What’s included:

• How to read your Allstate Policy Declarations

• Protecting your home and personal property

• Understanding deductibles

• Additional protection

• How to file a claim

Homeowners Insurance

made simple

Knowledge is power.

We created this brochure to help you feel more knowledgeable

and confident about homeowners insurance.

If you’re an Allstate customer, you can read

this brochure along with your Allstate

Homeowners Policy Declarations and the

Homeowners Insurance Policy. Then, if you

have any questions, please contact us.

If you’re not an Allstate customer, this

brochure can help you better understand

homeowners insurance. If you have any

questions, call your local Allstate Agent.

How to reach us 24/7.

• Call, visit or e-mail your Allstate agency

• Call 1-800-ALLSTATE (1-800-255-7828)

• Log on to create an account at allstate.com

What’s inside:

• How to read your Allstate Policy Declarations

• Protecting your home and personal property

• Understanding deductibles

• Additional protection

• How to file a claim

Homeowners Insurance

made simple

2

3

Home Insurance

• House

• Condo

• Renters

• Manufactured home

• Landlords Package Policy

Auto Insurance

• Your Choice Auto®

Featuring:

Accident Forgiveness, Safe Driving

Bonus® Check, Deductible Rewards®

and New Car Replacement

• Standard auto

Power Sports Insurance

• Motorcycle

• Snowmobile

• Boat

• Motor home

• ATV

• There’s more—call us!

Business Insurance

• Business auto and fleet

• Property and liability

• Specialty insurance programs

• Supplemental insurance

for the workplace

Other Protection Options

• Personal Umbrella Policy

• Scheduled Personal Property

• Identity Theft Restoration

• Allstate Motor Club®

Financial Protection

• Life insurance

• Education funds

• Retirement

• Banking and Savings

Call your local Allstate Agent or 1-800-ALLSTATE to find out about product

availability and qualifications in your state.

Allstate offers a range of

products to help you protect

your lifestyle.

At Allstate, we take pride in the service we provide our

customers. And with our range of innovative insurance and

financial products, we can help you protect your lifestyle.

4

Your Declarations Page

How to read your

Homeowners Policy

Declarations.

Your Homeowners Policy Declarations “declares” the choices you’ve

made for your home insurance policy, such as deductibles for some

coverages as well as optional protection you may have purchased.

You’ll receive a new Allstate Homeowners Policy Declarations every

renewal period, which is typically one year.

The following page is an example of an Allstate Homeowners Policy

Declarations and shows you where to find some of the important

information. It’s a good idea to check your own Policy Declarations

to make sure all the information is correct.

Questions? Want to make changes to your coverage? Call your local

Allstate Agent or 1-800-ALLSTATE.

Homeowners

Policy Declarations

Summary

NAMED INSURED(S) YOUR ALLSTATE AGENT IS: CONTACT YOUR AGENT AT:

Jane A Sample

123 West Street

Anywhere USA 12345-1234

Sample A Sample

123 West Street

Anywhere USA 12345

(123) 456-7890

POLICY NUMBER POLICY PERIOD PREMIUM PERIOD

0 03 001234 09/01 Begins on Sep. 1 Sep. 1 to Sep. 1

at 12:01 A.M. standard time, at 12:01 A.M. standard time

with no fixed date of expiration

LOCATION OF PROPERTY INSURED

123 West Street, Anywhere, USA 12345-1234

Total Premium for the Premium Period (Your bill will be mailed separately)

Premium for Property Insured $908.00

TOTAL $908.00

Your policy change(s) are effective as of Feb. 2

5

Your Declarations Page (continued)

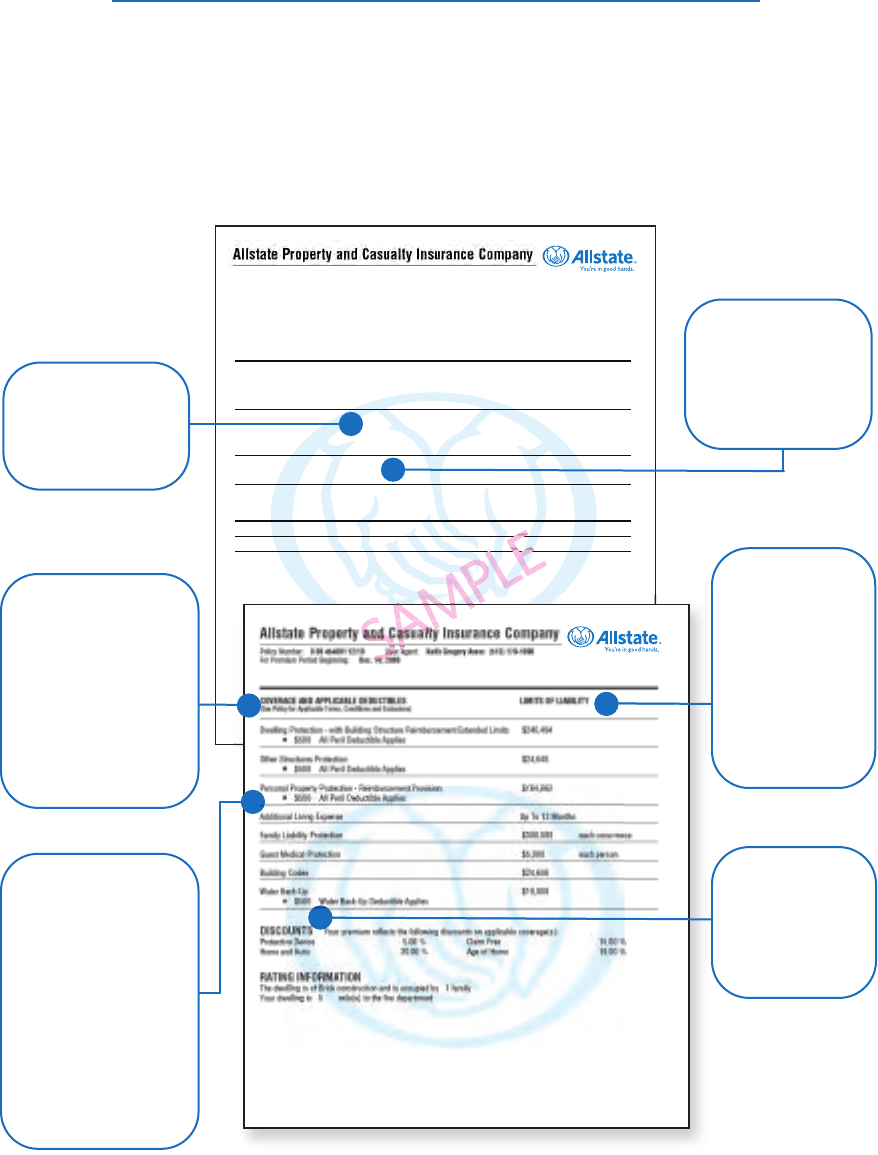

Location of

property. This

shows the address

of the insured

property.

Coverages. This

shows all the

coverages you have

as part of your

homeowners

insurance.

For more about coverages,

see pages 6-16 of this

brochure.

Deductibles.

A deductible is the

amount you pay out

of pocket when you

file a claim for a

covered loss.* Your

policy’s deductibles

will be shown under

each coverage.

For more about

deductibles, see page 12

of this brochure.

Limits of liability.

This shows the

maximum limit

Allstate will pay

for each covered

loss.*

For more about

limits, see page 10

of this brochure.

Policy period.

Home policies

typically cover a

one-year period.

* What does “covered loss” mean?

It’s an insurance term that means a loss or damage that falls within the bounds of

the policy. Throughout the rest of this brochure, when we refer to a loss or accident,

we assume it is a covered loss.

Sample of an Allstate Homeowners Policy Declarations

Discounts.

Any discounts

you may have

received are

listed here.

6

An overview of

homeowners insurance.

Allstate homeowners insurance protects you and your family in

many kinds of situations involving your home and the things you

own. This brochure summarizes key information about Allstate

homeowners insurance including:

• Home and other structures

• Personal property

• Deductibles

• Other ways you’re protected

Overview

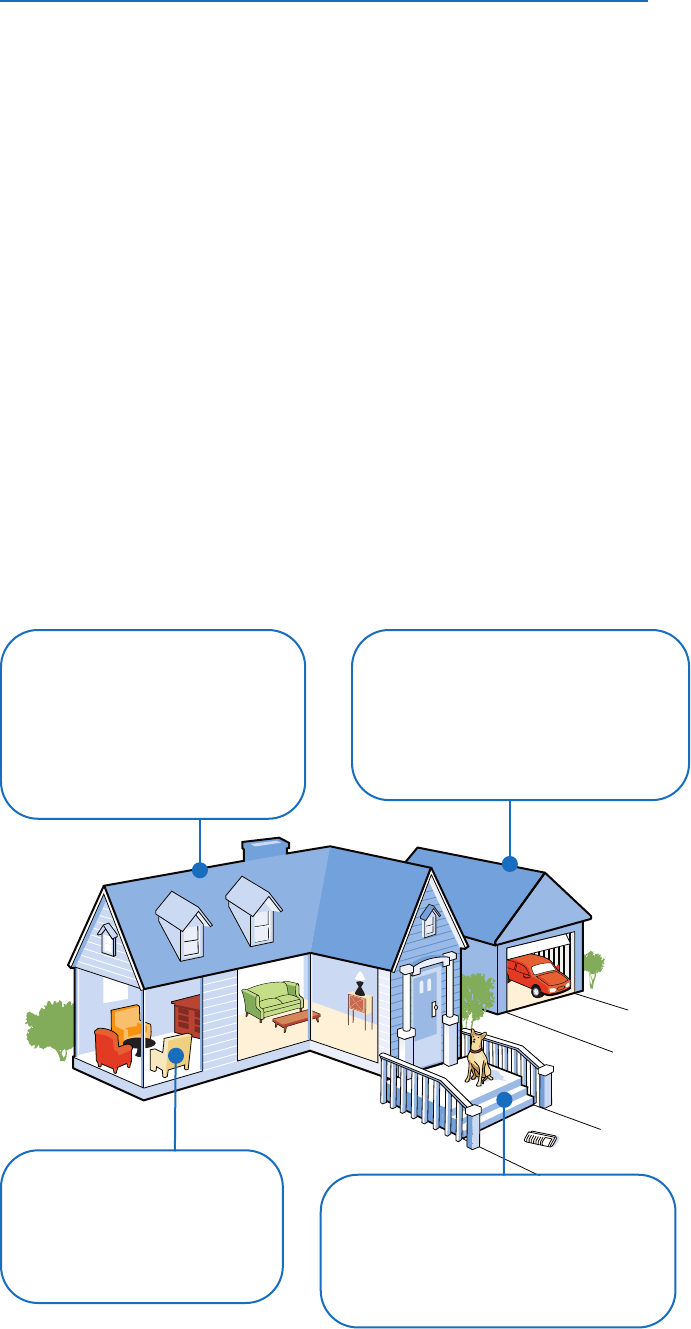

Personal Property such as

furniture and other contents

are typically covered.

Read more about Personal Property

Protection on pages 9-11.

Other Structures are covered

under your policy and include

buildings such as a garage or storage

shed that are separate from the house.

Read more about Other Structures

Protection on pages 7-8.

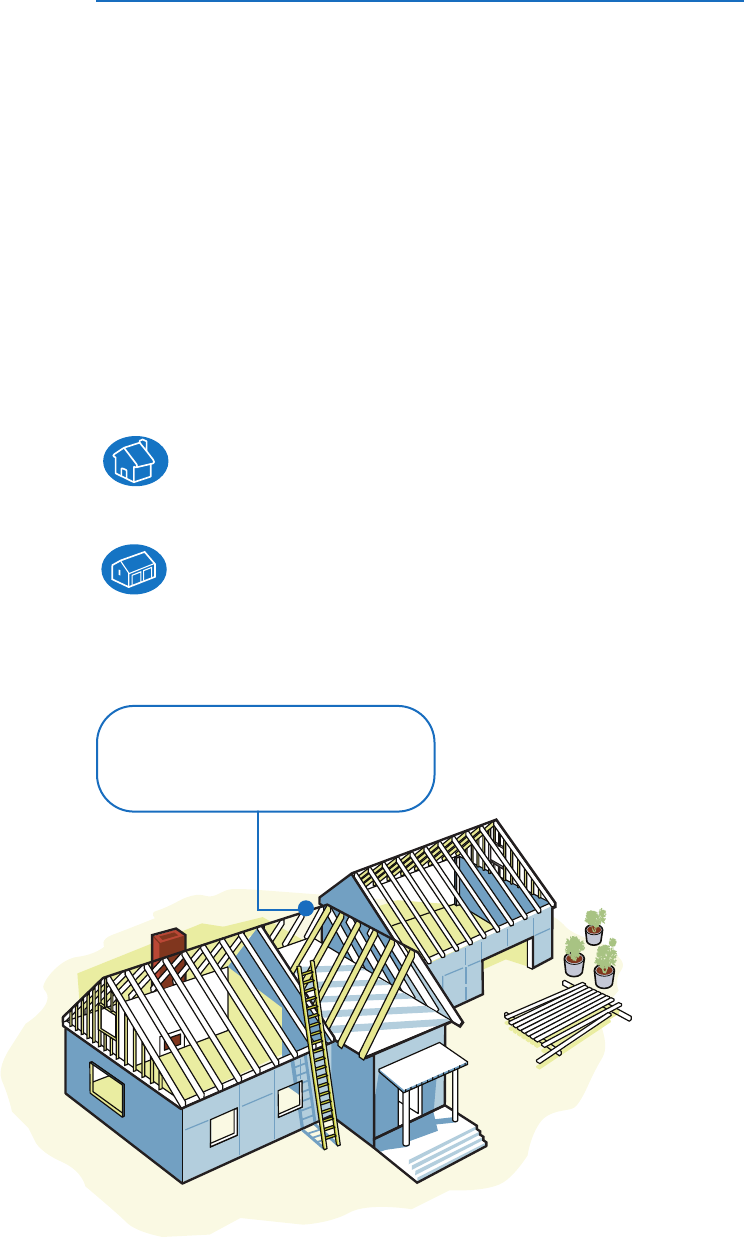

Your Dwelling is covered under

your policy and includes your

home and structures such as a

garage or deck that are attached

to your home.

Read more about Dwelling Protection

on pages 7-8.

Family Liability Protection helps protect

you if someone sues you for damages

after being injured on your property.

Read more about Family Liability Protection

on page 13.

• What may not be covered

• Optional protection you can buy

• Claims

Homeowners insurance can help protect your most important

asset. The property section of your policy includes two basic types

of protection:

Dwelling Protection covers the home you live in and

other structures attached to it such as a garage, porch or deck.

Other Structures Protection covers other buildings

on your property that are separate from your home, such as a

stand-alone garage or a shed.

Your home and buildings

are protected.

7

Dwelling and other structures

If your home or garage is damaged,

your homeowners insurance can help

you repair or replace it.

• Theft

• Fire and smoke

• Windstorm or hail

• Falling objects

• Freezing of plumbing

• Car crash into home

• Water damage

from plumbing,

furnace/AC or

water heater

Additional Living Expense can help by

reimbursing you for reasonable increases in living expenses

when a loss Allstate covers makes your home uninhabitable.

This may include payments for the cost of rent, hotel, food

and other expenses. This coverage is included in an Allstate

homeowners policy.

What if your home is

too damaged to live in?

If you temporarily cannot live in your home due to damage from

a peril we cover, you may have to pay to rent a place until your

home is rebuilt or repaired. This could be tough when you’re still

paying the mortgage on the home that’s damaged.

Dwelling and other structures (continued)

Questions? Want to make changes to your coverage? Call your local Allstate Agent

or 1-800-ALLSTATE.

8

Allstate covers a range of perils.

Allstate homeowners insurance typically covers a range of perils.

Below are a few of the most common ones.

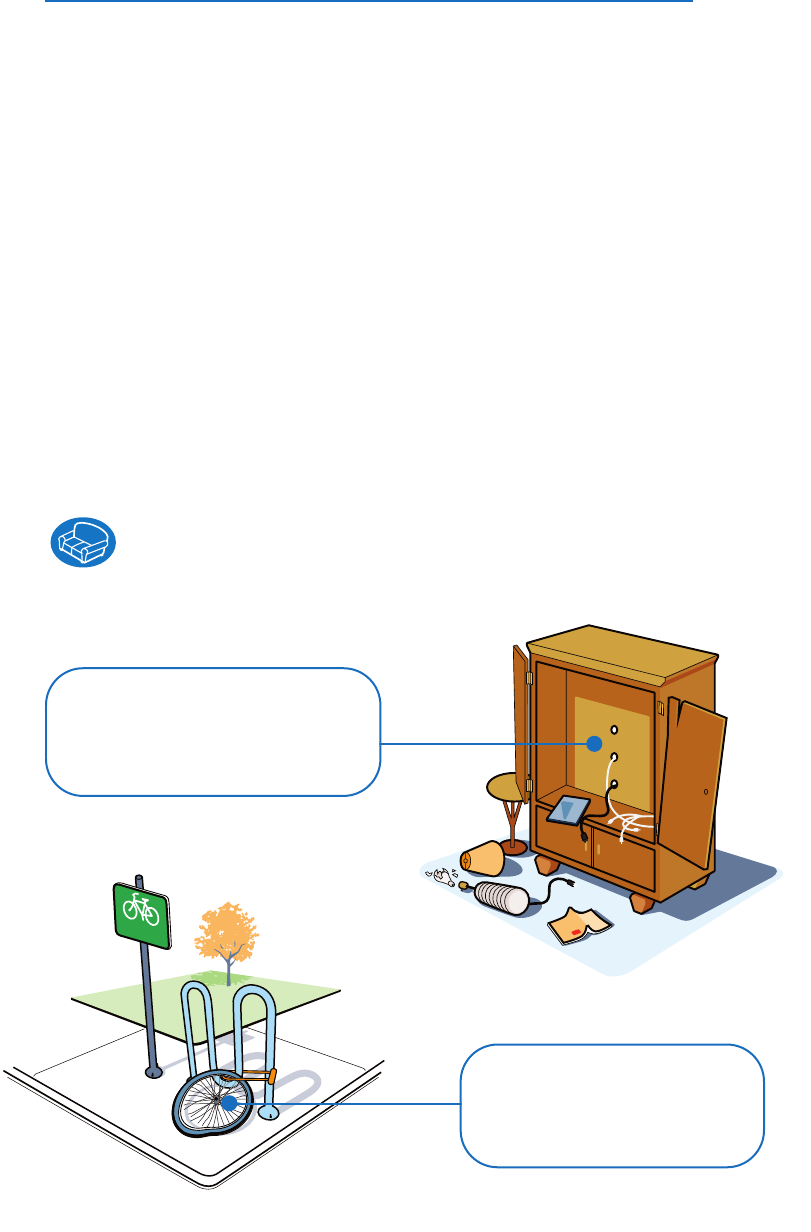

Personal Property Protection covers the loss

of your belongings* if they’re stolen or damaged.

PARKING

Most of your belongings

are covered, too.

Allstate homeowners insurance includes coverage that can

help you pay for losses that occur in your home such as

burglary or fire. It can even protect you from loss away from

home such as in a hotel. Keep in mind that a deductible will

apply. (See page 12 for more about deductibles.)

If your belongings are stolen from

your home or destroyed by fire,

your homeowners insurance can

help you replace them.

If your belongings are stolen or

damaged outside of your home,

your homeowners insurance can

help you replace them.

9

Personal property

*When we refer to “belongings” in this document, we mean personal property

as detailed in your insurance policy.

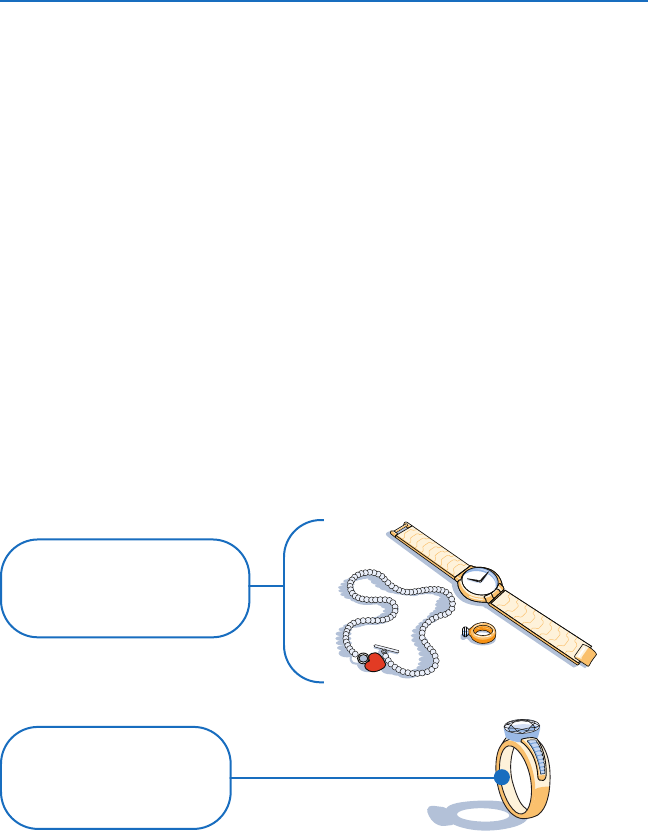

There are limits on the coverage

of some belongings.

Some categories of personal property coverage have a maximum

dollar limit that Allstate will pay a policyholder in case of damage

or loss. Within these categories, there may also be a limit per

single item.

You can increase your limits.

If you have valuable belongings, it may be a good idea to increase

your protection. Talk with your Allstate Agent or call

1-800-ALLSTATE

.

If you’ve already added increased protection for your personal

property, it will be listed on your Allstate Policy Declarations under

Coverage and Applicable Deductibles or under the Scheduled

Personal Property section.

10

Personal property (continued)

Note: This is just an example. Your actual limits may vary.

Maximum limit per item:

$1,000

Maximum limit for all jewelry:

$2,500

Example: A homeowner has a $2,500 limit for all of the jewelry

she owns, with a $1,000 limit per single item.

Questions? Want to make changes to your coverage? Call your local Allstate Agent

or 1-800-ALLSTATE.

The value of most of your belongings decreases over time. With

Allstate homeowners insurance, you’re able to choose one of the

personal property coverages below:

Actual Cash Value typically means your belongings are covered

for their replacement cost minus depreciation. Depreciation is

the decrease in the item’s value due to its age, condition or

other factors.

Reimbursement Provision typically means your belongings are

covered for the amount it would take to replace them at the time

of the claim. Premiums are usually higher for this coverage.

Here’s how the Reimbursement Provision works:

• First, we give you a check for the Actual Cash Value of the item.

• When you replace the item, we then issue a separate check

for the remaining amount needed to make the purchase.

Actual Cash Value vs.

Reimbursement Provision.

How to review what you’ve chosen.

11

Personal property (continued)

If you have Allstate homeowners insurance, you can review

which type of coverage you have purchased by looking at your

Policy Declarations under Personal Property. With either

coverage, a deductible will apply. (See next page for more

about deductibles.)

Questions? Want to make changes to your coverage? Call your local Allstate Agent

or 1-800-ALLSTATE.

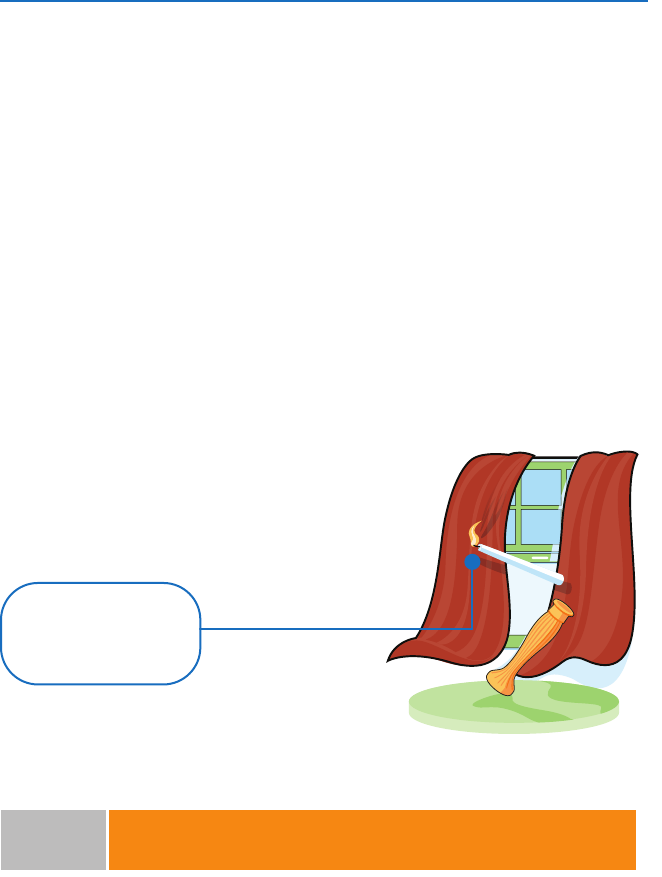

A deductible is your

share of the cost.

When you file a claim for a covered loss, you may be responsible

for a set amount, called a deductible, to repair or replace whatever

is damaged or stolen.

12

Deductibles

Example: A candle falls in the living room

and starts a fire. It will cost $5,000 to

replace the damaged furniture and drapes.

$4,500

$500

Homeowner has

$

500 deductible for Personal Property Protection.

Insurance pays:

Homeowner pays:

More about deductibles.

• Not all coverages will have a deductible. However, a deductible

will always apply to Allstate’s Dwelling, Other Structures and

Personal Property coverages.

• The amount of any deductible will be shown on your Policy

Declarations next to the coverage.

• In most cases, you choose the deductible from a range of options.

A higher deductible usually means a lower insurance premium.

Damage

$

5,000

Your homeowners policy can

help you in case of an accident.

Allstate homeowners insurance includes Family Liability

and Guest Medical Protection to help protect you in other

situations, too.

For example, let’s say there’s a loose handrail in your house and

it causes someone to fall. You may be found negligent for not

repairing the handrail and therefore be legally responsible to pay

for the injured person’s medical bills and lost wages.

13

Other ways you’re protected

If someone injures himself on your

property due to your negligence, your

homeowners policy may help pay for

their injuries and any legal costs.

Family Liability Protection can help protect you

from financial loss if you’re legally obligated to pay for another

person’s injuries or damage to another person’s property.*

*For more protection, you may be able to increase this coverage on your Allstate policy

or buy a Personal Umbrella Policy (PUP). See page 16 for more information about PUP.

Or what if your son is playing at a neighbor’s house and hits a

baseball through their window? You may be responsible for those

types of damages, too. If so, Allstate homeowners insurance can help.

If you or a family member cause

injury to another person or damage to

their property, your homeowners policy

may help pay for the damages.

Guest Medical Protection can help pay for

reasonable and necessary medical expenses if someone

is injured in an accident on your property.

What if a guest is injured in your home?

If a guest has an accident in your home and it’s not covered

by Family Liability, your homeowners policy may help.

If a guest is injured on your property,

Guest Medical Protection may help pay

for necessary medical expenses including

surgery, x-rays and dental work.

14

Other ways you’re protected (continued)

Questions? Want to make changes to your coverage? Call your local Allstate Agent

or 1-800-ALLSTATE.

Homeowners insurance

doesn’t cover everything.

Homeowners insurance protects a home from accidental and

sudden losses. However, there are some losses that aren’t covered.

Breakdowns in the home.

Most homeowners insurance does not cover basic maintenance

repairs. For example, if your water heater cracks, your coverage

most likely will not help to replace the water heater. (But it might

help pay for the damage to your floors.) That’s why it’s a good

idea to have all your heating, cooling and plumbing systems

regularly serviced.

Floods, earthquakes and water backup.

Typically, floods, earthquakes and water (sewer) backups

are excluded from most homeowners insurance. If you want

to purchase additional insurance to cover these events, talk

to your local Allstate Agent or call 1-800-ALLSTATE.

What may not be covered

If you have chosen to add Water

Backup Coverage to your policy,

it could help pay for damage from

backed up drains or sump pumps.

15

Available as

add-ons

Extended coverage

on jewelry, watches

and furs

Scheduled Personal

Property

Identity Theft

Restoration

Water Backup

Increased coverage

on business property

Separate policies

you can purchase

Flood insurance

Personal Umbrella

Policy (PUP)

Need more protection?

Below are just a few of the optional coverages that you may be

able to purchase either as add-ons to an Allstate policy or as a

separate policy. Coverages may not be available in all states and

limits may vary.

Additional protection you can buy

Increases limits for jewelry, watches and furs.

Provides increased limits for personal property

such as jewelry, cameras, antiques, recreational

equipment and more.

If your identity gets stolen, this coverage can

help with legal work, phone calls and lost wages.

Helps cover damage in your home from backed

up drains or broken sump pumps.

Protects items you’re keeping in your home as

business samples or for sale.

Your Allstate Agent can help you purchase a

separate policy through the National Flood

Insurance Plan (NFIP). Or call 1-800-ALLSTATE.

If someone sues you over an accident and the

settlement exceeds the liability limits on your

auto and/or home insurance, this coverage can

help protect your assets.

16

Look under Coverage on your Allstate Policy Declarations.

Look for these policies in a separate mailing.

Questions? Want to make changes to your coverage? Call your local Allstate Agent

or 1-800-ALLSTATE.

How to file a claim.

You can file a claim one of three ways:

• Call 1-800-ALLSTATE (1-800-255-7828)

• Log on to your account at allstate.com

• Call your local Allstate Agent

To track your claim, call your Allstate claim representative,

your Allstate Agent or log on to your account at allstate.com.

What happens next?

The Allstate claim process will vary based on the extent of

damage. Here’s the typical process:

Step 1: If needed, we can provide referrals for assistance with

temporary repairs such as boarding up windows.

Step 2: We’ll evaluate damages and prepare an estimate.

Step 3: Your Allstate claim representative will go over your policy

with you to explain which coverages and limits apply.

Step 4: Where available, you can choose an Allstate-

recommended repair vendor and have the workmanship

guaranteed by the vendor. Or you can choose your own vendor.

Step 5: We wrap up your claim by answering any questions you

may have and provide you with payment when appropriate.

What to do in case of a catastrophe.

A catastrophe such as a tornado or fire can damage many homes

in an area all at once. When that happens, a dedicated Allstate

team is on site to help make sure your claim is handled as quickly

as possible. Call 1-800-54-STORM (1-800-547-8676).

To learn more about claims, go to allstate.com/claims,

call your local Allstate Agent or 1-800-ALLSTATE.

17

Claims

Q: What if I don’t have

all the information to file

a claim?

Q: What else can I do to

speed up the claim

process?

Q: My repair person has

found additional damage

from the loss that wasn’t

on the initial estimate.

What do I do?

Q: What if I don’t agree

with the estimate I

received?

Q: Why does the check I

received from Allstate

include the name of my

mortgage holder?

A: Calling Allstate as soon as possible can

help speed up the claim process. Even if you

don’t have all the information, you can always

provide us with additional details later.

A: Taking an inventory of your belongings

before anything happens can be very useful

in verifying what you have and what it’s

worth. To help you, you can download free

inventory software from www.allstate.com/

homeinventory.

A: Once the repair process begins, further

damages could be found. If this happens,

call your Allstate claim representative, who

will arrange to investigate the newly found

damages. Sometimes there’s no need for us

to physically inspect the damage and an

additional payment, up to the policy limit,

can be issued right away.

A: When you disagree with our evaluation

of damages, please contact your Allstate

claim representative or your Allstate Agent.

Our commitment is to always settle claims

as fairly as possible.

A: If you have a mortgage on your property,

the mortgage holder is usually included on

your policy along with your name. Most

mortgage companies require that claims

payment checks include the name(s) of the

mortgage holder(s). Simply contact your

mortgage holder to find out how to obtain

their endorsement on the check.

Frequently asked questions.

FAQs

FAQs continue on next page.

18

Q: How can I save money

on my homeowners

insurance?

Q: My neighbor just

purchased flood insurance.

Should I do the same?

Q: What is Reimbursement

Extended Limits and how

do I know if I have it?

A: Allstate offers many discounts that can

help you save on your insurance. For

instance, you may qualify for a discount if

your home has been renovated in the last

10 years; if you are 55 or older and not

employed full-time; or if your home has

smoke alarms, fired extinguishers or a

security system. And, if you insure both your

car and home or have auto and renters

insurance with Allstate, you can save on

both. Talk to your local Allstate Agent or call

1-800-ALLSTATE to make sure you’re getting

all the discounts you’re eligible for.

A: Most homeowners insurance does not

include flood insurance. Less than 50% of all

flooding incidents are awarded a Federal

Disaster Assistance declaration, and most

disaster assistance is provided in the form of

a loan that must be repaid with interest.

That’s why it’s a good idea to consider buying

this extra protection. Call your local Allstate

Agent or 1-800-ALLSTATE to find out more.

A: Reimbursement Extended Limits is a

“coverage cushion” that extends the covered

damage to your dwelling and other structures

beyond the limit stated in your policy. In most

states, this extra coverage is up to 120%. For

example, if you had a limit of $100,000 for

your Dwelling Coverage, you could be

reimbursed up to $120,000 for a covered

loss. This coverage could come in handy if a

large storm or situation in your area increases

the demand for building supplies. If prices go

up unexpectedly, the amount needed to

repair or replace your home could also go up.

If you have purchased this optional coverage,

it will appear on your Allstate Policy

Declarations next to Dwelling Protection.

FAQs (continued)

19

Please note that this brochure is only a summary of homeowners insurance, written to

illustrate in general terms how homeowners insurance works. The Allstate Homeowners

Insurance Policy is the legal contract that contains the terms and limitations of your policy.

You should carefully review the contents of your policy. All products and coverages are

subject to availability and limitations.

Allstate Your Choice Auto,® Accident Forgiveness, Deductible Rewards,® Safe Driving Bonus® Check, and

New Car Replacement are optional and subject to terms and conditions. NOT AVAILABLE IN EVERY STATE.

Patent pending. Deductible Rewards apply to collision coverage. In NY and PA, deductible amount will not go

below $100. Safe Driving Bonus Check is not available in every state and may not be available for renewal

customers until next policy period. Amounts less than $5 will be applied to renewal bill. Safe Driving Bonus is

optional and subject to terms and conditions. Policy issuance is subject to qualifications.

Certain property and casualty insurance offered through Allstate Insurance Company, Allstate Indemnity

Company, Allstate Property and Casualty Insurance Company and Allstate Fire and Casualty Insurance

Company: Northbrook, IL; Allstate County Mutual Insurance Company: Irving, TX; Allstate New Jersey

Insurance Company: Bridgewater, NJ. Life insurance and annuities offered through Allstate Life Insurance

Company and in NY, Allstate Life Insurance Company of New York. Please contact your Allstate Agent, call

1-800-ALLSTATE or visit allstate.com for complete information on other products and services.

©2010 Allstate Insurance Company. allstate.com 02/10

D10236AE

Are you in Good Hands®?

For more than 75 years, Allstate has been there when people

need us most.

We have innovative insurance for your life's needs, financial

solutions to help you save and dedicated representatives to help

you sort it all out. We also have a long history as a leader in

helping to make our roads and highways safer.

With Allstate, you can feel better protected and more in control

of your future than ever before.

• Call, visit or e-mail your Allstate agency

• Call 1-800-ALLSTATE (1-800-255-7828)

• Visit allstate.com