A business of Marsh McLennan

September 26

th

, 2023

analyzing Homeowners Insurance

Availability and affordability

following a catastrophe

A Case Study Presented to the Federal Advisory Committee on Insurance

Prepared by Oliver Wyman Actuarial Consulting

2

© Oliver Wyman

Richard J. Babel, FCAS, MAAA

Etienne Scarborough, FCAS Robin Fitzgerald, FCAS, MAAA

Oliver Wyman Actuarial

Partner

Rich.Babel@oliverwyman.com

Oliver Wyman Actuarial

Senior Manager

Etienne.Scarborough@oliverwyman.com

Oliver Wyman Actuarial

Senior Manager

Robin.Fitzgerald@oliverwyman.com

Rich has provided actuarial services for over 31 years;

the first 15 with insurance carriers and as a consultant

since then.

Rich has extensive experience in pricing and

reserving

for

a variety of business segments, including

homeowners.

Prior engagements led him to model the catastrophic

exposure of a large US carrier using catastrophe models

in a catastrophe

-prone state.

Etienne has 8 years of actuarial experience; 6 years

with carriers and 2 years as a consultant for Oliver

Wyman.

He specializes in predictive analytics, and his work

spans a variety of segments across personal (including

homeowners) and commercial lines.

Over the years, he developed a multitude of predictive

models for insurance pricing using machine learning.

He also has an extensive background in developing

innovative solutions for data analysis in Python.

Robin has 26 years of actuarial experience; 15 years

with insurance carriers and 11 years as a consultant

for Oliver Wyman.

With a strong background in pricing and reserving,

Robin’s current focus is providing actuarial consulting

services to regulators.

Recent work has centered on ratemaking and market

issues related to workers compensation and personal

lines.

.

MEET THE TEAM

3

© Oliver Wyman

OVERVIEW

Background

Quick introduction by Michael

Conway, the Insurance

Commissioner of Colorado.

Framing the Problem

Identify the research question(s),

and which analytical tools can

provide an answer.

Information Sources

Determine what kind of data is

required to perform the analysis

and where to find it.

Catastrophic Exposure

Catastrophic events often produce

sparse and volatile data;

sophisticated scientific models are

generally required in these cases.

1 2 3

4

From Data to Insights

Overview of the key findings that

emanated from our Colorado study

5

Our goal for this presentation is to discuss the analytical journey we went through to prepare our

Homeowners Availability Study in Colorado.

1

Every step of the way we will share our thought process as well as any lessons learned that we would

build upon if we were to repeat the exercise.

1

: Link to the Oliver Wyman study: https://doi.colorado.gov/announcements/homeowners-insurance-availability-study-now-available-sb22-206

Background

1

INTRODUCTION BY

COMMISSIONER CONWAY

1. Colorado Homeowners Market Status

2. Reasons for an Availability Study

3. Actions Taken Following the Study

6

© Oliver Wyman

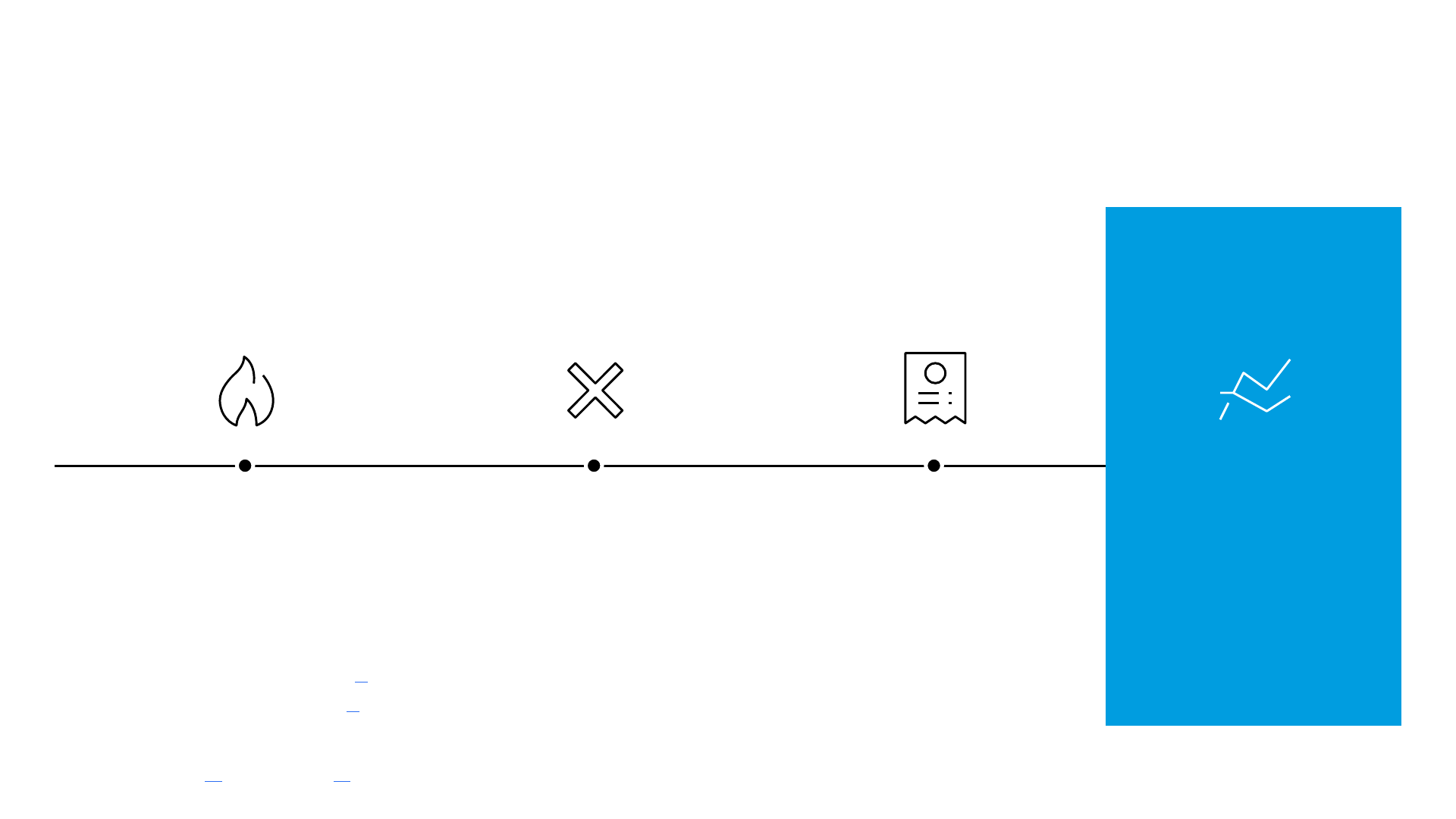

TIMELINE OF EVENTS

Oliver Wyman Study

Q4 2022, Q1 2023

In that context, the Division wanted to

obtain a clear data-driven view of

trends affecting their homeowner

insurance market.

Our team was engaged by the Division

to determine the existing or developing

concerns regarding availability of

homeowner insurance in the state.

Record-Breaking Wildfires

October 2020, December 2021

Colorado has experienced multiple

catastrophic wildfires in recent years.

Events from 2020 and 2021 have each

broken records in terms of size of insured

losses for the state:

1. East Troublesome (2020): $543m

[1]

2. Marshall Fire (2021): > $2,000m

[2]

Anecdotal Customer Complaints

Q1-Q2 2022

Over the course of 2022, the Division

started receiving significantly more

complaints from homeowners regarding

their home insurance policies.

Many customers claimed they were getting

non-renewed and/or had trouble finding

coverage.

Senate Bill 22-206 is Passed

August 2022

In response to what appeared to be a

tightening insurance market, the state

senate passed Bill 22-206 on “Disaster

Preparedness And Recovery Resources”.

One of its objectives was to seek ways of

addressing the stability, availability, and

affordability of homeowner insurance in

the State.

Source: The Coloradoan [1], The Denver Post [2], Discussions with the Colorado Division of Insurance

Framing the Problem

2

8

© Oliver Wyman

TWO TYPES OF DATA ANALYSIS TO CONSIDER

Both are useful and complementary types of analysis, often employed at distinct stages of research.

VS

Objective: Identify and measure a phenomenon

What is happening?

• Exploratory in nature, it will usually entail a variety of graphs and metrics:

1. Trends over time

2. Summary Statistics (mean, median, etc.)

3. Geospatial visualization

4. Etc.

• It summarizes the data and its patterns but doesn’t go into reasons or

causes behind them

• Will usually need to come first, as any further analysis would depend on

the results of this exploration

Descriptive Analysis

Objective: Identify the root causes of a phenomenon

Why is it happening?

• Explanatory analysis delves deeper in order to discern relationships between

variables:

1. Forming hypotheses and testing their validity

2. Measuring/assessing correlations

3. Etc.

• Since it is aimed at identifying causes & reasons behind a pattern, it will

usually come as part of a second iteration; once the phenomenon is clearly

identified and its magnitude well understood

Explanatory Analysis

Given our study was a first dive into the topic on behalf of the state of Colorado, its content was predominantly descriptive. The main priority was to

translate anecdotes into facts in order to guide next steps.

To the extent that some hypotheses could be formed a priori (e.g., with regards to wildfire), some explanatory components have been factored in as well.

9

© Oliver Wyman

Descriptive Features

Are there availability/affordability concerns in the state and if so, where?

Explanatory Features

What might be driving these results?

Trends in Premiums & Exposures Over Time

• How did the average Homeowner premium grow

between Jan-2019 and Oct-2022; did it outpace

inflation and/or trends from other states?

• How did the number of houses insured grow

between Jan-2019 and Oct-2022; does it seem

consistent with new housing developments?

Distribution of Carrier Results

• Are carrier-level trends in premiums and

exposures homogeneous or heterogeneous?

• Are there notable difference in behavior

between the largest carriers and the smaller

ones?

Correlation of Results and Wildfire Risk

• Have ZIP codes with high wildfire exposure

experienced higher premium increases in 2022?

• Have ZIP codes with high wildfire exposure

experienced more exposure shrinkage in 2022?

Historical Profitability vs Rest of Country

• Does the historical profitability of the state vs

the rest of the country align with the trends in

premiums/rate changes observed?

Filed Rate Changes

• Are carriers filing for more rate increases in

Colorado than in the rest of the country?

Results Visualization by ZIP Code

• Do 2022 movements in average premiums and

exposure counts appear more concerning in

certain areas of the state?

• Which counties have seen the most premium

increases/exposures shrinkage?

ANALYSIS TOPICS OF THE COLORADO STUDY

Our primary goal was to identify and measure the existence of availability/affordability concerns in the state (i.e., descriptive)

Information Sources

3

11

© Oliver Wyman

3 SOURCES OF INFORMATION WERE USED IN THIS STUDY

The customized data call was the primary data source for this study, the other 2 serving as complements to help explain the results.

Customized Data Call Publicly Available Information Proprietary Data

All carriers writing more than $5m of direct written

premiums for “Homeowners Multi Peril” in

Colorado were subject to a data call.

The data call was necessary in order to assess the

following topics regarding availability/affordability

in the state:

i. Presence of significant trends in premium

increases or exposures written in 2022

following the Marshall Fire

ii. Identification of areas of concern within the

state

Carriers also received a qualitative survey with

questions regarding pricing & underwriting

practices in the state to help interpret the trends

found in the data and provide additional insights.

1. NAIC Statutory Filings

NAIC data was used in 2 ways in our analysis:

i. Reconciliation: Carrier surveys were reconciled

against reported Homeowners MP market

shares in CO

ii. Historical Loss ratios: Industrywide loss ratios

in CO were compared against the rest of the

country

2. Filed Rate Changes

Impacts from filed rate changes in CO vs the rest of

the country were compared using the filings of the

most material Homeowners MP writers in each

state.

Note: Both were sourced through S&P Market

Intelligence

To assess the wildfire exposure in the state, Oliver

Wyman partnered with their sister company Guy

Carpenter.

Guy Carpenter owns a proprietary wildfire risk

score model (see next section) that has been

presented at the ZIP code level to compare against

trends in premiums and exposures measured.

Data Integrity

Obtaining accurate and consistent data responses across the industry was a somewhat iterative process. Data integrity checks and follow-ups with carriers were a material effort

during the course of the analysis. This is not unexpected given that the data requirements were new. The process would most likely be more straightforward in the future.

12

© Oliver Wyman

Fields of Interest

Limits

Information Breakdown

Reconciliation

Premiums Exposures

Losses

Monthly Data ZIP-level Data

Product

STRUCTURE OF THE DATA CALL

Data had to be granular enough to conduct our analysis but also sufficiently convenient for carrier to populate accurately.

To provide the most flexibility in

measuring emerging trends in

response to the Marshall Fire

catastrophe.

It is the most granular geographical

unit that is readily available for

reporting purposes.

Homes (HO-3/HO-5), apartments

(HO-4) and condos (HO-6) were split

out given how different the

associated insurance products are.

Instructions required that all surveys

reconcile with the company’s figures

in their statutory filing.

Losses and defense/cost

containment expenses incurred as

well as claim counts

Written, earned and in-force

premiums on a direct basis (prior to

application of reinsurance)

Written, earned and in-force insured

locations (i.e., homes for

homeowners)

Total coverage A limit in-force

13

© Oliver Wyman

• “Written units” represents the number of homes for which insurance

policies are sold each month.

• For “Homeowners” policy types, one written unit represents one

personal property insured for one year (e.g., one HO-3 policy).

• An industry-wide decrease in written units would indicate that fewer

households are protected by insurance policies year-over-year.

• Average premium is defined as Written Premiums / Written Units.

• It represents the average annual premium per written unit.

• Carriers will increase rates when in their perception, the current

premium will no longer be high enough to cover the projected loss and

expense levels.

• For example, this would happen if actuarial analyses highlight an

increasing frequency and/or severity of losses vs prior estimates.

Written Units

Trends

Average Premium

Trends

VS

KEY METRICS ANALYZED IN THE STUDY

These two metrics are key indicators of the availability/affordability situation in the state

Additional Reporting

Considerations

• “Homeowners” policy types only: The following exhibits are specifically focused on pure homeowner policies (i.e., excluding Renters & Condos).

• Year-to-date figures: These exhibits contain data from January through October for each year.

• Group-level figures: The data call was made at the company level, but then rolled up at the group level for analytical purposes. Each group only

contains the volume from its underlying entities writing more than $5M in direct premiums in the state of Colorado.

• Top 5 carrier groups: Where applicable, any reference to “Top 5 Carrier groups” is intended to represent the 5 largest groups in the state: State Farm,

Liberty Mutual, USAA, American Family & Allstate. In 2021, these 5 groups represented 65% of the “Homeowners Multi-Peril” market in Colorado.

1

1

: S&P Market Intelligence

Catastrophic Exposures

4

15

© Oliver Wyman

• Look at historical patterns to predict future risk

• Assumption that the past is representative of the future

• Main process followed by actuaries to price insurance products

Backward-Looking Risk Assessment

• Rather than relying on historical patterns alone, create models that

proactively factor in cutting-edge scientific knowledge to make

projections about the future, often simulation-based

• Extensive domain expertise and careful consideration are needed to

calibrate adequately the assumptions and scenarios that underlie

these models

Forward-Looking Risk Assessment

This works for well-established insurance products with lots of

data, but not so much for emerging risks and catastrophic

events

Used by insurers to predict future costs of catastrophic perils:

Hurricanes, Earthquakes, Wildfires, etc.

ASSESSING CATASTROPHIC RISK: PAST IS NOT ALWAYS INDICATIVE OF THE FUTURE

Where data is sparse and/or volatile, insurers often rely on scientific models to assess the risk rather than historical data alone.

16

© Oliver Wyman

GUY CARPENTER’S WILDFIRE RISK SCORE

This tool allowed us to reconcile the availability findings with each region’s wildfire exposure

The Tool Applications for this projectSpecifications

• Enhanced & repurposed version of the US Forest

Service’s (USFS) Wildfire Hazard Potential for

insurance usage.

• Classifies the US territory into 6 categories of

wildfire hazard grades, from Very Low to Extreme.

• Developed for P&C insurers to enable an

evaluation of wildfire risk at the location level.

• Scores are updated periodically to reflect updates

to data sources & refinements in methodology.

Baseline: USFS

1

• USFS’s Wildfire Hazard Potential represents a

combined view of wildfire likelihood & intensity.

• It uses multiple spatial datasets:

• Data produced for the Large Fire Simulator

• Fuel & vegetation data (LANDFIRE)

• Past fire occurrences (1992-2015).

• Primary purpose is to identify areas that require

vegetation treatment, not

explicit wildfire risk.

Adjustments

• Fire Intensity: Based on conditional flame length,

adjusts for the potential for structure damage.

• Fire Suppression: Adjusts for enhanced

suppression response in highly populated areas.

• Spatial Smoothing: Reduce cell-to-cell volatility

and capture ember transport.

• Ignition Frequency: Adjust score in areas without

recent ignitions.

Local Enhancements

• Apply a factor based on granular 30m resolution

data, considering fuel, slope, and aspect.

1

: From the US Forest Service’s website. Source: Guy Carpenter

Risk Assessment

• This model can identify Colorado’s high-risk areas

at a very high level of granularity.

• This wildfire exposure can be translated at the Zip

Code level using satellite imagery, by counting the

building footprints falling under each hazard grade.

Interpretation of recent trends in industry data

• We were then be able to compare our findings in

terms of premium increases & coverage

restrictions to each area’s wildfire exposure.

Important Note

• While the model is highly granular (30m

resolution), the full benefit of this granularity is not

realized when the results are summarized at a zip

code or county level.

17

© Oliver Wyman

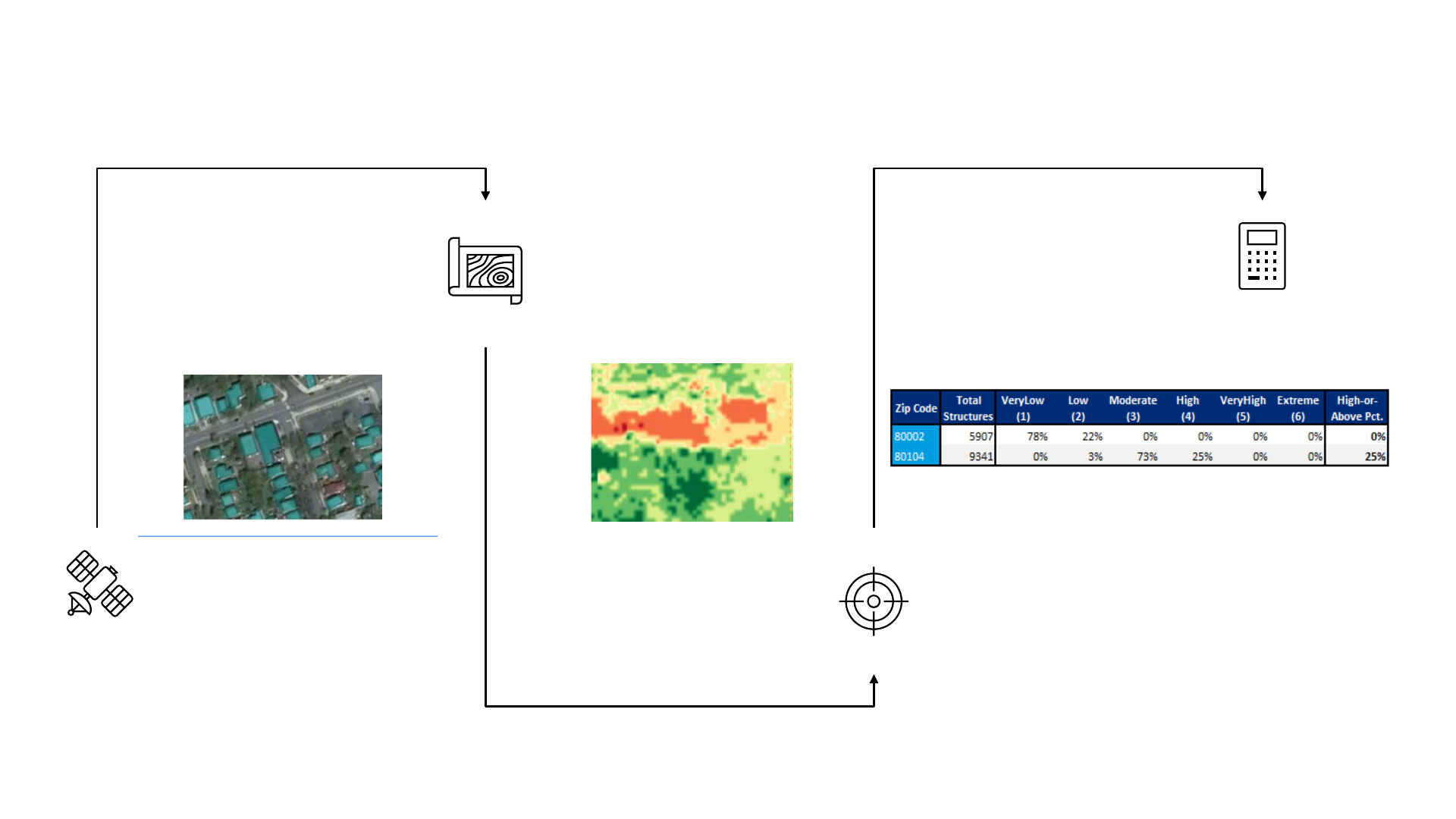

2. Localization of buildings

on the wildfire map

All buildings get located on GC’s

wildfire map

1. Microsoft Building Footprints

Estimation of all building structures in the

US using AI & Satellite imagery.

4. Percentage of Structures in

High to Extreme Areas*

The proportion of buildings with a

wildfire score of “high or above”

within a Zip Code is used to assess

the wildfire exposure in that area.

3. Wildfire score assignation

Each building receives a score

based on the area of the wildfire

map they fall into.

ESTIMATION OF WILDFIRE EXPOSURE BY ZIP CODE

The detailed wildfire map has been translated at the Zip Code level using satellite imagery

https://www.microsoft.com/en-us/maps/building-footprints

Source: Guy Carpenter, Oliver Wyman Analysis

18

© Oliver Wyman

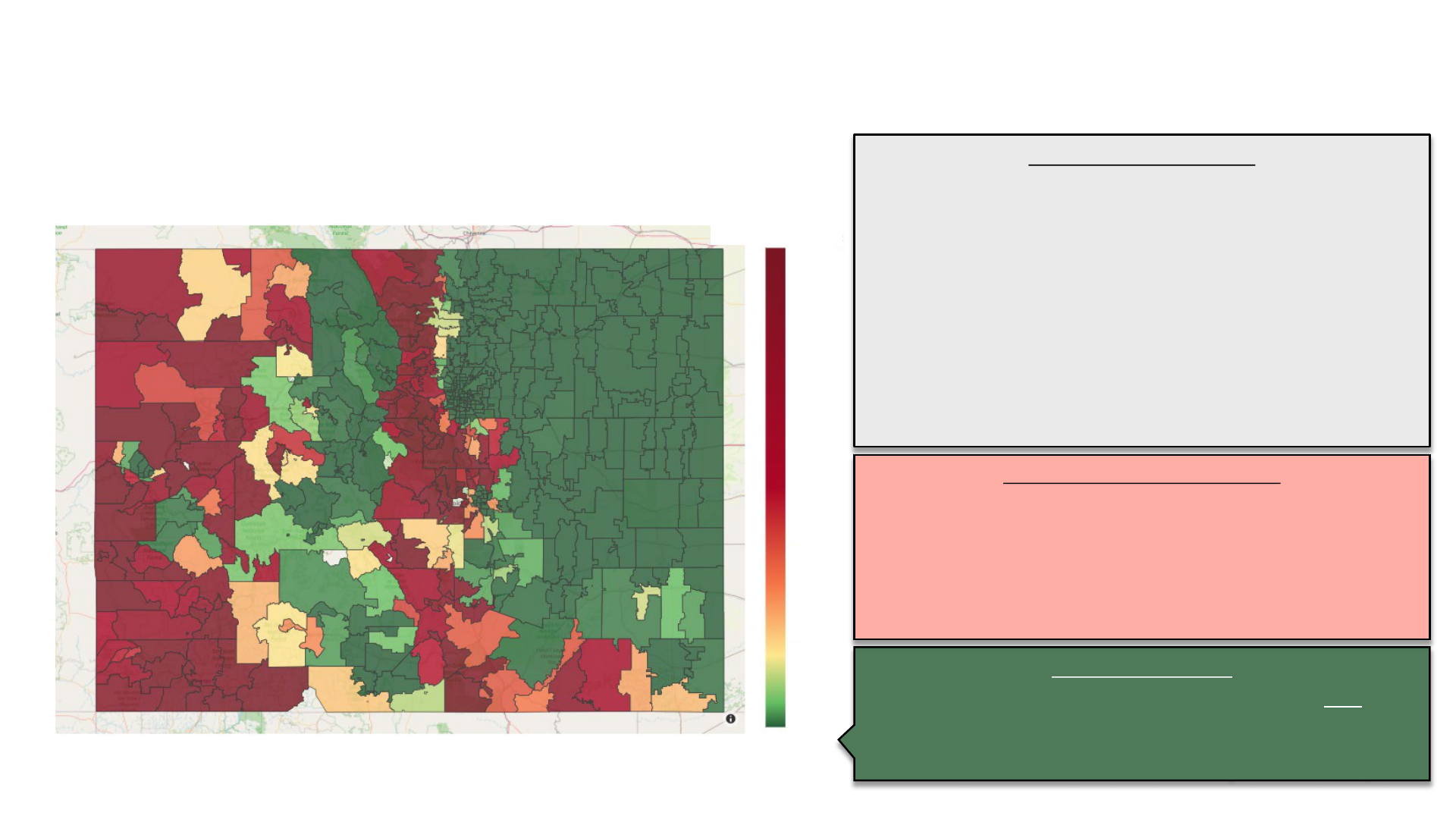

KEY FINDINGS: COLORADO WILDFIRE EXPOSURE

Source: Guy Carpenter’s wildfire risk score, ESRI dataset of U.S. ZIP Codes (from ArcGIS), Oliver Wyman Analysis

Color Scale Disclaimer

Any ZIP code not depicted with the darkest shade of green presents some

exposure to areas with high-or-above risk of wildfire.

Note: Blank shadings indicate areas where a score was not available. Different ZIP

code extraction dates between GC and OW are causing a handful of discrepancies.

Representation of wildfire risk in Colorado at the ZIP code level

Measured as the % of building structures found in areas of “high”, “very high” or “extreme” risk

Wildfire Exposure in Colorado

Wildfires are believed to have played a material role in Colorado’s loss

experience in recent years, and such it is anticipated that at least some of

the measures implemented by carriers (such as non-renewals and

tightening underwriting criteria) are targeted at controlling this risk.

There is indeed significant wildfire exposure in the state. The map on the

left combines Guy Carpenter’s wildfire risk score and satellite imagery to

estimate the level of wildfire exposure found in each ZIP code of the state.

This wildfire exposure is largely concentrated in two bands of land that run

across the state from North to South, with the easternmost band running

close to the densely populated areas of Denver, Colorado Springs & Fort

Collins.

High-or-Above Areas of Wildfire Risk

The wildfire map segments the US territory into zones representing exponentially

more risk of wildfire. The risk starts becoming more material once we reach the

“High” zone and above.

The exposure at the ZIP code level is estimated by counting the building structures

that fall under high-or-above areas using satellite imagery. Overall this represents

16.64% of building structures in Colorado.

High-or-above %

100%

80%

60%

40%

20%

0%

From Data to Insights

5

20

© Oliver Wyman

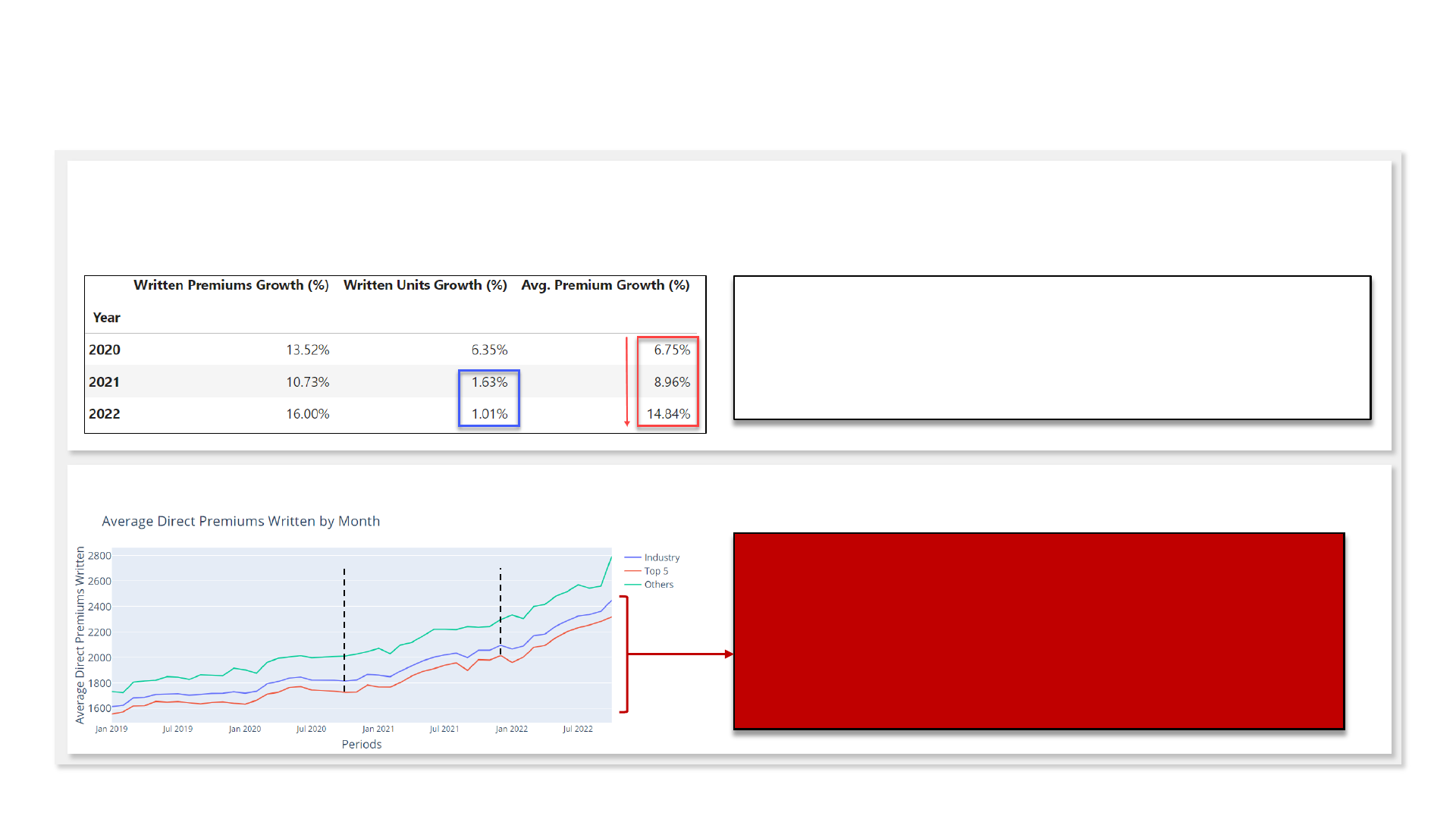

5-Year Loss Ratio Assessment

The Colorado “Homeowners Multi-Peril” market has been struggling

over the recent years from a profitability standpoint.

Colorado’s Loss & DCC

1

ratios have consistently been above

countrywide averages, leading each time to an underwriting loss for the

industry:

KEY FINDINGS: STATE OF THE COLORADO MARKET

Source: S&P Market Intelligence, Oliver Wyman Analysis.

Copyright © 2022, S&P Global Market Intelligence. Reproduction of any information, data or material, including ratings (“Content”) in any form is prohibited except with the prior written permission of the relevant party. S&P and their content

providers are not responsible for any errors obtained as a result of usage of such Content and will not be liable for any damages in connection with the use of this content.

1

: DCC stands for Defense & Cost-Containment Expenses. It refers to the costs of adjusting a specific claim, and represents roughly 1%-2% of Earned Premiums for the “Homeowners Multi-Peril”.

129

76

71

93

75

74

60

68

71

0

20

40

60

80

100

120

140

20212017 2018 2019 2020

Direct Loss & DCC Ratio

85

Calendar Year

Colorado

Countrywide

Approved rate changes by year – Homeowners MP – Selected Carriers

1

1

: Derived from the rate filings of top national carriers (~Top 10) in each state.

The magnitude of the difference between rate adjustments undertaken in

the state vs the rest of the country highlights the industry’s perspective on

the profitability of homeowner policies in the state.

6.1%

3.3%

2018

3.3%

2019

2.6%

5.8%

5.0%

2020

6.4%

3.9%

2021

Colorado Countrywide

Source: S&P Market Intelligence, Oliver Wyman Analysis.

21

© Oliver Wyman

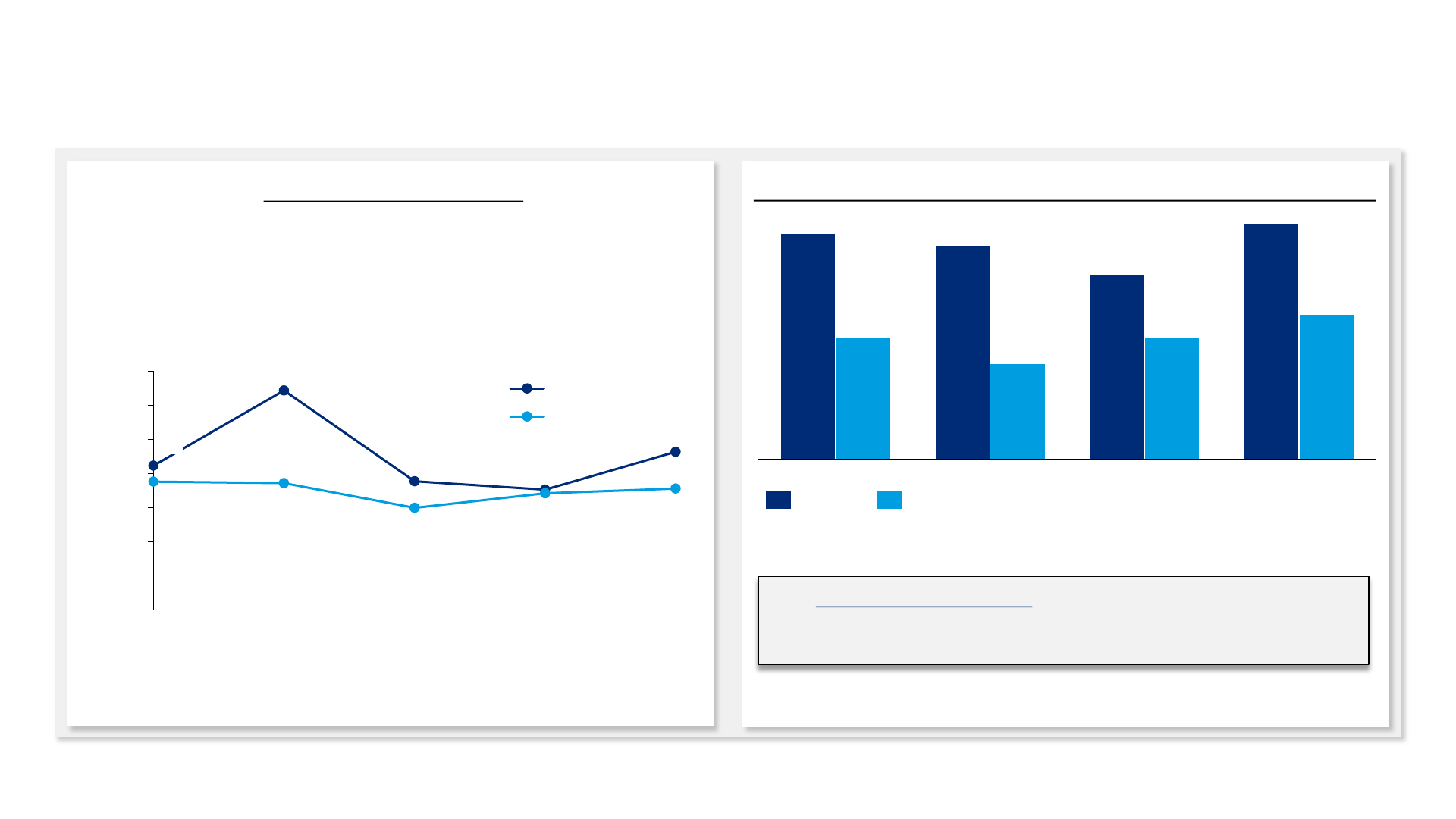

Measured annually, average premiums have increased significantly between 2019 and 2022, and at an accelerating pace.

Measured on a monthly basis, the magnitude of increases is even clearer, standing at +51.7% between January 2019 and October 2022.

KEY FINDINGS: TRENDS IN AVERAGE PREMIUMS

• The industry average premium is up +51.7% over the analysis period (46

months), or +11.5% annually.

• Inflection points are observed concurrent with the major wildfires.

• Inflation and efforts to improve rate adequacy are likely other key

contributors to the increases over time.

• The increase since the beginning of 2022 is +18.6%, or +22.7% annually.

Marshall Fire

East Troublesome Fire

Source: Colorado “Homeowners MP” data surveyed from carriers as-of October 2022, filtered on “Homeowners” policy type, Oliver Wyman Analysis.

Average premiums have been increasing significantly over the last 3 years, and at

an increasing rate.

In terms of total exposures written, the industry is still growing on a year-to-date

basis, although the trend is headed downwards with time. In fact, on a quarterly

basis growth is now reaching 0% as-of 2022-Q3 (see next slide).

Industry movements in premiums & exposures – October 2022 year-to-date

22

© Oliver Wyman

The growth in written units observed at the industry level is driven by the largest carrier groups; others have been shrinking in the last 2 years.

A majority of carrier groups have been shrinking their exposures in the state in 2022 (YTD-October)

KEY FINDINGS: TRENDS IN WRITTEN EXPOSURES

8

1

2

5

3

2

1

3

0

6

2

4

8

Number of Carrier groups

[-12.5% to

-10.0%[

[-10.0%

to -7.5%[

[-7.5% to

-5.0%[

[-5.0% to

-2.5%[

[-2.5%

to 0.0%[

[0.0% to

2.5%[

[2.5% to

5.0%[

[5.0% to

7.5%[

7.5% or

above

Distribution of carrier-level variation in written units – 2022 year-to-date

• The industry as a whole has been growing (at a generally declining pace) since 2020.

However, outside of the top 5 carrier groups, exposures have been materially shrinking

since 2020-Q4.

• Growth in the overall industry & Top 5 carrier groups has leveled off, just reaching 0%

growth for the first time in 2022-Q3. Larger concerns may lie ahead if the largest

carriers are also starting to reassess their appetite.

• A market consolidation appears to be taking place in Colorado, with the largest carriers

taking a bigger piece of the pie.

Through October 2022 year-to-date, 76% of carrier groups have

written fewer policies than during the same period last year.

Furthermore, a material 32% of carrier groups are even down more

than 10% over the period.

At the industry level this is offset by some larger carriers picking up

a portion of the risks left out by others.

Growth

Shrinkage

Source: Colorado “Homeowners MP” data surveyed from carriers as-of October 2022, filtered on “Homeowners” policy type, Oliver Wyman Analysis

23

© Oliver Wyman

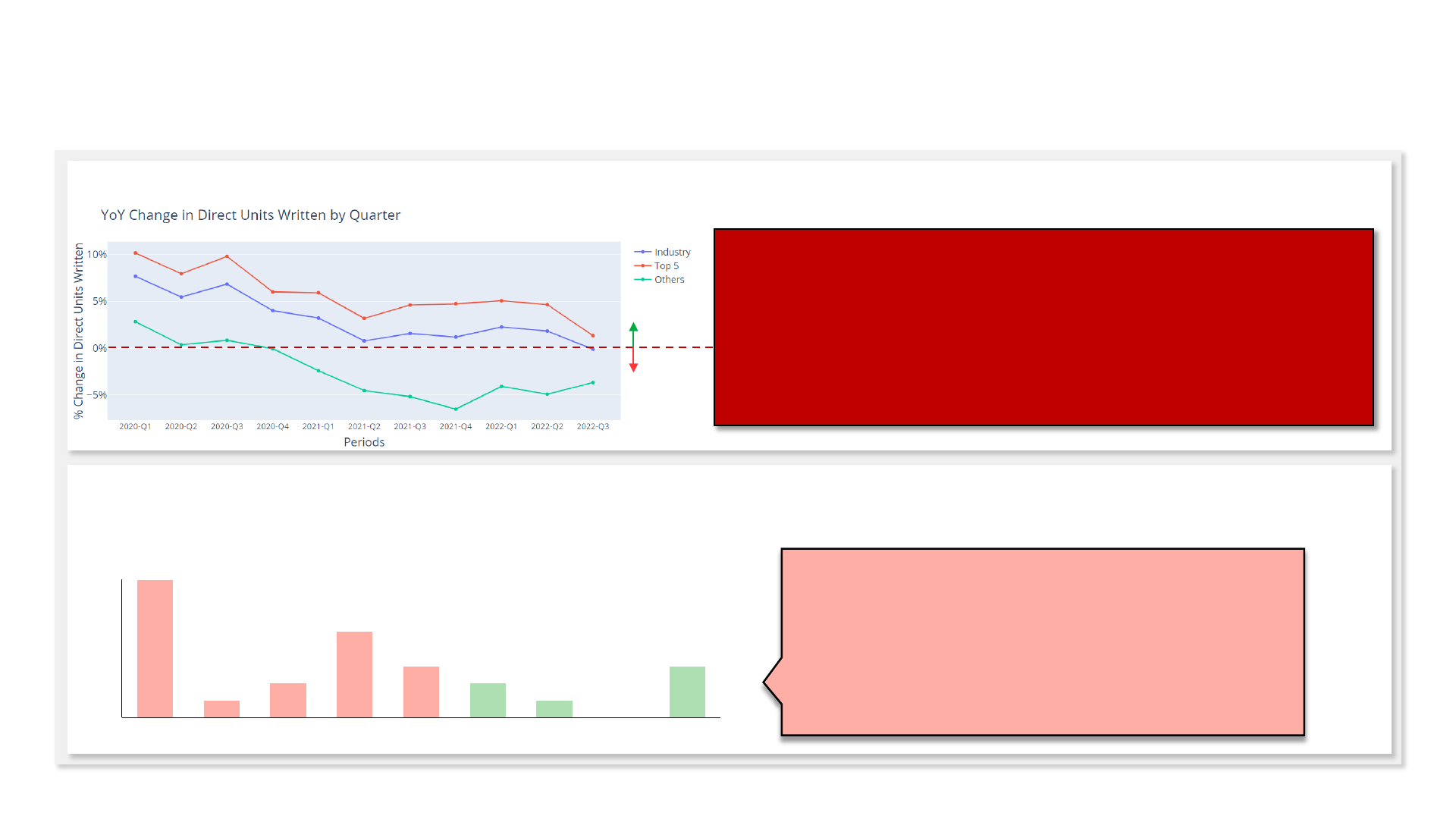

KEY FINDINGS: CORRELATION WITH WILDFIRE RISK

Growth in written units vs wildfire risk in the ZIP code – 2022 YTD

0

5

10

15

20

25

30

35

40

45

50

55

1.0%

2.5%

1.5%

2.0%

0.0%

0.5%

3.0%

51%

Portion of buildings in “high-or-above” wildfire area

21%

Portion of CO ZIP Codes in range

Growth in direct units written – 2022 YTD

0.37%

<= 0.01%

1.61%

18%

]0.01% to 15%]

1.56%

5%

]15% to 30%]

1.96%

5%

]30% to 50%]

1.96%

> 50%

Written Units Growth

Portion of ZIP Codes

Source: Colorado “Homeowners MP” data surveyed from carriers as-of October 2022, filtered on “Homeowners” policy type, Guy Carpenter’s wildfire risk score, Oliver Wyman Analysis

It does not seem like high-risk areas have been subject to greater shrinkage in exposures in

2022.

While some policyholders may be facing significant restrictions in these areas at the carrier

level, this is not the case at the industry level.

Average premium increase vs wildfire risk in the ZIP code – 2022 YTD

0

5

10

15

20

25

30

35

40

45

50

55

13%

10%

11%

12%

15%

14%

16%

17%

]0.01% to 15%]

Portion of buildings in “high-or-above” wildfire area

Portion of CO ZIP Codes in range

Increase in average premium – 2022 YTD

15%

14%

51%

17%

<= 0.01%

14%

18%

15%

5%

]15% to 30%]

5%

21%

]30% to 50%] > 50%

Average Premium Increase Portion of ZIP Codes

Although this graph highlights a positive correlation between the size of premium increases

and the exposure to wildfire risk, it is important to note that the amplitude

between the

smallest and the largest increases remains relatively small (+14% to +17%).

This suggests that the rating actions currently taking place in Colorado are probably much

broader in scope than the wildfire peril alone, although there seems to be some

segmentation with respect to the wildfire peril.

24

© Oliver Wyman

Descriptive

First round of analysis laid the

foundation of a structured

data collection framework.

It can now be updated to

enhance or refresh the

analysis data

Explanatory

Now that the current market

conditions are better

understood and the a priori

hypotheses have been tested,

additional research might be

of interest to understand the

underlying causes.

POSSIBLE ADDITIONAL AREAS OF RESEARCH

Findings stemming from this first analysis on the topic have sparked interest for additional analysis ideas on future iterations.

Timely Data Refresh

Insurance availability/affordability is a time-

sensitive topic that can take quick and significant

turns.

Depending on market signals, it might be beneficial

to have timely refreshes to assess the emerging

trends in 2023.

1

More Granular Exposure Data

Our first iteration was focused on creating a

streamlined process to obtaining structured and

accurate information from all carriers.

Now that this has been achieved, it might be

interesting to enhance the data collection to obtain

more targeted answers, for example by collecting

new business, renewal, and non-renewals data.

2

Inflation-adjusted metrics

The current high-inflationary environment certainly

has an impact on the premium movements

currently observed in the state.

It would be interesting to identify what share of

rate changes/premium increases is driven by

inflation vs other factors.

3

1

Exposure to Other Perils (e.g., Hail)

Our study has shown that the premiums and

exposure swings go beyond the regions at high risk

of wildfire, which highlights other types of

exposures may have played a role.

Hail risk might be an interesting area to examine,

given it has led to multi-billion dollars losses in the

state as recently as 2018.

[1]

2

Historical Profitability Within the State

The current study looked at historical profitability

at the state level in order to answer the most

pressing questions on the topic.

Given the results, in future iterations it might be

interesting to assess to which extent the

underwriting results vary across the geographic

regions of the state.

3

Exposures Growth and Housing Developments

To help understand the industrywide trends in

exposures by county and/or ZIP code, it would be

beneficial to obtain measurable data on the

number of new houses to insure in each region.

This would also allow to assess to which extent new

development are taking place in “high risk” areas.

Source: The Gazette [1]

Disclaimers and limitations

6

27

© Oliver Wyman

• Missing Carriers: Oliver Wyman had initially surveyed 97.3% of Colorado’s “Homeowners Multi-Peril” market shares to produce this study. Some of the surveyed

carriers – either because they did not respond or because material data integrity concerns were identified – had to be excluded from the data analysis. This brought

us down to 95.3% market share available for our analysis, which we feel is sufficient to depict an adequate portrait of the industry in this state. However, we

recognize that in the event where significant movement would be happening within the remaining 4.7% (e.g., significant growth in 2022), this could have an impact

on our findings.

• Discrepancies with NAIC Statements: All carriers were instructed to report premium volumes that reconcile with their NAIC annual statements for “Homeowners

Multi-Peril” in Colorado. We performed a reconciliation, and where the discrepancies were completely unrealistic (in multiples of the NAIC-reported volume), we

contacted the carriers for revision. Smaller discrepancies – which could range from -22% to +22% depending on the carriers & years – have been observed as well.

Depending on the nature & magnitude of volume missing or in excess, findings could be materially impacted by this issue.

• Reliance on Guy Carpenter’s wildfire score: In order to assess the wildfire exposure in the state, we have relied on the wildfire score developed by our sister

company Guy Carpenter. We recognize that different vendors may come to different assessments of the wildfire risk in the state. Also, due to the granularity of the

surveyed data, we represented wildfire exposure at the zip code level. This is an important simplification, as in practice the wildfire risk may vary greatly within a zip

code. Insurers may even rely on geo-coding to properly assess the risk of each policy.

• Data Validations: While we have made several reasonability checks of the data received and created a process that allows for reconciliation of some of the figures

with NAIC statements, this analysis still largely relies on the assumption that insurers answered the survey accurately and in good faith.

• Data Confidentiality: To produce this study, Oliver Wyman surveyed granular data from insurance carriers, and collected detailed information regarding the

companies’ pricing & underwriting methodologies. As our goal was to depict industrywide trends, all the exhibits & findings presented throughout this report are

always aggregated in some way. We did not

highlight information from individual carriers anywhere in this report.

DISCLAIMERS REGARDING DATA LIMITATIONS

28

© Oliver Wyman

QUALIFICATIONS, ASSUMPTIONS, AND LIMITING CONDITIONS: OLIVER WYMAN

Oliver Wyman Actuarial Consulting, Inc. (Oliver Wyman) prepared this report for the State of Colorado’s Division of Insurance (the Agency), to support the Agency in

fulfilling the requirements of SB22-206, C.R.S. § 10-1-143, which requires the commissioner of the Agency to conduct a study and prepare a report concerning methods to

address the stability, availability, and affordability of homeowner’s insurance for Coloradans with a focus on stabilizing the current market.

This report includes important considerations, assumptions, and limitations and, as a result, is intended to be read and used only as a whole, and may not be separated

into, or distributed in, parts.

This report is being provided strictly for information purposes and, in the case of regulators and officers of the Agency, is intended to be used by them solely for the

purposes set forth in SB-22-206 and to fulfil their related legislative, regulatory, administrative, and official functions. This report may not be reproduced, quoted, or

distributed for any other purpose or to any other third party without the prior written permission of Oliver Wyman. All decisions in connection with the implementation or

use of the results, advice or recommendations contained in this report are the sole responsibility of the Agency. Oliver Wyman shall not have any liability to any third party

in respect of this report or any actions taken or decisions made as a consequence of the results, advice or recommendations set forth herein.

The opinions expressed herein are valid only for the purpose stated herein and as of the date hereof.

Information furnished by others, upon which all or portions of this report are based, is believed to be reliable but has not been verified. No warranty is given as to the

accuracy of such information. Public information and industry and statistical data are from sources Oliver Wyman deems to be reliable; however, Oliver Wyman makes no

representation as to the accuracy or completeness of such information and has accepted the information without further verification. No responsibility is taken for

changes in market conditions or laws or regulations and no obligation is assumed to revise this report to reflect changes, events or conditions, which occur subsequent to

the date hereof.

29

© Oliver Wyman

QUALIFICATIONS, ASSUMPTIONS, AND LIMITING CONDITIONS: GUY CARPENTER

The data and analysis provided by Guy Carpenter herein or in connection herewith are provided “as is,” without warranty of any kind whether express or implied. The

analysis is based upon data provided by the Agency or obtained from external sources, the accuracy of which has not been independently verified by Guy Carpenter.

Neither Guy Carpenter, its affiliates, nor their officers, directors, agents, modelers, or subcontractors (collectively, “Providers”) guarantee or warrant the correctness,

completeness, currentness, merchantability, or fitness for a particular purpose of such data and analysis.

The data and analysis are provided strictly for information purposes, may not be separated into, or distributed in, parts, and may not be reproduced, quoted, or distributed

for any other purpose or to any other third party without the prior written permission of Guy Carpenter. In no event will any Provider be liable for loss of profits or any

other indirect, special, incidental and/or consequential damage of any kind howsoever incurred or designated, arising from any use of the data and analysis provided

herein or in connection herewith.

There are many limitations on actuarial or modeling analyses, including uncertainty in the estimates and reliance on data. We will provide additional information regarding

these limitations upon request.

As with any analysis, the results presented herein are subject to significant variability. While these estimates represent our best professional judgment, it is probable that

the actual results will differ from those projected. The degree of such variability could be substantial and could be in either direction from our estimates.

A business of Marsh McLennan