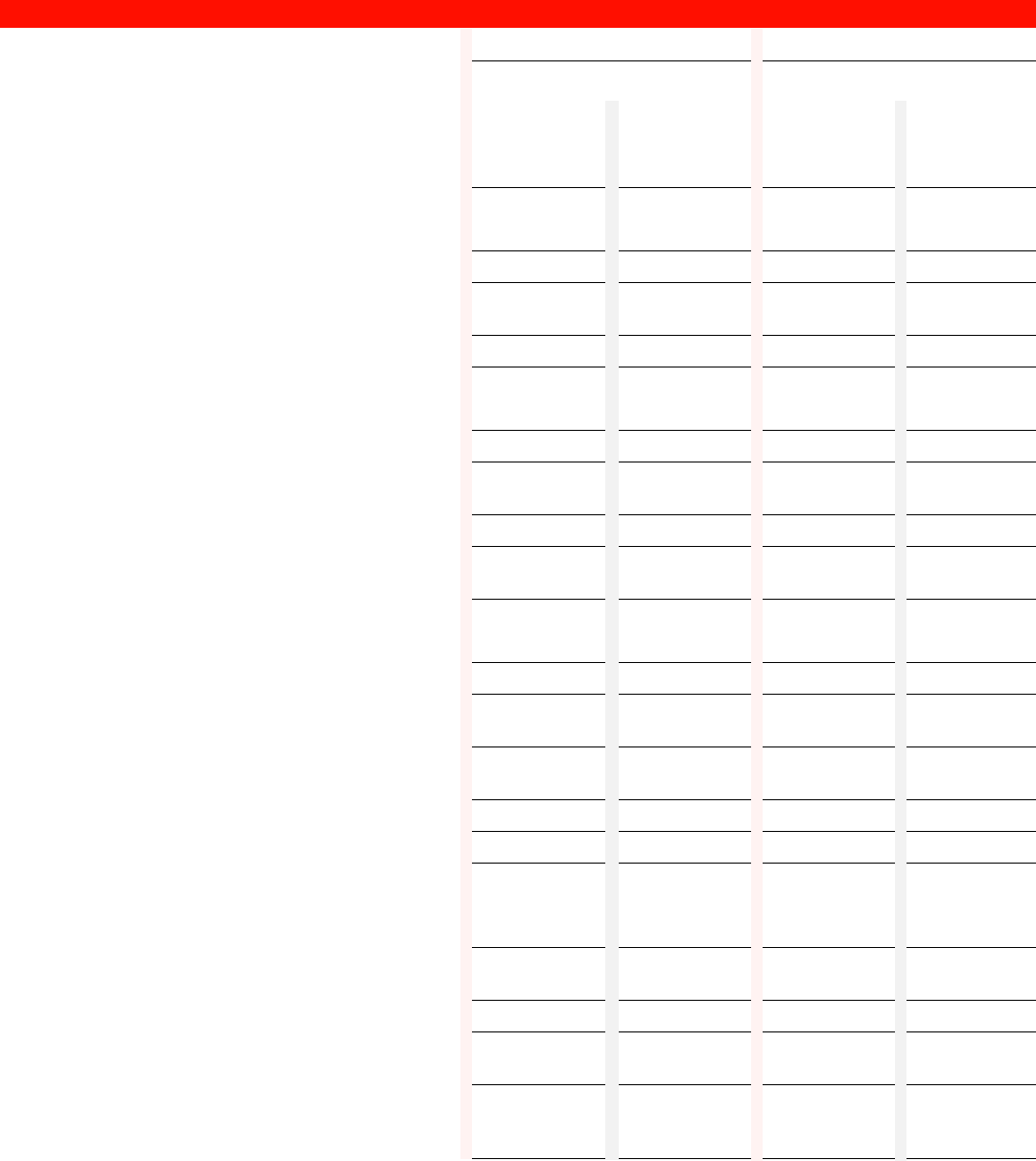

Mortgage Shopping Worksheet

Lender 1 Lender 2

Name of Lender: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Name of Contact: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Date of Contact: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Mortgage Amount: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

mortgage 1 mortgage 2 mortgage 1 mortgage 2

Basic Information on the Loans

Type of Mortgage: fixed rate, adjustable rate, conventional,

FHA, other? If adjustable, see below . . . . . . . . . . . . . . .

Minimum down payment required . . . . . . . . . . . . . . . . . . . .

Loan term (length of loan) . . . . . . . . . . . . . . . . . . . . . . . . . .

Contract interest rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Annual percentage rate (APR) . . . . . . . . . . . . . . . . . . . . . .

Points (may be called loan discount points) . . . . . . . . . . . .

Monthly Private Mortgage Insurance (PMI) premiums . . . .

How long must you keep PMI? . . . . . . . . . . . . . . . . . . . . . .

Estimated monthly escrow for taxes and hazard insurance

Estimated monthly payment (Principal, Interest, Taxes,

Insurance, PMI) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Fees

Different institutions may have different names for some

fees and may charge different fees. We have listed

some typical fees you may see on loan documents.

Application fee or Loan processing fee . . . . . . . . . . . . . . . .

Origination fee or Underwriting fee . . . . . . . . . . . . . . . . . . .

Lender fee or Funding fee . . . . . . . . . . . . . . . . . . . . . . . . . .

Appraisal fee . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Attorney fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Document preparation and recording fees . . . . . . . . . . . . .

Broker fees (may be quoted as points, origination fees,

or interest rate add-on) . . . . . . . . . . . . . . . . . . . . . . . . . .

Credit report fee . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Other fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Other Costs at Closing/Settlement

Title search/Title insurance

For lender . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

For you . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Estimated prepaid amounts for interest, taxes,

hazard insurance, payments to escrow . . . . . . . . . . . . .

State and local taxes, stamp taxes, transfer taxes . . . . . . .

Flood determination . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Prepaid Private Mortgage Insurance (PMI) . . . . . . . . . . . . .

Surveys and home inspections . . . . . . . . . . . . . . . . . . . . . .

Total Fees and Other Closing/Settlement Cost

Estimates . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

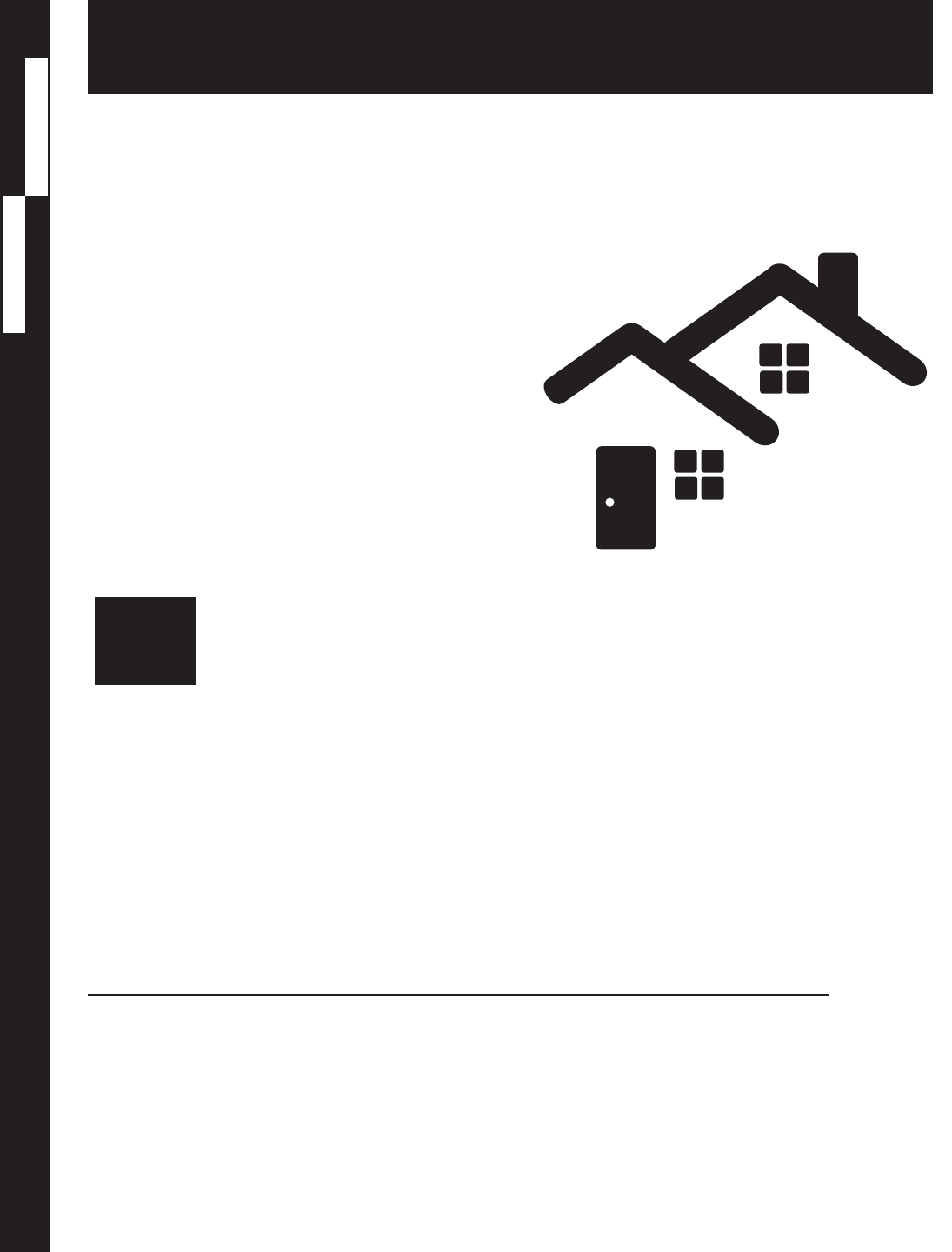

Mortgage Shopping Worksheet—continued

Lender 1 Lender 2

Name of Lender: . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

mortgage 1 mortgage 2 mortgage 1 mortgage 2

Other Questions and Considerations

about the Loan

Are any of the fees or costs waivable? . . . . . . . . . . . . . . . .

Prepayment penalties

Is there a prepayment penalty? . . . . . . . . . . . . . . . . . . . . .

If so, how much is it? . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

How long does the penalty period last? (for example,

3 years? 5 years?) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Are extra principal payments allowed? . . . . . . . . . . . . . . . .

Lock-ins

Is the lock-in agreement in writing? . . . . . . . . . . . . . . . . . .

Is there a fee to lock-in? . . . . . . . . . . . . . . . . . . . . . . . . . . .

When does the lock-in occur—at application,

approval, or another time? . . . . . . . . . . . . . . . . . . . . . . .

How long will the lock-in last? . . . . . . . . . . . . . . . . . . . . . . .

If the rate drops before closing, can you lock-in at a

lower rate? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

If the loan is an adjustable rate mortgage:

What is the initial rate? . . . . . . . . . . . . . . . . . . . . . . . . . . . .

What is the maximum the rate could be next year? . . . . . .

What are the rate and payment caps each year and

over the life of the loan? . . . . . . . . . . . . . . . . . . . . . . . . .

What is the frequency of rate change and of any

changes to the monthly payment? . . . . . . . . . . . . . . . . .

What is the index that the lender will use? . . . . . . . . . . . . .

What margin will the lender add to the index? . . . . . . . . . .

Credit life insurance

Does the monthly amount quoted to you include

a charge for credit life insurance? . . . . . . . . . . . . . . . . .

If so, does the lender require credit life insurance

as a condition of the loan? . . . . . . . . . . . . . . . . . . . . . . .

How much does the credit life insurance cost? . . . . . . . . . .

How much lower would your monthly payment be

without the credit life insurance? . . . . . . . . . . . . . . . . . .

If the lender does not require credit life insurance, and

you still want to buy it, what rates can you get

from other insurance providers? . . . . . . . . . . . . . . . . . .

This brochure was prepared by the following agencies:

Department of Housing and Urban Development

Department of Justice

Department of the Treasury

Federal Deposit Insurance Corporation

Federal Housing Finance Board

Federal Reserve Board

Federal Trade Commission

National Credit Union Administration

Office of Federal Housing Enterprise Oversight

Office of the Comptroller of the Currency

Office of Thrift Supervision

These agencies (except the Department of the Treasury)

enforce compliance with laws that prohibit discrimination in

lending. If you feel that you have been discriminated

against in the home financing process, you may want to

contact one of the agencies listed above about your rights

under these laws.

For more information on home lending issues, visit

(http://www.consumer.gov), write to the Consumer Informa-

tion Center, Pueblo, CO 81009 or visit the Center’s Web

site at (http://www.pueblo.gsa.gov). The following brochures

are available from the Center:

A Consumer’s Guide to Mortgage Lock-Ins

A Consumer’s Guide to Mortgage Refinancing

Buying Your Home: Settlement Costs and Helpful

Information

Consumer Handbook on Adjustable Rate Mortgages

Guide to Single Family Home Mortgage Insurance

Home Buyer’s Vocabulary

Home Mortgages: Understanding the Process and Your

Rights to Fair Lending

How to Buy a Home with a Low Down Payment

How to Dispute Credit Report Errors

The HUD Home Buying Guide

When Your Home Is on the Line

S

hop,

Compare,

Negotiate

Looking for the Best Mortgage?

FRB1-750000,0199C

FTC FACTS for Consumers

FOR THE CONSUMER

1-877-FTC-HELP

ftc.gov

FEDERAL TRADE COMMISSION

Mortgage Servicing:

Making Sure Your

Payments Count

W

hen you get a mortgage, you may think that the lender will hold and service your

loan until you pay it off or sell your home. That’s often not the case. In today’s

market, loans and the rights to service them often are bought and sold. In many cases, the

company that you send your payment to is not the company that owns your loan.

A home is one of the most expensive purchases you’ll make, so it’s important to know who is

handling your payments and that your mortgage account is properly managed. The Federal Trade

Commission (FTC), the nation’s consumer protection agency, wants you to know what a mortgage

servicer does and what your rights are.

Mortgage Servicers: Their Responsibilities; Your Rights

A mortgage servicer is responsible for the day-to-day management of your mortgage loan account,

including collecting and crediting your monthly loan payments, and handling your escrow account,

if you have one. The servicer is who you contact if you have questions about your mortgage loan

account.

Facts for Consumers 2

Escrow Accounts

An escrow account is a fund held by your

servicer that you pay into for property taxes and

homeowners insurance. Your escrow payment

typically is part of your monthly mortgage

payment. The servicer then uses your escrow

account to pay your taxes and insurance as

they become due during the year. If you do not

have an escrow account, you must make those

payments on your own.

If your mortgage servicer administers an escrow

account for you, federal law requires the servicer

to make escrow payments for taxes, insurance and

any other escrowed items on time. Within 45 days

of establishing the account, the servicer must give

you a statement that clearly itemizes the estimated

taxes, insurance premiums and other anticipated

amounts to be paid over the next 12 months, and

the expected dates and totals of those payments.

The mortgage servicer also is required to give you

a free annual statement that details the activity of

your escrow account, showing, for example your

account balance and reflecting payments for your

property taxes, homeowners insurance and other

escrowed items.

Transfer of Servicing

If your loan is transferred to a new servicer,

you generally get two notices: one from your

current mortgage servicer; the other from the new

servicer. In most cases, your current servicer

must notify you at least 15 days before the

effective date of the transfer, unless you received

a written transfer notice at settlement. The

effective date is when the first mortgage payment

is due at the new servicer’s address. The new

servicer must notify you within 15 days after the

effective date of the transfer.

Both notices must include:

the name and address of the new servicer•

the date the current servicer will stop •

accepting your mortgage payments

the date the new servicer will begin accepting •

your mortgage payments

telephone numbers (either toll-free or •

collect), for the current and new mortgage

servicer, for information about the transfer

whether you can continue any optional •

insurance, such as credit life or disability

insurance; what action you must take

to maintain coverage; and whether the

insurance terms will change

a statement that the transfer will not affect •

any terms or conditions of your mortgage,

except those directly related to the servicing

of the loan. For example, if your contract

says you were allowed to pay property

taxes and insurance premiums on your own,

the new servicer cannot demand that you

establish an escrow account.

a statement explaining your rights and what •

to do if you have a question or complaint

about the servicing of your loan.

There is a 60-day grace period after the transfer:

during this time you cannot be charged a late fee

if you mistakenly send your mortgage payment to

the old servicer.

Facts for Consumers 3

Transfer of Loan Ownership

The ownership and servicing rights of your

loan may be handled by one company or two. If

ownership of your loan is transferred, the new

owner must give you a notice that includes:

the name, address and telephone number of •

the new owner of the loan

the date the new owner takes possession of •

the loan

the person who is authorized to receive legal •

notices and can resolve issues about loan

payments

where the transfer of ownership is recorded.•

The new owner must give you this notice within

30 days of taking possession of the loan. It is in

addition to any notices you may get about the

transfer of the servicing rights for your loan.

Posting Payments

The servicer must credit a payment to your

loan account as of the day it is received. Some

consumers have complained that they’ve been

charged late fees, even when they know they

made their payments on time. To help protect

yourself, keep detailed records of what you’ve

paid, including billing statements, canceled checks

or bank account statements. You also may be

able to check your account history online. If you

have a dispute, continue to make your mortgage

payments, but notify the servicer in writing (see

Sample Complaint Letter) and keep a copy of

your letter and any enclosures for your records.

Send your correspondence by certified mail to the

address specified by the servicer, and request a

return receipt. You also may wish to fax or email

your letter and any enclosures. Be sure to follow

any instructions the servicer has provided and

confirm the fax number or email address before

sending your letter. Keep a copy of transmittal

confirmations, receipt acknowledgments and

email replies.

Force Placed Insurance

It’s important to maintain the required property

insurance on your home. If you don’t, your

servicer can buy insurance on your behalf. This

type of policy is known as force placed insurance.

It usually costs more than typical insurance even

though it provides less coverage. The primary

purpose of a force placed policy is to protect the

mortgage owner.

Read all correspondence from your mortgage

servicer. Your mortgage servicer may ask that

you provide a copy of your property insurance

policy. Respond promptly to requests about

property insurance, and keep copies of every

document you send to your mortgage servicer.

If you believe there’s a paperwork error and that

your coverage is adequate, provide a copy of

your insurance policy to your servicer. Once the

servicer corrects the error, removes the force

placed coverage and refunds the cost of the force

placed policy, make sure they remove any late

fees or interest you were charged as a result of the

coverage.

Fees

Read your billing statements carefully to make

sure that any fees the servicer charges are

legitimate, including fees that may have been

authorized by you or the mortgage contract to

pay for a service. If you don’t understand what

any fees are for, send a written inquiry asking for

an itemization and explanation. Also, if you call

your mortgage servicer to ask for a service, like

faxing copies of loan documents, make sure you

ask whether there is a fee for the service and how

much it is.

Facts for Consumers 4

Special Considerations for Loans In Default

If you fail to make one or more payments on

your mortgage loan, your loan is in default.

The servicer may then order “default-related

services” to protect the value of the property.

These services may include property inspections

to make sure you are still living in the home

and maintaining the property. If the property is

not being properly maintained, the servicer may

order “property preservation services,” like lawn

mowing, landscaping and repairing or boarding

up broken windows and doors. The costs for

these services, which can add up to hundreds or

thousands of dollars, are charged to your loan

account. If the servicer starts to foreclose on

your property, additional costs like attorneys

fees, property title search fees, and other charges

for mailing and posting foreclosure notices will

be charged to your loan account. That can add

hundreds or thousands of dollars more to your

loan, and make it even more difficult for you to

bring the loan current and avoid foreclosure.

If you find yourself in this situation, stay in

touch with your servicer. Servicers have different

policies about when they will order default-

related services. Some may not order property

inspections or property preservation work if you

let them know each month that you are still living

in the home, keeping it well maintained, and are

working with them to resolve the default on your

account. Even so, it’s important to review your

billing statements carefully and question added

fees. If fees appear on your statement under

general headings like “other fees” or “corporate

advances,” contact your servicer – in writing – as

soon as possible to get an explanation of those

fees and a reason they’ve been charged to your

account.

Struggling to Make Your

Mortgage Payments?

If you are struggling to make your

mortgage payments – or you’ve

missed payments – contact your

servicer. It’s critical to keep the

lines of communication open when

you’re trying to resolve issues

with your account. If you have

difficulty reaching or working with

your servicer, call 1-888-995-HOPE

for free personalized advice from

housing counseling agencies

certified by the U.S. Department of

Housing and Urban Development

(HUD). This national hotline –

open 24/7 – is operated by the

Homeownership Preservation

Foundation, a nonprofit member

of the HOPE NOW Alliance of

mortgage industry members and

HUD-certified counseling agencies.

For free guidance online, visit

www.hopenow.com.

Payoff Statements

A payoff statement is a document that specifies

the amount needed to pay a loan in full.

Generally, servicers must give you this statement

if you ask for it and follow the instructions.

Your servicer must provide the statement within

a reasonable time – generally 5 business days –

after receiving your request.

Inquiries and Disputes

Under federal law, your mortgage servicer must

respond promptly to written inquiries, known

as “qualified written requests” (see Sample

Complaint Letter). If you believe you’ve been

charged a penalty, late fee or some other fee by

Facts for Consumers 5

mistake, or if you have other problems with the

servicing of your loan, write to your servicer.

Include your account number and explain why

you believe your account is incorrect. Send

your correspondence to the address the servicer

specifies for qualified written requests.

The servicer must send you a written

acknowledgment within 20 business days of

receiving your inquiry. Then, within 60 business

days, the servicer must correct your account or

determine that it is accurate. The servicer must

send you a written notice of the action it took and

Sample Complaint Letter

Here is a sample qualified written request. Use this format to address complaints under the Real

Estate Settlement Procedures Act (RESPA).

Date

Your Name

Your Address

Your City, State, Zip Code

Subject: Your loan number

Attention: Customer Service

Name of Loan Servicer

Address

City, State, Zip Code

This is a “qualied written request” under Section 6 of the Real Estate Settlement Procedures Act (RESPA).

I am writing to:

Describe the issue or the question you have and/or what action you believe should be taken.

Attach copies of any related written materials.

Describe any conversations with customer service about the issue and to whom you spoke.

Describe any previous steps you have taken or attempts to resolve the issue.

List a phone number in case a customer service representative wants to call you.

I understand that under Section 6 of RESPA you are required to acknowledge my request within 20 business

days and must try to resolve the issue within 60 business days.

Sincerely,

Your name

why, as well as the name and phone number of

someone to contact.

Do not subtract any disputed amount from your

mortgage payment. Your servicer might consider

this a partial payment and refuse to accept it.

Your payment might be returned to you or put

in a “suspense” or “hold” account until you

provide the rest of the payment. Either way, your

servicer may charge you a late fee or claim that

your mortgage is in default and start foreclosure

proceedings.

Facts for Consumers 6

FOR THE CONSUMER

1-877-FTC-HELP

ftc.gov

FEDERAL TRADE COMMISSION

June 2010

Federal Trade Commission

Bureau of Consumer Protection

Division of Consumer and Business Education

Fair Debt Collection

By law, a debt collector is a person who regularly

collects debts owed to others. Your mortgage

servicer is considered a debt collector only if your

loan was in default when the servicer acquired it.

If that’s the case, you have additional rights. Read

about them in Debt Collection FAQs: A Guide for

Consumers at ftc.gov/debtcollection.

To learn more about mortgages and what to do

if you’re having difficulty making payments,

visit ftc.gov/YourHome.

The FTC works to prevent fraudulent, deceptive

and unfair business practices in the marketplace

and to provide information to help consumers

spot, stop and avoid them. To file a complaint

or get free information on consumer issues,

visit ftc.gov or call toll-free, 1-877-FTC-HELP

(1-877-382-4357); TTY: 1-866-653-4261.

Watch a new video, How to File a Complaint,

at ftc.gov/video to learn more. The FTC

enters consumer complaints into the Consumer

Sentinel Network, a secure online database and

investigative tool used by hundreds of civil and

criminal law enforcement agencies in the U.S.

and abroad.